This post is sponsored by Lexington Law.

You may not realize it, but identity theft is one of the fastest growing crimes in America. Millions of Americans are victims of this crime every year, and billions of dollars are lost because of it.

Finding out your identity has been compromised can be overwhelming. What do you do? Who do you contact? How do you prevent more damage? We will answer all of those questions for you and provide you with resources to get your identity back, repair the damage, and move on with confidence.

What Is Identity Theft?

Identity theft, in short, is “the deliberate act of assuming another person’s identity to perform a fraudulent act such as falsifying a credit application or framing them for a crime.”

According to The Identity Theft Resource Center, millions of Americans are directly affected by identity theft every year. Essentially, thieves use your identifying information like your name and social security number to open credit cards or other lines of credit. When the bill comes due, creditors turn to the person whose name is on the loan — AKA you — for payment.

It can happen to anyone and having your identity stolen can leave you feeling very vulnerable. If you suspect your identity has been stolen or know it has, here is the step-by-step guide to overcoming identity theft.

The Step-by-Step Guide To Overcoming Identity Theft

1. Check your credit report.

If you haven’t yet discovered you’ve been a victim of identity theft, the first place you’re likely to find out about unsavory activity in your name is on your credit report.

You can view your credit report for free once a year at AnnualCreditReport.com. Review your report. Are you responsible for everything on it? If not, you may have been a victim of identity theft.

2. Alert the right people and institutions.

Once you’ve noted that your identity has been compromised, you’ll need to alert the right people to prevent further damage.

1. Place a fraud alert on your credit reports — it’s free.

A fraud alert lasts one year and monitors the activity on your credit reports. To do this, contact one of the credit bureaus. They are obligated to then contact the remaining two on your behalf.

You can contact them here:

Equifax

Equifax.com/personal/credit-report-services

800-685-1111

Experian

Experian.com/help

888-EXPERIAN (888-397-3742)

Transunion

TransUnion.com/credit-help

888-909-8872

Placing a fraud alert also requires additional verification when you open new lines of credit. Lenders will be required to contact you to verify the application. If they are unable to, the application will be flagged and reported as fraud.

2. File a police report.

Because identity theft is a crime, a police report gives you paper trail. Make sure to provide as much evidence to them as possible and request a copy of the report for your records.

3. Contact the FTC or an individual lender if…

If one of your accounts was compromised, your entire identity might not be at risk. It is still a good idea to place a fraud alert on your credit reports, just in case your personal information was mishandled and thieves are biding their time using it.

If your identity was certainly stolen, you will need to file an Identity Theft Affidavit and create an identity theft report. Taking the proper steps and creating a paper trail will help you in the legal aspects of fixing the problem.

3. Begin repairing the damage.

To start, make sure you have the most up-to-date version of your credit report. You are entitled to one after placing a fraud alert on your credit report. Highlight or mark any account or line of credit that you did not open, close, or don’t recognize. Pay close attention to fraudulent charges on your individual accounts as well.

When/if you see things you are not responsible for, contact the fraud department of each business/institution that is reporting an error.

Tip: Keep a log of all of the phone calls you make, the names of the people you talk to, the date and time you speak to them, emails you send, etc. Also, keep track of any expenses you incur as you work towards the resolution of your identity theft. They are often tax deductible.

Most likely, you will need to alert the credit bureaus regarding the incorrect information on your report. This is where the police report will come in handy to verify your claims. Also include any letters or communication from your lenders verifying the fraudulent activity.

Continuously Follow Up

Follow up on your credit repair and police report by contacting the credit bureaus, local police, and your lenders. Make sure progress is still happening on your case, even if they haven’t caught the responsible party yet.

Additionally, make sure that your creditors or lenders haven’t instructed the credit bureaus to place unfair or inaccurate items on your credit report. If they have, be sure to contact them along with your police report and ask them to remove the incorrect information.

Fix Your Credit

Identity theft can damage your credit in many ways. From running up your debt and reducing your credit utilization ratio, tanking your credit score, draining your accounts, opening new accounts, damaging your credit score with hard inquiries, to sending your accounts into non-payment and delinquency, the consequences are vast.

If you’re overwhelmed by repairing your credit due to identity theft, contact the credit repair consultants at Lexington Law.

Fixing your credit after identity theft can take considerable time. You’re not in this alone, and it’s okay to need help. To learn more about how Lexington Law can help you overcome the damage, schedule a consultation here.

[click_to_tweet tweet=”The Step-by-Step Guide To Overcoming Identity Theft” quote=”The Step-by-Step Guide To Overcoming Identity Theft”]

4. Protect yourself for the future.

Going through the process of restoring your good name is both physically and emotionally taxing. The last thing you want to have to do is go through it again.

To keep your personal information safe:

- shred your documents with sensitive information like your SSN

- be aware of email phishing and other scams

- don’t give your information out over the phone or to an unverified source

- don’t access your personal accounts over a public network

- avoid leaving your info in plain sight of others (like in your car or on your office desk)

- don’t carry your SSN card with your or write it down

- Use an RFID wallet

Taking these precautions can help protect your identity from falling into the wrong hands.

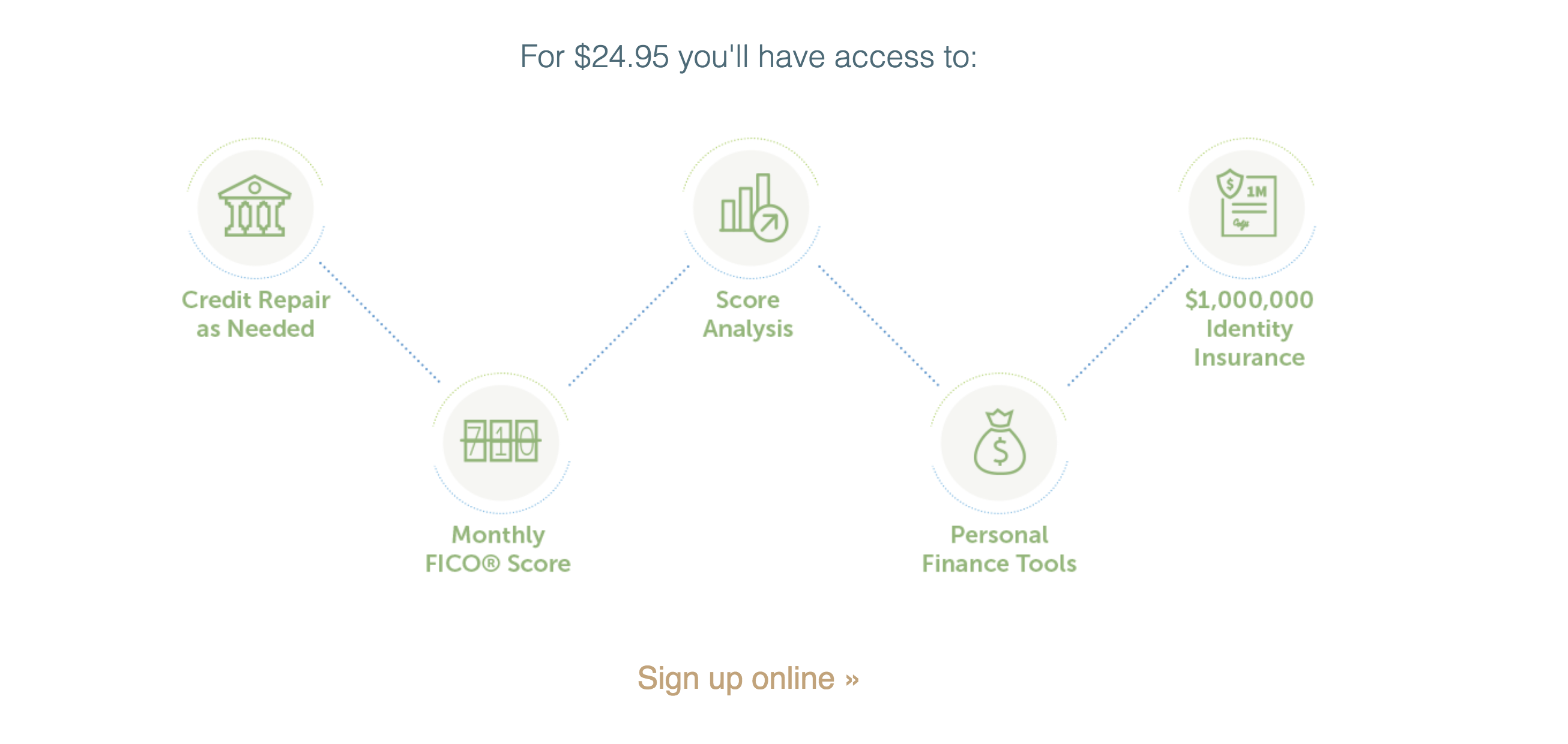

We also strongly advocate for signing up for a credit monitoring service, like Lex OnTrack.

Lex OnTrack will notify you of changes on your credit report, give you your FICO score, provide a credit score analysis, as well as credit repair as needed, and $1,000,000 in identity insurance.

Actively monitoring your credit means you’ll be alerted quickly to changes and potentially devastating problems like identity theft. Your credit report, score, and history is important, and it’s something you should be taking very seriously.

Using a reputable service with provide you with peace of mind and with protection, should you need it.

Don’t Let Identity Theft Steal Your Financial Confidence

Identity theft can happen to anyone. The consequences are vast, and the sooner you catch fraudulent activity and react, the better. The important thing is you work to resolve the situation as quickly as possible and take the appropriate steps to protect yourself in the future.