This post is sponsored by Lexington Law.

Which would you categorize yourself as: a spender or a saver?

I personally would call myself a saver that likes to spend. I can’t lie to you, I do like to spend money. I enjoy purchasing things that enrich my life and bring me joy. It’s fun to go shopping with friends and bring home matching lipsticks or t-shirts (yes, this is a thing that I do with my friends — and it’s awesome!). I enjoy a meal out. I like buying cute stuff for my kid.

That said, I also like to save money. In fact, I save over 50% of my income. I’d also like to be transparent and say that we do have a dual income household and it has taken us years of trial and error and brutal honesty about our spending and future financial goals to get to this point. It didn’t happen overnight.

I also don’t think that there is a magic number of what you should save and what you should spend. You need to look at your current situation and your own personal goals to decide what is right for you.

All that said, it’s hard to know whether saving is a learned behavior or one you’re born with. It’s kind of like which came first, the chicken or the egg? Regardless, though, I think the habits you build on a daily basis can help you turn your spending habit into a saving one.

Saving is ultimately better for your finances and your credit. Did you know that 2 in 5 Americans have less than $1,000 in savings? They might be one major car repair or illness away from having to dip into emergency lines of credit, taking out a payday loan with outrageous interest, or declaring bankruptcy. Doing any of these can tank your credit score and elongate or even eliminate your motivation to reach your financial goals and cause unnecessary stress.

These ten habits can make a huge impact in your life and help you sock more money away for a rainy day. Or a dream vacation. Or a house. Or funding your education without loans. Or even quitting your job and retiring early. Building a savings habit and educating yourself financially is putting you on the path to financial freedom. Let’s get into it.

[Tweet “Building a savings habit and educating yourself financially is putting you on the path to financial freedom.”]

10 Money Habits That Will Turn You Into a Saver

1.Saving for a specific goal.

Instead of throwing money generally into savings account for “something you might need in the future,” why not give your accounts names?

It can be easier to save for “two-week dream trip to Thailand” instead of “vacation.” One is very specific detailing exactly what you’re planning to spend the money on. The other is a general, might not ever come to fruition kind of title.

Every time you make a transfer into that savings account, savor it. Give yourself a moment to imagine sitting next to a pool in Bali, seeing the Opera House in Sydney, or diving in Iceland. Envision it and remind yourself that it is worth the effort.

[Tweet “Need motivation to save money? Name your savings accounts.”]

2. Budgeting.

Yep, the “b” word. Love it or hate it, it’s one way to help you save more money. Knowing where your money is going in the first place is the first step to getting it to where you want it to go in the long-term. Plus, having disorganized finances might be tanking your credit score.

[Tweet “Knowing where your money is going in the first place is the first step to getting it to where you want it to go in the long-term.”]

Budgeting doesn’t have to be overly complex. You don’t need to beat yourself up if you go over in a category. Simply adjust your spending to be more in line with your goals.

Another shortcut to budgeting is having a simple budget. Instead of multiple line items, classify your budget like this:

- Needs (fixed expenses like rent, phone bill, internet, car payments, groceries, debt payments, etc)

- Wants (eating out, shopping, etc)

- Savings (what you save)

This is an easy three-category way to manage your spending. Make sure to take tip #3 into account before setting limits on yourself.

3. Paying yourself first.

This is probably one of the best pieces of advice anyone can give you. It’s so important to pay yourself first!! (So important, in fact, that it requires two exclamation points.)

Paying yourself first involves an automatic transfer directly to your savings account immediately when you get paid.

[Tweet “Paying yourself first involves an automatic transfer directly to your savings account immediately when you get paid.”]

It means you’re saving money before you can even think about spending it. This is a key move because it keeps your money in your pocket instead of sending it into your bank account, through a revolving door, and away to someone else.

[Tweet “You need to pay yourself first. Here’s why (and what it means):”]

4. Try the cash envelope system.

If you’re struggling with using your credit cards and learning how to save money, I have a different method for you.

Instead of spending on your cards, spend with cash only! This might not be a great long-term method for you but it can help you reign in your spending.

Essentially the idea is to set aside cash for each area of your budget. From groceries to utilities to personal spending, you’re only allowed to spend the cash money allotted. If you don’t have the cash, you can’t buy the item. Simple as that.

My friend Kayla from Lost Gen Y Girl shared her experience in depth on this method on her YouTube channel. If you’re the kind of person who needs to see this in action, her video is a good place to start!

5. Checking your credit report annually.

When you’re checking your credit report, you’re looking for unusual activity. If something seems fishy, you have rights as a consumer to inquire about those unfair negative items.

Your credit report also shows you your available credit and the credit you’re using. If you’re saving to buy a house or a car, for example, checking your credit report can be the motivation you need to sock more money away.

If you’re confused about how to read it, here is a step-by-step guide to show you how to understand your credit report.

If you do notice something out of the ordinary, unusual, or concerning on your credit report, considering contacting the credit repair consultants at Lexington Law with your questions.

After having my identity stolen, I know how vulnerable it can feel to have something so personal taken away from you. If there is anything I learned from that experience, it’s that diligent checking of your credit report can make all the difference. It was also that experience that helped me understand that I needed to establish credit. I started my credit journey in college with student loans, and then a store card, and then a Discover card.

I later learned about utilization ratios and how important they are, but what checking my credit report made me realize was that I need to have money saved to cover my emergency expenses. Having an emergency fund keeps you from dipping into lines of credit — which can wreak total havoc on your credit score, by the way.

Put it on your calendar to pull your credit report at least once a year and give it a line by line look over.

[Tweet “Have you checked your credit report yet this year? Here’s your reminder.”]

6. Actively improving your credit score.

When you’re taking steps to actively improve your credit score, chances are these behaviors involve saving more money.

If you don’t know what your credit score is right now, our friends at Lexington Law have an awesome guide with three ways to check your credit score for free.

Once you check your credit score, you can decide if you want to start improving it. When I realized I needed to start improving my credit score, I knew I had to cut back on my spending and stop accumulating more debt. Once I was able to do that, and after I paid down my debt, there was more leeway in my budget to up my savings numbers.

By making your payments on time, lowering your utilization ratios, keeping your oldest lines of credit open, and working with a credit repair consultant as needed, you can work towards improving your credit score.

7. Automating transfers.

Another way to save money? Do it mindlessly.

Automating your payments and transfers (and automating that monthly payment to yourself!) is such a simple, simple way to save money.

As an extra tip, check your credit card balance and your bank balance at the end of the month. Transfer the difference to your savings ASAP. That way, you’ll be more inclined to save it instead of spending it!

[Tweet “An easy way to save more money? Do it mindlessly. “]

8. Living below your means.

I always think spending below what you can *actually* afford is a good idea. There are many millennials who are living paycheck to paycheck because of the cost of rent plus student loan debt payments and a lower salary than what they deserve. It’s challenging and difficult to think about saving money when there’s barely enough to go around. (And you seriously won’t believe what you might be paying in interest.)

I’ve been there. I’ve rented an apartment at the top of my budget before, leaving virtually no money behind to save. It was to the point that while I could afford the apartment itself, I wasn’t even able to purchase a $500 couch for about six months to fill the space.

Since that time, I’ve learned to manage my money a bit better. My husband and I lived in a 600 square foot apartment for three years while we saved. This rent was on the low side for the area we lived in and at that point we could have technically afforded more, but we both understand that by not spending that money, we could save it instead.

We also chose not to own a car for over six years. I know this isn’t necessarily practical for everyone, but it’s something to consider if your vehicle is not strictly necessary and eating into your overall budget.

9. Paying off your credit cards in full every month.

When I was aggressively paying off my debt, I would cringe at my credit card payments. And when I couldn’t make them in full? I nearly cried. It was heartbreaking and defeating to be trying to pay off debt only to see myself fail month after month.

Eventually, I decided that to see real change, I would have to do something I’d never done before. Ultimately that meant keeping the balances on my credit card lower than the amount in my bank account.

Doing so meant I could pay my balances in full every month. Eventually, I was able to lower the amount I spend every month to be able to pay off my debt and transfer even more to savings.

[Tweet “10 Money Habits To Go From Spender To Saver”]

10. Reviewing your accounts, and monitoring your credit report and identity.

In today’s digital world, it’s easier than ever to access our money and information in just a few seconds. But it also makes us more vulnerable to identity theft through data breaches. Even Equifax has been impacted by a data breach.

In these times, it’s more important than ever to take necessary precautions to protect yourself. As much as we can automate savings, nothing compares to you checking your accounts. Make sure you check in on your credit card statements at least once a week to protect yourself financially from false charges and identity theft.

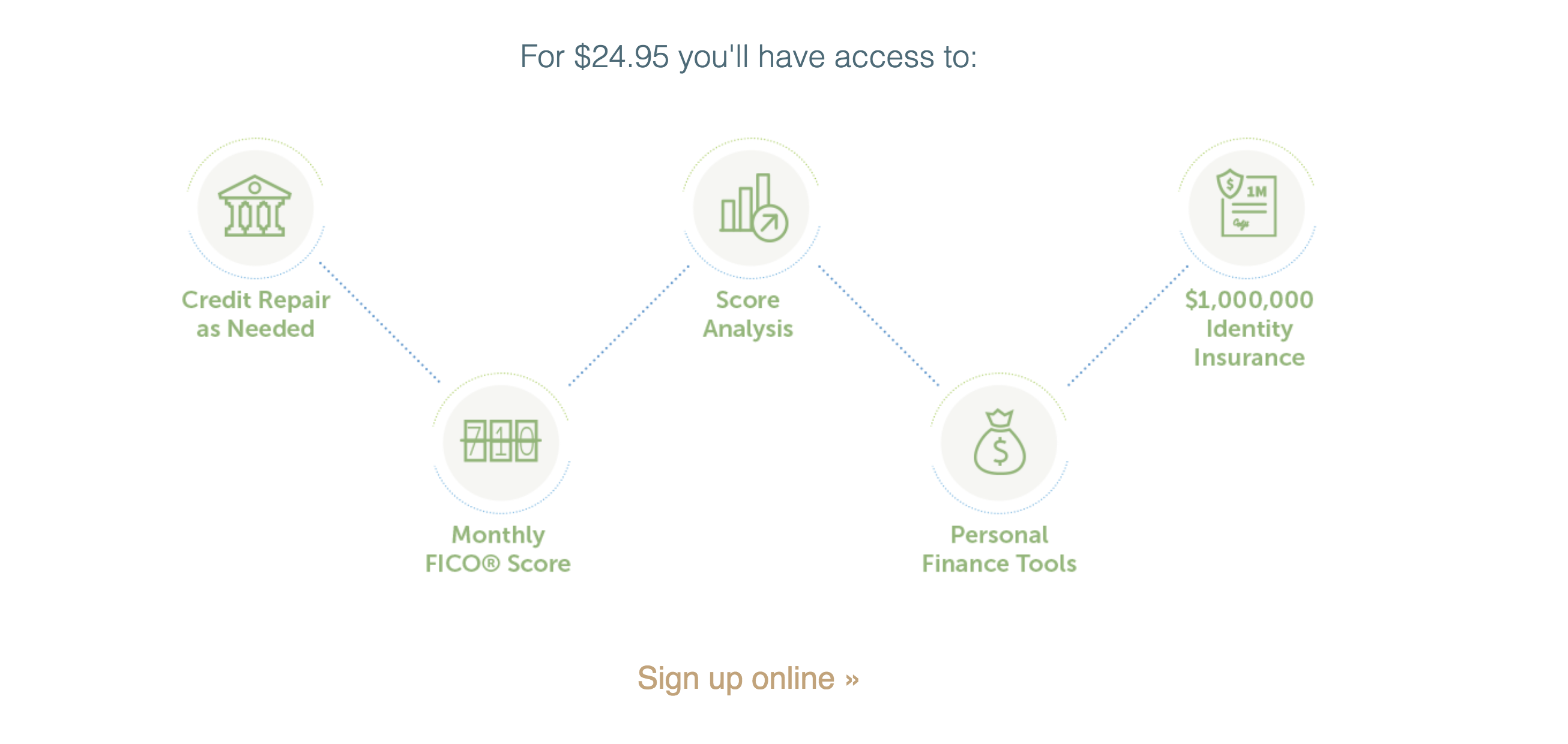

And just like checking your credit report, it’s important to monitor your identity a well. I use Lex OnTrack myself to stay abreast of potentially devastating actions. They provide you with your FICO credit score, a credit score analysis, access to credit repair as needed, and $1,000,000 in identity insurance. You can learn more and sign up here.

Related: Lex OnTrack Review: Why You Should Monitor Your Credit

Part of my financial plan is to be prepared in case disaster strikes. Monitoring my credit has helped me be more motivated to be financially prepared for emergencies. My emergency fund has six months worth of expenses in it (and I’m working on getting to nine next). Monitoring my credit report and identity has made me more mindful of how saving is protecting my future self.

So there we have it, 10 money habits that will turn you into a saver. Are these foolproof? No. It will still take intention to help you reach your financial goals. But after learning a lot throughout my twenties about spending habits and credit, I wholeheartedly believe that practicing these behaviors can have a huge impact in how your view your money and help you reach your financial goals.

I’d love to hear from you below — what money habits have helped you save more money?