This post is sponsored by Lexington Law.

Welcome back to Adulting and Money Part 2. Today we are going to tackle how to build your emergency fund as well as six things you can start doing now to prepare for your financial future. If you missed Part 1, catch up here!

Now that you have a steady income coming your way, it’s time to start building your emergency fund. Have questions? Don’t worry! We’re going to cover the why, the when, and the how of it. After that, we’re going to discuss six ways to start preparing for your financial future in your early twenties. Let’s go!

Building Your Emergency Fund

First, let’s look at some reasons why you should have an emergency fund:

- To cover an emergency expense: Perhaps the most obvious reason, your emergency fund is liquid cash that can help you cover an emergency, unforeseen expense. Need to replace a car part? Emergency fund. Spilled water on your laptop? Emergency fund. Have to purchase a last minute flight? Emergency fund. (A short-term emergency fund is great for this purpose! We will get into this in a minute.)

- Loss of income: One of the biggest reasons to have a filled emergency fund is in case you lose your income. If you were to be fired or laid off, how would you manage your expenses until you can find employment? Another example would be having to take unpaid leave from work. Maybe you have major surgery and need to take more time than you have banked. Your emergency fund can help you cover the gap.

How much money should you save?

The next question many people have is how much should I have in my emergency fund?

The general rule of thumb is three to six months worth of expenses.

For these expenses, you need to make sure you are saving for everything you absolutely have to pay for. All of your fixed and variable expenses should be covered. If it is really an emergency and you won’t be including discretionary spending. Your emergency fund will cover your rent or mortgage, and insurance payments, car payment, utilities (water, electricity, etc.), internet or cable, plus your groceries, gas budget, and a buffer of 5-10 percent to be safe.

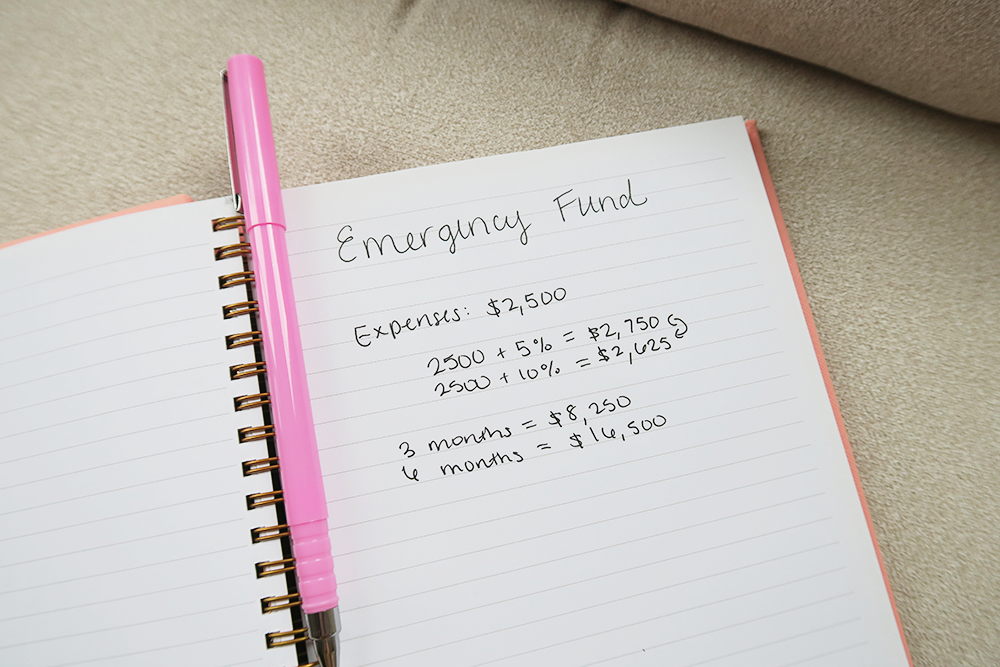

To figure this out, take the expenses number from your budget and add five to ten percent.

For example, say your expenses are $2,500. Multiple 2500 by .05 to get your additional five percent. Double that to get your ten percent number. So 2500 x .05 = 125. So your expenses plus five percent is $2,625. Your expenses plus ten percent is $2,750.

So, three months worth of your expenses in this example would come out to be $8,250. Six months worth of your expenses would be $16,500.

Take a few minutes now to figure out what your three and six month emergency fund figures are now.

Short-Term Emergency Fund vs Long-Term Emergency Fund

As Jessica has shared previously, she calls her short-term emergency fund her “unplanned expenses budget.” This short-term emergency fund should be easily accessible and liquid — meaning you can access that money immediately if you were to need it.

My suggestion is to keep this as a separate savings account attached to your bank account. Call it “unplanned expenses” or “short-term emergency fund.” That way, you can dip into these funds should an emergency expense arise. Once it’s fully funded, I suggest continuing to deposit a small amount of money (think $25-$50) into this account every single month. Aim to have $1,500 – $2,000 in this account.

I’ve had to dip into my short-term emergency fund several times in my 20s. Every time, I have been extremely grateful that I set aside this money so I didn’t have to stress about the financial side of things when an urgent need did arise.

Your long-term emergency fund is more so there so cover your loss of income for an extended period of time. As we calculated above, figuring out these numbers is the first step. It is meant to help bridge the gap until you are employed again. Your emergency fund will keep you afloat and out of debt.

Now, hopefully you will never have to spend this money but know that you will be grateful to have if you ever need it. If you do need to ever use this money, I suggest having a game plan or emergency budget that you will use instead of your current one. Figure out which expenses you would nix ASAP and have a plan to keep your discretionary spending as low as possible.

I suggest keeping your long-term emergency fund in an investment account. Hopefully you will never need to use this money, so you might as well let it grow while it’s waiting for you.

How To Save For an Emergency Fund

Looking at those numbers from earlier, this might seem like an impossible feat. But I can tell that it’s not impossible! It take a little bit of discipline and focus to accomplish.

1. Deposit 10 percent of your paycheck directly into your emergency fund.

Using the example above, let’s say you make $3,500 a month. Ten percent of that is $350. To save your full six months worth of expenses, it would take you about 47 months or 3.9 years. To save your three months worth of expenses, it would take you about 2 years.

Even if you can’t save 10 percent of your paycheck, try to at least save five. And if you think you can’t try it out for six months and see if you actually can adjust your budget to reach your savings goals. The experts at Lexington Law agree — your future self will thank you.

2. Sell your old stuff.

Go through your space and start decluttering. Anything with value can be sold on eBay, in Facebook groups or on Craigslist. There’s no point in holding on to things you aren’t using anymore. Turn them into cash and put it in your investment account where it will start growing!

Plus, when you’re spending time decluttering and selling stuff, you have less time to spend on expensive activities. It’s a win-win.

3. Start a side hustle.

Chances are you probably have skills that someone else values enough to pay money for. Use your expertise to bring in some extra cash! From tutoring to babysitting to managing Facebook ads for local businesses, there is plenty you can do to make an extra $500 each month.

Every dollar you’re able to put towards your emergency fund makes a difference. Having an emergency fund gives you peace of mind and financial freedom in the future.

Start Preparing For Your Financial Future

Beyond saving for your emergency fund, here are six things to start doing in the six to twelve months:

1. Grow your skills and network.

This should really be a lifelong goal but let’s face it: the more skills you have and the bigger your network, the more career opportunities you’ll have.

My friend Erin is a freelance copywriter and the majority of her clients come from her network. She’s had major brands for clients and has the experience, expertise, and results to back her skills up. Plus, she’s always staying on top of industry trends to stay knowledgeable on her field. Because of these two things, she’s earning more than ever and is able to create a financial life she’s always dreamed of having.

2. Set defined savings goals.

You’re far more likely to actually reach your savings goals if you define them. Planning for a vacation? Name that fund “Hawaii” or “Japan.” Saving for a car? Name your account using the make and model. Creating a future family fund? Call it “Baby 1” or “Adoption.” Aim to have a specific amount of money in each account so you know exactly what you need to save to reach your goal!

Getting clear on your goals makes it easier for you to save for a specific goal instead of for a generic, lofty one.

3. Sign up for credit monitoring.

This is one of those things that unfortunately many people don’t consider until it’s too late. (Think data breaches and stolen identities — you often know well after the fact, usually only when a company is required to report that your data was stolen.)

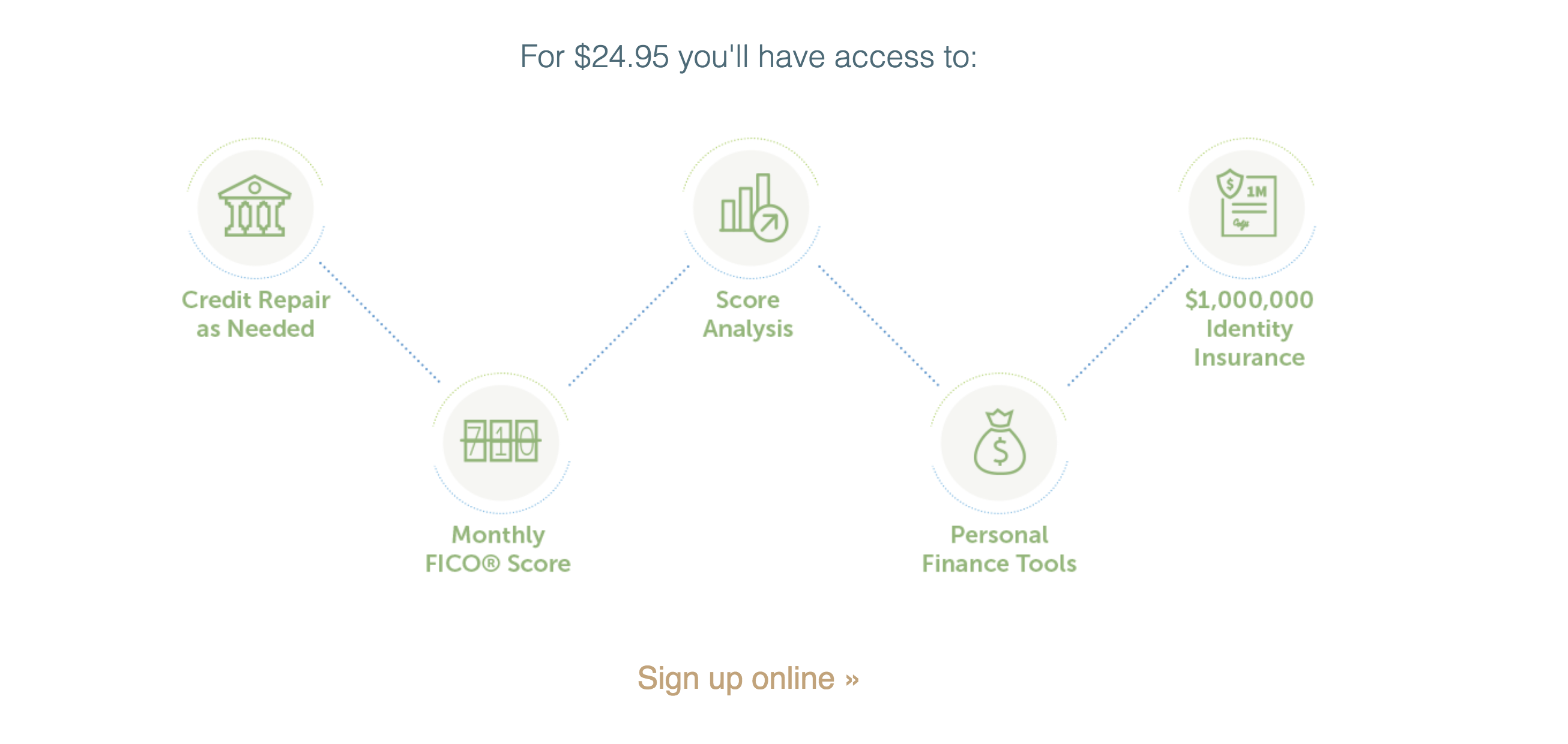

A credit monitoring service like Lex OnTrack is invaluable in helping you stay on top of your financial goals. With a service like this, you can monitor your credit, work with professionals as needed for credit repair, analyze your credit score, use their personal finance tools, and you’ll have $1,000,000 in identity insurance. Click here to learn more and sign up.

4. Create a debt repayment plan.

If you have any debt, now is the time to get serious about paying it off. Don’t wait until your late thirties to finally rid yourself of those numbers!

Have various debts? Maybe debt consolidation is the right way to go for you. Weigh the pros and cons and talk to a financial professional before making any quick moves.

5. Start investing.

Feel unsure of the stock market? You’re not alone. According to our annual reader survey, nearly 70 percent of our readers want to know more about investing. Investing can be a complicated topic, so we will save the nitty gritty for another day. One thing to know, though, is that the best thing we have on our sides as twenty-somethings right now is time! The earlier we can start investing, the more our money will grow.

One service we really like for investing is Betterment. They make it easy — and easy to understand! — what is happening with your money. We recommend starting small and speaking with a financial advisor to decide what your investment goals will be. It’s also a good idea to get your credit score up before you start investing — here’s why.

6. Think about your retirement plan.

Like I said in my post on 5 Financial Goals To Achieve Before You Turn 30, looking so far ahead to retirement can be tricky, but there are a few things you can do now to prepare for your financial future:

Roughly calculate how much money you’ll need in savings for retirement.

This can be super tricky. How can we even possibly know what we will want to do when we retire? Plus, when you look at retirement calculators, many of them base your retirement expenses based off of your current lifestyle and income. It’s really hard to say if that’s realistic or not. No one can predict the future, but we can do our best to be prepared.

Talk to your family members who are approaching retirement or are retired and ask them about their experience. What are they happy with? What would they have done differently? Also look at the cost of various options. Would you want to live in your own home? Go to senior center or assisted living facility? These are tough questions but important to think about before the time comes.

Once you have a handle on how much you’ll need per month or annually, it’s time to look into the best options for retirement. There’s not always a clear cut answer, though when it comes to saving money, when you’re in your 20s, time is on your side. See if stocks and mutual funds will be worth your effort or if your 401(k) or IRA is the way to go. Chances are it’s going to be a mix of the two.

A good idea is to take a retirement test run to see what it might be like for you. It also helps to plan to have all debt eliminated by then and have excellent health insurance.

[Tweet “Adulting and Money: Building Your Emergency Fund & Preparing For Your Financial Future”]

All of these are important too, especially if you’re considering retiring early like those who are part of the F.I.R.E Movement do.

Still with me? Phew! I know this was a lot of information to digest. If you haven’t started saving for your emergency fund, I want you to sit down some time in the next seven days and figure out your plan. Beginning with your next paycheck, start saving!

As for preparing for your financial future, now is the time. Pick one or two of these things to get started on seriously in the next six months. Do some research, consult with an expert, and figure out what the right path is for you. Take action now — your future is in your hands.

Read the full Adulting and Money series here:

- How To Manage Your First Salary and Benefits

- Building Your Emergency Fund & Preparing Your Financial Future

- How To Talk To Your Partner About Money

- How To Prepare Your Finances For a Family