This post is sponsored by Lexington Law.

Your twenties can be a confusing time, especially when it comes to your finances. There’s a lot of different pieces of advice and opinions coming at you from all different directions. That said, today I’d like to share three financial don’ts to avoid in your twenties. These are lessons I’ve learned through my own mistakes, from past generations, and mistakes and sticky situations I’ve seen my peers have to go through.

1. Not having an emergency fund.

Did you know that nearly 3 in 5 Americans have less than $5,000 in savings? Most people struggle to cover emergency car repairs, nevertheless the loss of income for an extended period of time.

Your emergency fund should, in an ideal world, be able to cover three to six months worth of expenses. It’s there for you in case you need it — but the hope is that you’ll never have to tap into it.

I had a conversation a few months ago with a friend of a friend who had just purchased her first home. We were discussing the ins and outs of the expenses and it made me think of another aspect of my finances that I hadn’t considered yet — item specific emergency funds.

I currently have my six month emergency fund, my business emergency fund, and my “oops” emergency fund. This covers things like last minute travel or unexpected expenses. For example, it helped me out when my flight home from New Zealand was cancelled at one in morning a few years ago. It also helped me out when I had to fly to the east coast for an unexpected funeral. But even this is a small fund that couldn’t cover a major repair or replacement.

So now, one of my new savings goals is to have item specific emergency funds. One of them will be for the home we plan to purchase soon and one will be for car expenses.

To figure out how much you need in your emergency fund, start by calculating three to six months work of expenses. You’ll need to make sure you are saving for everything you absolutely have to pay for. All of your fixed and variable expenses should be covered by your emergency fund.

To be honest, if it is really an emergency and you won’t be including discretionary spending, your emergency fund will cover your rent or mortgage, and insurance payments, car payment, utilities (water, electricity, etc.), internet or cable, plus your groceries, gas budget, and a buffer of 5-10 percent to be safe.

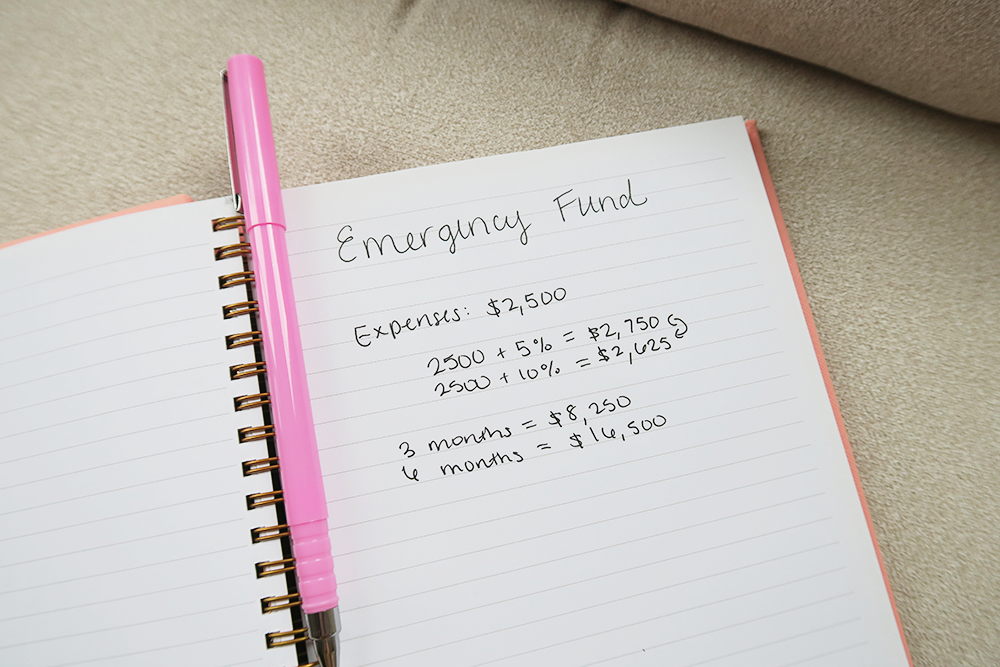

To figure this out, take the expenses number from your budget and add five to ten percent. Here is an example:

Say your expenses are $2,500. Multiple 2500 by .05 to get your additional five percent. Double that to get your ten percent number. So 2500 x .05 = 125. So your expenses plus five percent is $2,625. Your expenses plus ten percent is $2,750.

So, three months worth of your expenses in this example would come out to be $8,250. Six months worth of your expenses would be $16,500.

That might feel like a lot of money, but remember you don’t need to save it all in a month. Work backwards from your goal finish date to figure out how much you need to save per month to reach the goal. Continuing from the example above:

Say you want to have your emergency fund fully saved in three years. Take $16,500 and divide it by the number of paychecks you get between now and then. If you get paid once a month, this is what 36 paychecks. So dividing $16,500 by 36 gets you about $500/paycheck to finish in three years.

Now this may or may not be possible for you depending on your current situation. It’s up to you to decide how you are going to adjust your budget and timeline to meet that goal. I recommend setting up automatic transfers so you’re paying your future self without even thinking about it.

2. Relying on your parents.

The millennial generation grew up in a difficult economic climate. Student loan debt coupled with the recession, education inflation, and the housing market has left most of us underemployed, underpaid, and overeducated for our positions. It also takes us far longer to even begin thinking about paying for things like children and houses that previous generations assumed were the logical next step. We’re having a rough go of it.

But even that said, I don’t think it’s a good idea to be overly-reliant on your parents, especially as we approach 30. Sure it’s nice if your parents offer to keep you on their phone plan or car insurance. It surely makes things more affordable for you. But what I think we need to remember is that they’re people too. They have their own expenses and as they are getting older, their own retirement and healthcare costs to think about. Plus, one day they might not be here to pay bills for you. So relying on them is a slippery slope.

I once overheard someone saying something to the effect of, “I know it sounds bad, but I’m trying to mooch off of my mom as long as possible.” I found this to be so sad, both for the mom and for the son. It made me reflect on how I am raising my own son and my ultimate desire is for him to be a good person and to be able to take care of himself.

Coming from someone who has paid her own way since she turned 18 (I didn’t even stay on my mom’s health insurance plan), it will be more beneficial to you if you figure out your finances sooner rather than later.

It’s extremely generous of your parents to offer to cover things financially and the best thing you can do to show them your gratitude is to start setting and reaching your own financial goals, in my opinion.

For example, take the money they’re saving you by paying your phone bill and put it into savings instead. Or invest it. That way the money will keep growing and work for you over time. Plus, you’ll be building smart financial habits that will improve your life down the road.

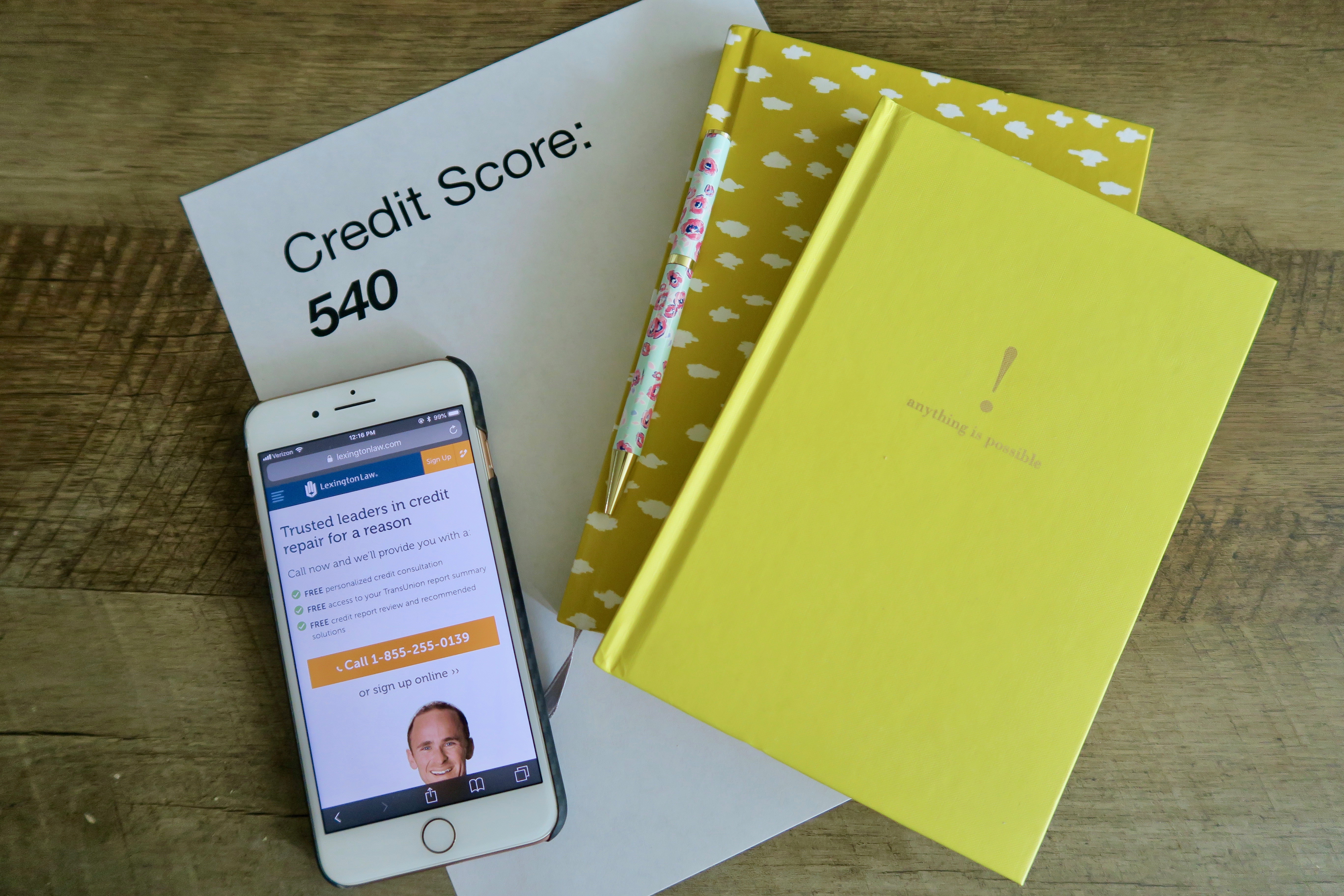

3. Not paying attention to your credit.

This is one thing I hear too often: “I don’t need credit for anything, I’ll just pay in cash” or “I’m not worried about my credit, I won’t need a loan anyway.”

It can take years and years to save enough money to buy something in cash. For example, I lived without a car for six and a half years before buying one in full this year and my credit score is over 800. It wasn’t necessarily intentional but it did take a while to build up that savings to pay in cash (even if i didn’t necessarily “need” to). But even a car is a much smaller purchase in comparison to say, a house.

I grew up around this mentality too. I’ve known people who thought they didn’t need credit because they inherited their homes from their parents. So while they may have owned them outright, they weren’t able to buy a car because they didn’t have any credit. I’ve known people who have purchased cars with interest rates over 13 percent on a seven year loan because of bad credit and lack of credit history. The interest payment is higher than the principal balance every month which stretches the final cost of the car to over $15,000 more than the selling price. That is devastating to consider.

Your credit plays a huge role in your life and can impact everything from your car insurance premiums to your ability to rent or buy where you want to how much interest you’ll pay over time to even if you can be employed somewhere. It’s really not something that should be ignored. If you’re the type of person who needs structure and a plan for your goals, we have a free financial audit download to help keep you on track!

When was the last time you checked your credit report? Do you know your credit score — or at least within 10 points of your *actual* score? These details might feel unimportant, but when it comes time to make a big purchase, you’ll want no surprises when it comes to your credit.

Start by checking your credit report for free at annualcreditreport.com. Lexington Law also has a great guide with three ways to get your credit score and additional information on checking your credit report here.

Even if you feel confident that your credit is in a good place, it’s always worth it to check because you never know what unfair negative items might have appeared. Checking your report will also alert you to the possibility that your identity might have been stolen (it’s happened to me!).

If something seems out of place on your credit report, I recommend reaching out to the credit repair professionals at Lexington Law for a free consultation. They can tell you what your credit rights are and create a plan of action for removing the unfair or incorrect items on your report. You can find out more information here.

While I’m definitely an advocate on figuring out things in your own time, I also think that we should get ahead of the curve while we can. Our twenties are foundational years for the rest of our lives — and that especially includes our finances. One of the best things we have on our sides right now is time, and that won’t always be true.

What do you consider a financial don’t in your twenties?