This post is sponsored by Lexington Law.

Have you ever looked at your credit score and thought, wow — I wonder how I can make that higher? If you have, you’re not alone!

Upping your credit score is a matter of educating yourself and then implementing that education. There are a few simple steps you can take in the next 6 months to start improving your score. For more complicated situations, there are specialists who can help you achieve your credit repair goals.

The fact of the matter is that your credit score is important. You shouldn’t ignore it just because you don’t understand it! Your credit score is how lenders gauge your creditworthiness, aka the risk they are taking on to lend you money or a line of credit. Your score comes into play with your interest rates, credit limits, and loan terms, to name a few things it impacts. It also can determine other things to like whether you can lease an apartment without a cosigner, if you will even be approved for a loan, or even if you can get a job.

Below, I’m going to walk you through what factors your FICO score is made up of and how you can work to improve your score based on that. Plus, my first step is something I always recommend — and for good reason.

First of all, sign up for an identity monitoring service.

I have been using a service for identity monitoring for nearly five years now. Every month, I get updates on if there were any changes to my credit report. This gives me so much peace of mind!

For example, recently one of my automatic payments to my credit card wasn’t processed properly. I was notified immediately that I had a late payment due and was able to rectify with situation immediately without any lasting damage. If I hadn’t gotten that report, it may have been an entire month before I noticed the late payment.

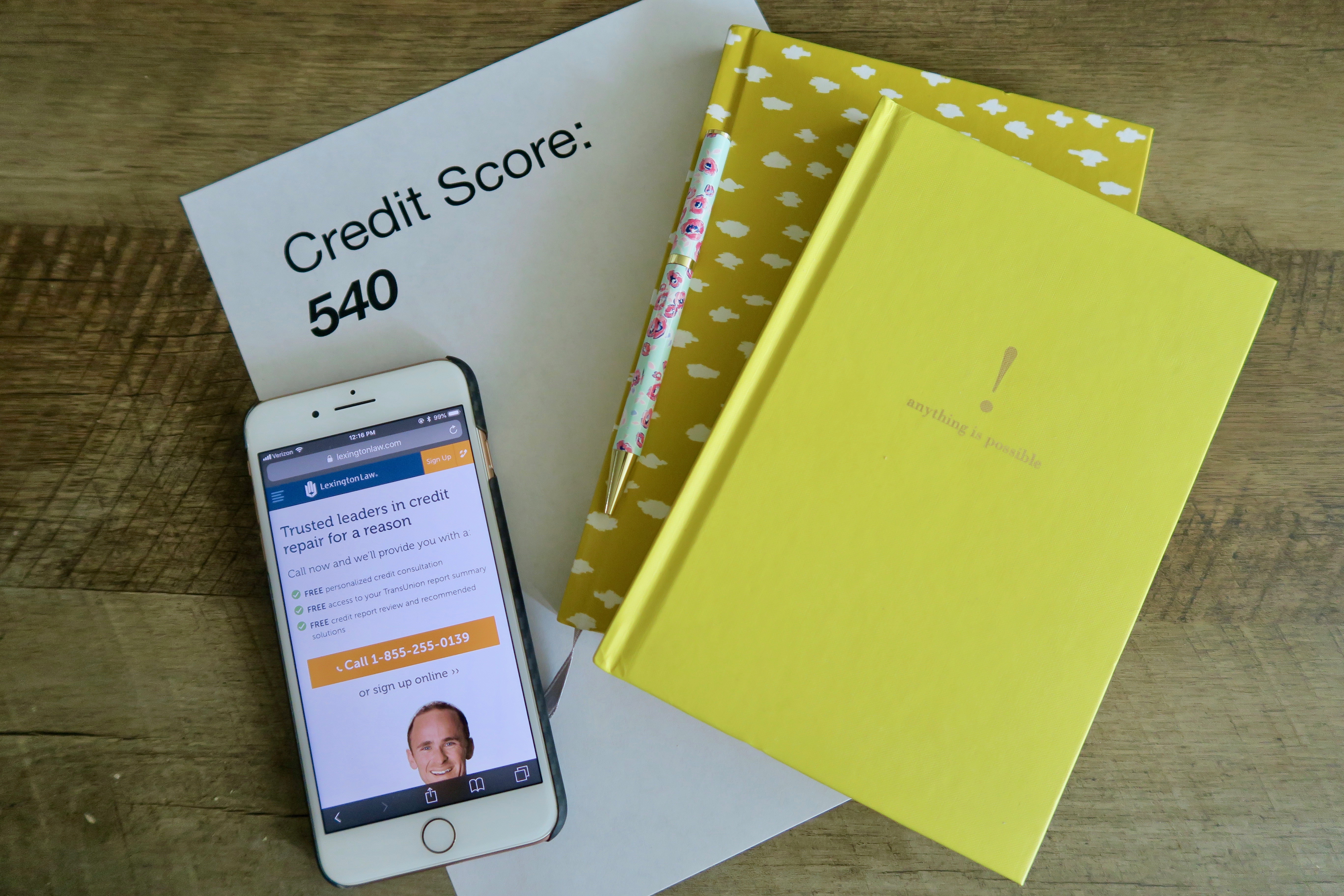

An identity monitoring service, like Lex OnTrack, is an invaluable part of your financial strategy. You’ll be able to track and protect your identity but also your credit and finances. They’ll not only monitor your credit report for changes but banking system fraud alerts as well. Whenever something changes, you’ll be notified so that you can identify fraudulent or incorrect changes.

With Lex OnTrack, you also have access to credit repair specialists who can help you as-needed. Plus, with the score analysis feature, you’ll have targeted insight on how you can begin improving your credit score.

How To Start Improving Your Credit Score in the Next 6 Months

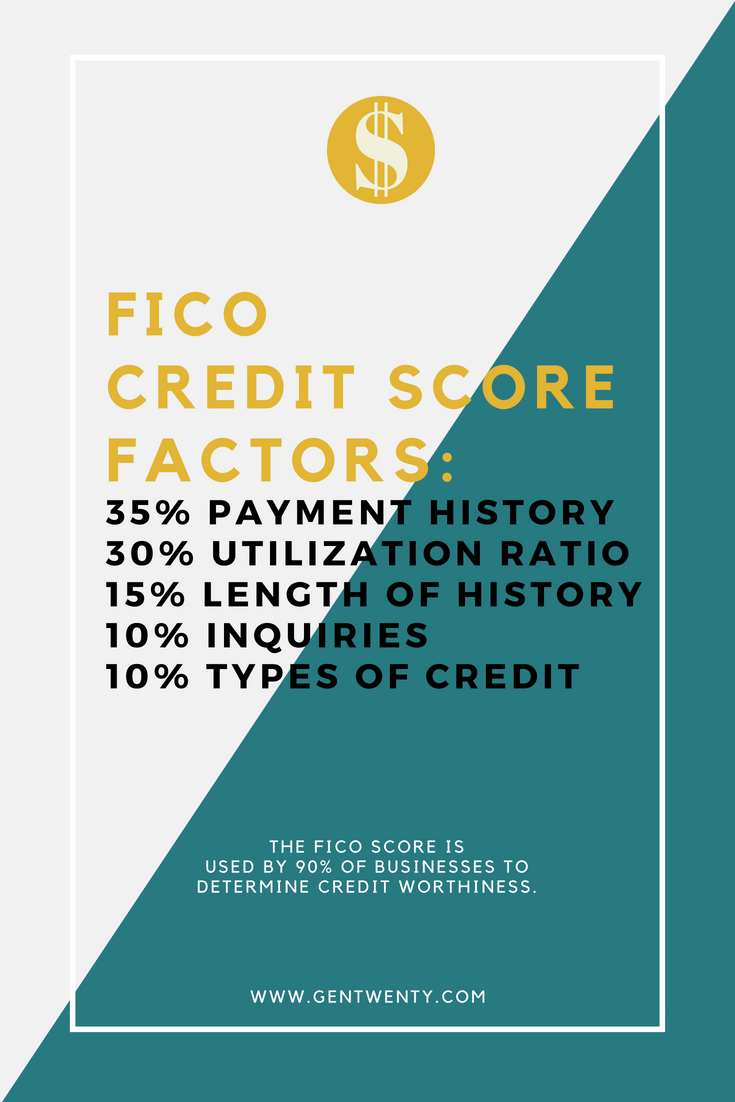

Now, improving your credit score involves taking a look at what your score is made up of. If you remember correctly, you’ll know that there are five factors that make up your FICO credit score:

- Payment history — 35%

- Utilization ratio — 30%

- Length of credit history — 15%

- New credit or inquiries (this hurts!) — 10%

- Types of credit/Credit Mix — 10%

See those percentages next to each factor? Those are arguably the most important part. They indicate how much each factor affects your total score. (For a more in-depth refresher on the factors, see this post).

There are steps you can take that impact each of the factors that will begin improving your credit score in the next 6 months. Here’s how to do it:

1. Begin making all of your payments on time.

If you think making a late payment here and there isn’t a big deal — think again. Because your payment history makes up a whopping 35% of your credit score, late payments are a BIG deal.

By the numbers:

- A late payment on one single account can lower your score by 15-40 points.

- Missing payments for all of your accounts in the same month can drop your score by 150 points.

- One payment that is 90 days late can be as damaging as a collection account, a judgement, a tax lien, or even a bankruptcy.

- Each late payment you make is weighted more heavily than the one before.

If you’re struggling to make you payments on time every month, there are several things you can do to ensure you’ll be able to make your payments on time:

- Contact your creditors and adjust your payment date. If you situation is difficult because your payments are due before your paycheck comes in, talk to your lenders to see if it’s possible to adjust your payment dates. This will help ensure you have the cash to make the payment.

- Pay you bill the day it arrives. Don’t wait to make a payment. Send it off the day it comes in to make sure you get your payment in on time and it doesn’t accidentally slip your mind.

- Set up automatic payments. If you’re afraid you’ll forget to submit your payment, set up automatic payments! Mark your calendar so you know when these will be drafted and arrange them for after you get paid.

If it’s still difficult for you to make all of your payments on time, you might want to consider the pros and cons of debt consolidation. While it’s not appropriate for everyone, it may be a viable option given your motivations, discipline, and spending habits.

2. Reduce your utilization ratio.

Because your utilization ratio makes up another 30% of your score, it plays a major role in your credit score. It’s important because this is what lenders use to predict future behavior and risk. Are you going to pay them back what you owe? This gives them insight into that.

In short, utilization is how much of your available credit that you are currently using. The ratio is calculated by dividing your available credit by used credit to come up with a percentage. As an example, if you have $10,000 in available credit and are using $7,500 of that credit, your percentage is 75%. A utilization ratio over 30% can have a dramatic impact on your score.

In addition to that, Line Item Utilization (your ratio per each individual line of credit) and Aggregate Utilization (your ratio across all of your lines of credit) also matter.

To reduce your utilization ratio and begin improving your score, start by:

- Paying off some debt. Paying off some of your debt is one of the most straightforward ways to reduce your utilization ratio. You’ll free up your available credit and reduce the ratio, therefore giving room for your credit score to increase. Paying off debt will not only help increase your credit score, but will open up many other opportunities as well.

- Requesting a credit limit increase. Increasing a line of credit (not opening a new line of credit) will increase your available credit vs used credit and increase the ratio. Only do this if you have the discipline to not spend up. You may initially lose a few points if there is a hard inquiry on your credit, but because utilization is such a major factor in your score, it’s usually worth it.

- Changing your bill payment due dates. Our friends at Lexington Law have pointed out a major factor that many people wouldn’t even know to consider! If you are consistently seeing a high utilization ratio, it may be because your credit card issuers or lenders are reporting your balance to the credit bureaus before you pay your bill. This means that even if you pay your bill in full every month you may still be seeing a high ratio because it’s being reported before your payment goes through. Talk about a game-changer!

- Checking that your credit reports are accurate. Did you know that 79% of all credit reports contain errors? These errors can have a varying impact on your credit score. In this specific case, make sure to check that your credit limits are accurate. If a credit line increase was not reported properly, your utilization ratio could be incorrect which may have a dramatic impact on your score. You can’t afford to ignore the details!

3. Account for length of credit history, types of credit, and hard inquiries.

The final three factors may not be large individually, but together make up another 35% of your credit score. There isn’t necessarily any action you can take right now on these factors, however, they are important to keep in mind as part of your financial strategy going forward.

Here’s how to take the remaining factors into account:

- Keep your oldest line of credit open. Your length of credit history makes up 15% of your score. If you are looking to close old lines of credit, leave your oldest line open to show length. This is especially important when you’re in your 20s or 30s and haven’t had credit for that long. This may involve making a purchase on that card (and paying it off immediately) so your lender doesn’t close the card due to inactivity. Keeping it open is a simple thing to do in order to have it not impact your score negatively.

- A credit mix. Varying types of credit at different interest rates and term lengths can show that you’re a dependable borrower. These vary between installment debt (a loan with a fixed interest rate like a mortgage, car payment or student) and revolving debt (something with a variable interest rate and open-ended payoff date like a credit card). This is not a reason to go buy a house or car, but it’s something to keep in mind going forward as part of your financial planning.

- Hard inquiries. A hard inquiry is when you give a lender permission to check your credit report. They will cause your score to dip somewhere around a few points per inquiry. These stay on your report for two years before they are removed, however, there may be more options for you to remove these sooner or reduce their impact. Working with a credit repair service can help you isolate which can be removed to help improve your score. To avoid a heavy impact from hard inquiries, spread your applications for new lines of credit out over a few months.

4. Work with a credit repair specialist.

While there are some things you are able to do yourself to improve your credit like making payments on time, other situations may be much more complicated. As average consumers, we can do what is within our control to reduce our debt burden, make payments on time, and have a long credit history.

But what happens when it comes to knowing your rights according to legal statutes? How do you go about contacting a plethora of creditors? How do you raise your credit score when making payments on time isn’t enough?

While educating yourself on your credit and pursuing financial education is important, it’s also important to know when you need help. Working with the specialists at Lexington Law to improve your unique financial situation is the next step.

Reach out today to begin learning your options during a free consultation. Having knowledgeable staff who can advocate on your behalf is a positive step towards better credit, a better life, and a better financial situation.

Improving your credit score in the next 6 months will take time, discipline, and a strategy. Understanding what is impacting your unique financial situation is the first step to taking control of your finances. Don’t hesitate to reach out when you need additional resources from credit repair specialists. Your credit goals are achievable.