This post is sponsored by Lexington Law.

Did you know that identity theft impacts millions of Americans each year? It’s one of the fastest growing crimes in America and costs billions of dollars annually. Yup, billions.

About 10 or so years ago, I learned firsthand how potentially devastating identity theft can be. My story had a quick and happy ending, but for many that it isn’t the case.

Related: The Step-by-Step Guide To Overcoming Identity Theft

How My Identity Was Stolen

I can’t be sure of *exactly* how my identity was stolen. However, I do know that I noticed it when I was applying for student loans for college during my senior year of high school.

My mom and I uncovered that someone was using my social security number to work at a grocery store. They were reporting that I was earning the income but they were taking the money themselves. I had never applied to work at this store and hadn’t even ever been there.

While this person was working there under my name and social security number, they were trying to leave me responsible for the taxes. I was lucky that we caught it extremely early. Otherwise they could have opened multiple lines of credit in my name, leaving me massive payments and debt that wasn’t mine.

To resolve the issue, I had to file a police report and send letters to the credit bureaus. I was so lucky to catch it early so that was the only damage done. Even catching it early, though, I felt particularly vulnerable. I also felt uneducated when it came to my credit and how to protect myself in the future. It was because of that that I started taking steps to protect myself and improve my credit score.

[Tweet “How I Got My Credit Score Over 800 After Identity Theft”]

How I Got My Credit Score Over 800 After Identity Theft

1. I took the appropriate action steps.

First I checked my credit report to make sure nothing else was going on. I made sure I recognized all of the accounts and information by going line by line. You’re entitled to a free credit report every year. You can access yours at AnnualCreditReport.com.

Then you’ll need to file a fraud report. I’ve covered the exact steps for doing that here. You’ll also want to file a police report and keep detailed records of all of your correspondence regarding the situation.

Your case might be simple and straightforward, but many time it is not. If you’re feeling in over your head after your identity was stolen, I recommend contacting Lexington Law for a consultation. They will be able to assess your unique situation and create a game plan for repairing your credit after identity theft.

2. I started with small lines of credit.

My identity was stolen while I was in high school. Because I was so young at the time and hadn’t taken the opportunity to educate myself on credit further, this was the time I started to do so.

My first line of credit was technically a student loan that I took out to cover gaps in funding for a summer program I did before college. I did work all but one semester of college, including summers, so I had a decent part-time income coming in. While my spending habits were not the greatest during that time, I *did* recognize that I should take this opportunity to start building my credit.

I opened a small store card. I was only approved for a $300 limit, thankfully. That was just enough for me to spend responsibly and pay off that card month to month.

Related: Credit Building Basics: How To Build Good Credit

3. I made all of my payments on time.

Your payment history makes up 35% of your FICO credit score, so it’s a pretty big deal. I’ve always made my payments on time to ensure I don’t get dinged in that respect. I’ve made one late payment in my entire life and was able to call the bank and have them forgive it as it was my first time.

A tip is to set up automatic payments for your minimum payment due every month. That way you’ll know you’ll always be covered with at least the minimum in case of an emergency or forgetfulness.

4. I slowly opened more lines of credit over time while keeping my balances low.

It took me over a year of making payments on that card to be able to open a major credit card with a higher limit. I had to slowly build my credit score up to prove my trustworthiness to lenders. Keeping low balances (below a 30% utilization ratio!) helped prevent my small amount of credit card debt from greatly impacting my score.

I waited to apply for bigger cards with rewards until I was sure I would be approved. I didn’t want hard inquiries on my credit report that would only ding my score further.

5. I waited.

Repairing your credit and building your credit can take time. You might occasionally see results quickly but it’s never guaranteed. Your length of credit history makes up 15% of your FICO credit score, so patience is important here.

How I Protect Myself Now

1. Shred my documents.

Because my identity was stolen and I’m still not sure how that happened, I’m very careful to shred documents containing sensitive information.

This includes anything with my social security number, address, account numbers and names, sign up codes, special offers, etc. I don’t want to give anyone the chance to open an account in my name.

2. A credit monitoring service.

I have an account with CreditRepair.com. Each month I am notified if there have been any changes on my credit report. If there have been, I can speak with a credit consultant to make a game plan for removing those unfair negative items.

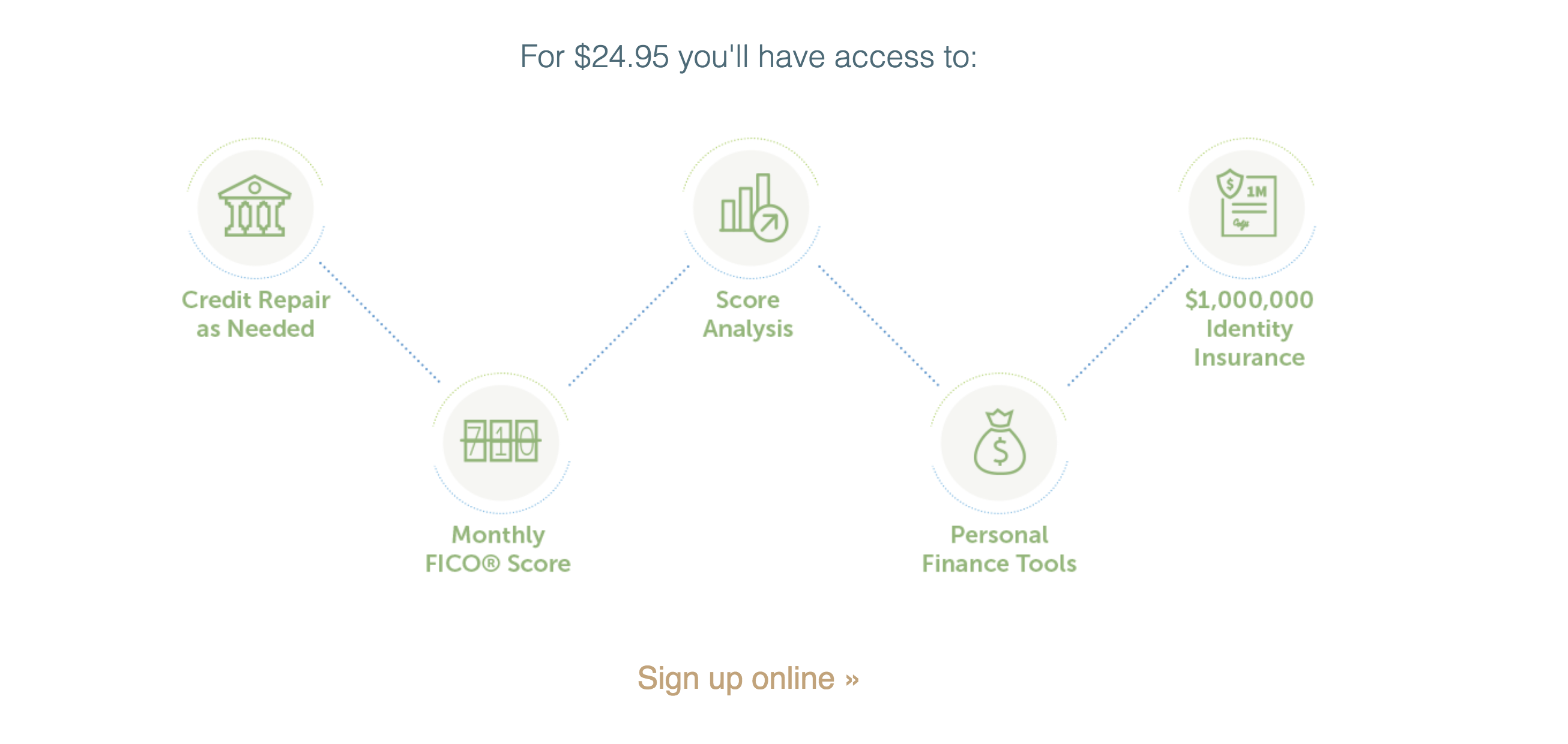

Even if your identity hasn’t been stolen, I strongly recommend using a service like Lex OnTrack to play the offense when it comes to your credit and identity theft. While it is absolutely possible to recover from identity theft, the quicker you can catch anything going awry, the better off you’ll be.

Using a reputable service like Lex OnTrack can give you peace of mind — and protection, should you need it! With your membership, you’re notified of changes on your credit report. You can see your FICO score as well as a score analysis to see where you can improve. You also have access to credit repair as needed and $1,000,000 in identity insurance.

If you’re actively monitoring your credit, you’ll be able to react quickly to potentially devastating problems. I was lucky in that I caught what happen to me early on but that’s not the case for many Americans. Your credit is so important and should be taken seriously!

3. I change my passwords frequently.

Changing your passwords frequently is so important! You never know when one of them might be compromised. If you’re using the same email address and password combination for many accounts, if someone figures it out for one account, they’ve pretty much figured it out for them all.

To combat this, use different passwords for all of your accounts. I also make a note to update my passwords every three months and close out online accounts that I am not longer using.

4. Be mindful of phishing.

From phone scams to internet scams, phishing is on the rise. Even now, I often get multiple calls a week from phone numbers I don’t recognize.

If you get a weird email or phone call that seems off, make sure to check the sender. If it’s an automated system calling you, be even wearier. You can also always call your lender, creditor, or bank directly with a trusted phone number to be sure the contact is legitimate. To go even further, you can even try to visit in person to make sure your accounts haven’t been compromised.

If a phone call or email is asking for your full social security number, that is a huge red flag. And never send sensitive information directly through email! Being cautious and withholding your information is the best way to protect yourself from phishing schemes.

Having your identity stolen can leave you feeling vulnerable. It can also be overwhelming with not even knowing where to begin! But know that there are steps you can take to feel financially confident again and credit repair consultants you can speak with to get back on track.

Have you ever dealt with identity theft?