This post is sponsored by Lexington Law.

In our recent reader survey we asked the GenTwenty community what they wanted to know about money. Ninety percent of you said finance is your favorite topic to read on the site and over 50% of our readers reported wanting to know how to increase your salary and make more money. So today we’re going to talk about it.

The two most common reasons that were given for wanting to make more money was to reach their financial goals and pay off debt.

When you think about making more money, I don’t necessarily want you to think about making more money this week or this month. Think about it in the long-term and building a sustainable plan that increases your income year after year.

Making more money has a plethora of benefits, including:

- financial freedom

- financial security

- less debt (and more money to put towards debt repayment)

- building up your savings account

- more money to put towards retirement

- less stress in your daily life

- the ability to improve your credit (and your life)

And presumably you’re reading this because you’re after at least one, if not many, of these benefits. And while there’s only so much you can cut back on within your budget, there’s really no limit or cap on how much you can earn.

Improving our credit scores is something more of us should take seriously. There can be painful, drawn-out consequences of unfair negative items on your credit report, avoiding checking your credit report, or neglecting to take care of financial issues when they arise.

There are many positive outcomes of paying off your debt and increasing your credit score.

A low or poor credit score can give you high interest rates, high car insurance premiums, keep your credit limits low, prevent you from renting or buying where you want, keep you from being hired, and damage your relationships.

Related: How To Start Improving Your Credit Score In The Next 6 Months

But there is hope for improving your score! Making more money is a good place to start, especially if you have debt. Your utilization ratio, which is directly related to your debt, makes up 30% of your FICO credit score.

Your utilization ratio is the percent of credit that you’re using over the credit you have available to you. If you have significant debt in comparison to your available credit, it could possibly be playing a big role in your credit score and limiting your future choices. Making more money and increasing your income can help you pay this debt off, lower your utilization ratio, and help improve your credit score.

Additionally, payment history makes up 35% of your FICO credit score. If you’re struggling to make your payments on time due to gaps in income or your pay schedule, making more money overall can help you bridge those gaps or even get ahead.

That said, there are times when the help of a professional is truly what you need.

The credit consultants at Lexington Law can help you establish a game plan, dispute unfair negative items on your credit report, and collaborate with you to work towards improving your credit. You can call them today for a free personalized credit consultation, free access to your TransUnion report summary, and a free credit report review and recommended solutions. Click here to call now.

Circling back, below we are going to get into five strategies for making more money. Let’s go.

The Ultimate Guide To Making More Money

1. Start a side hustle.

In our reader survey, 45% of you shared that you have a side hustle that supplements your full-time income. This is great! You’re already on your way to increasing your income overall.

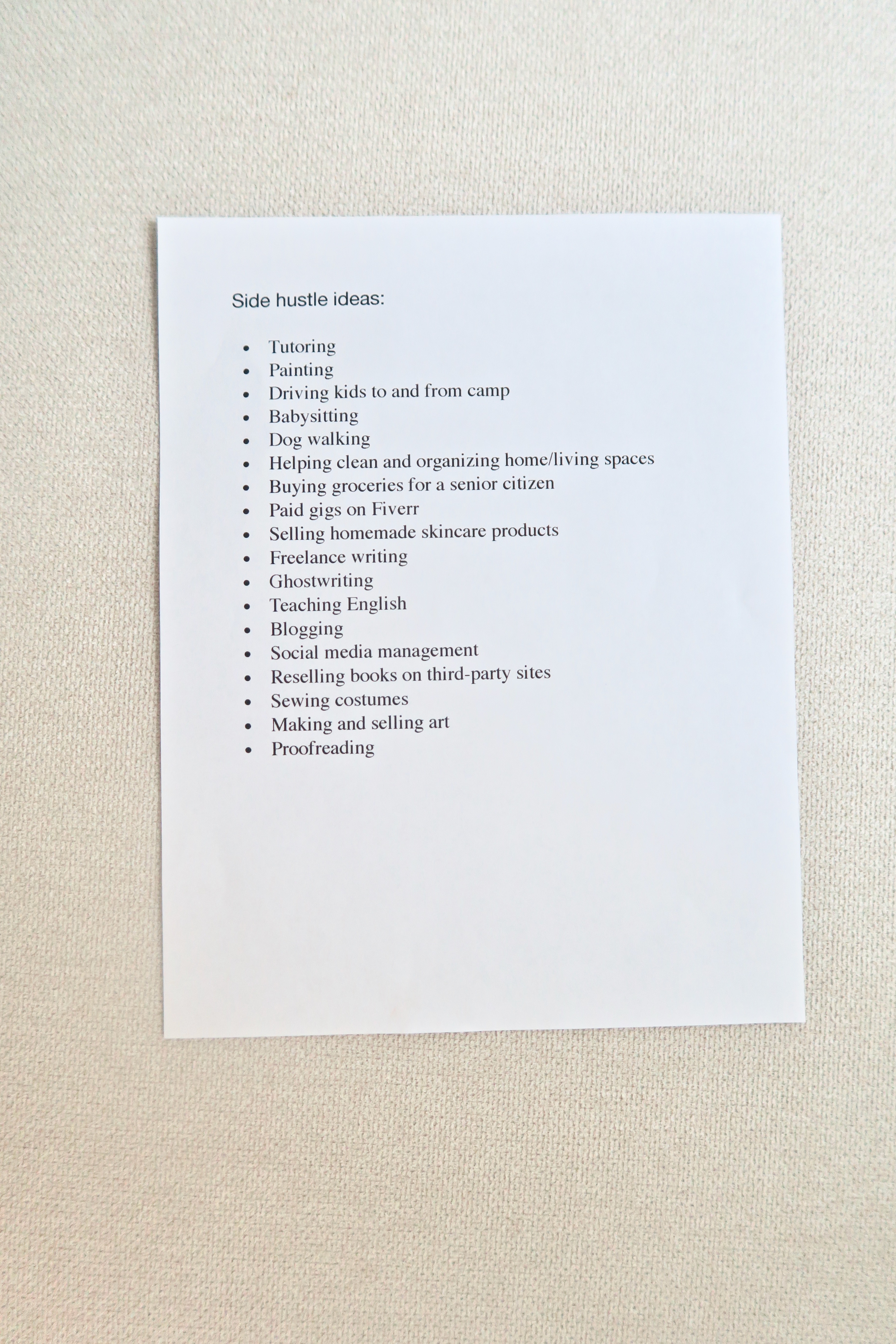

If you don’t currently have a side hustle, here are a few ideas inspired by your peers for what they’re doing as side hustles right now:

- Tutoring

- Painting

- Driving kids to and from camp

- Babysitting

- Dog walking

- Helping clean and organizing home/living spaces

- Buying groceries for a senior citizen

- Paid gigs on Fiverr

- Selling homemade skincare products

- Freelance writing

- Ghostwriting

- Teaching English

- Blogging

- Social media management

- Reselling books on third-party sites

- Sewing costumes

- Making and selling art

- Proofreading

And these are just a few ideas! On my own Facebook page, I have connections who do things like sell custom-designed cookies and seasonal handmade wreaths. People love both of these things and these people bring in consistent business.

A side hustle is a way to utilize skills and talents that you already have to make additional income. Your side hustle might be a service, a product, or creating passive income.

To get ideas of what might be the perfect side hustle for you, ask three to five friends or family members what they think you’re really good at. Common themes in their answers is a good place to start. You might have a knack for helping coach people through interviews. You might have a keen eye for refining resumes, baking cakes, or even designing websites.

If you have a valuable skill or talent, there’s a pretty good chance someone is willing to pay you for it. Pick an idea and get started. As you refine your process over a couple of months and bring in reviews and testimonials, your side hustle will likely continue to grow.

But that’s not the only way to make money as a side hustle! You can drive for a ride share company, babysit, petsit, housesit, do yard work, etc. There are many small things people are willing to pay you for if it makes their life easier. Just start asking around in your network (AKA friends and family) and get an idea for what people need help with, and then offer your services!

For example, in high school I helped people at my church clean their houses and do yard work. The pay wasn’t amazing but it did give me some extra money in my pocket for gas and movie tickets.

2. Negotiate a raise.

If you have no plans to change your career path or company, it’s probably time to ask for a raise.

Negotiating a raise can be scary and it can feel overwhelming. Where do you even start?

The first steps are truly in the groundwork. You have to be setting yourself up for a raise and promotion, proving your value, and keeping track of that value.

Here are 10 ways to start setting yourself up for a promotion in the next year:

- Take initiative and ask for more responsibility.

- Start setting yourself up for experiences that are valuable to the position above you.

- Help your boss — anticipate needs, go above and beyond, and deliver quality work every time.

- Try to always be early and always be prepared.

- Be a walking example of your company’s values.

- Ask people you work with (your manager, your co-workers, etc) what they would expect from you at a higher level.

- Keep track of the things that you do, even on a daily basis, so that you have ample examples of how you support and impact the company.

- Try to put yourself in a position where you are working with higher level individuals within your company.

- Ask for feedback often and continuously improve your skills.

- Be reliable — always follow through on what you say you’re going to do.

When you’re ready for the next steps, here is our guide to negotiating a raise within the next year.

And while these are great resources, I’ve often found that even just asking for more money can make all the difference.

For example, I was recently offered half my rate for a project. I countered with 20% over my rate — which yes, that is more than a 50% increase — and they came back giving me my rate. All I did was ask and brought up the conversation to make more for the same work that I would have had I not just asked. I realize it’s not always that simple (I’ve also been turned down and turned down the projects because I’m not willing to offer my services below a certain rate), but it’s a step in the right direction.

It’s important to be firm but also remain professional. You should always negotiate for your salary or additional benefits (people who do not negotiate make $1 million dollars less over the course of their career than those who do). If that’s not motivation, I don’t know what is.

3. Change jobs.

To be fair, there is some debate on how job hopping truly impacts your career. According to a Forbes article, “Staying employed at the same company for over two years, on average, will plummet your lifetime earnings by about 50%.” Our twenties are some of our prime foundational earning years. This means that that more we can negotiate our salaries now, the more we stand to bank over our lifetimes.

This article from Monster suggests that there is a *right* time to change jobs. Their reasoning includes things like when the salary increase is work it, when you can illustrate your impact through a success graph, when your stock options are vested, and when you can definitively say you’re being underpaid.

It’s up to you to determine if it’s the right time or not to change your job. Changing your career path is a whole different story, but making a lateral move could net you more money annual, especially if there are opportunities for growth.

4. Find “hidden income” in your expenses.

For this idea, you’re not necessarily making more money, but instead paying out less money to bills. By doing so, you’re leaving more of your income in your own pocket which you can then put into savings or use for debt repayment.

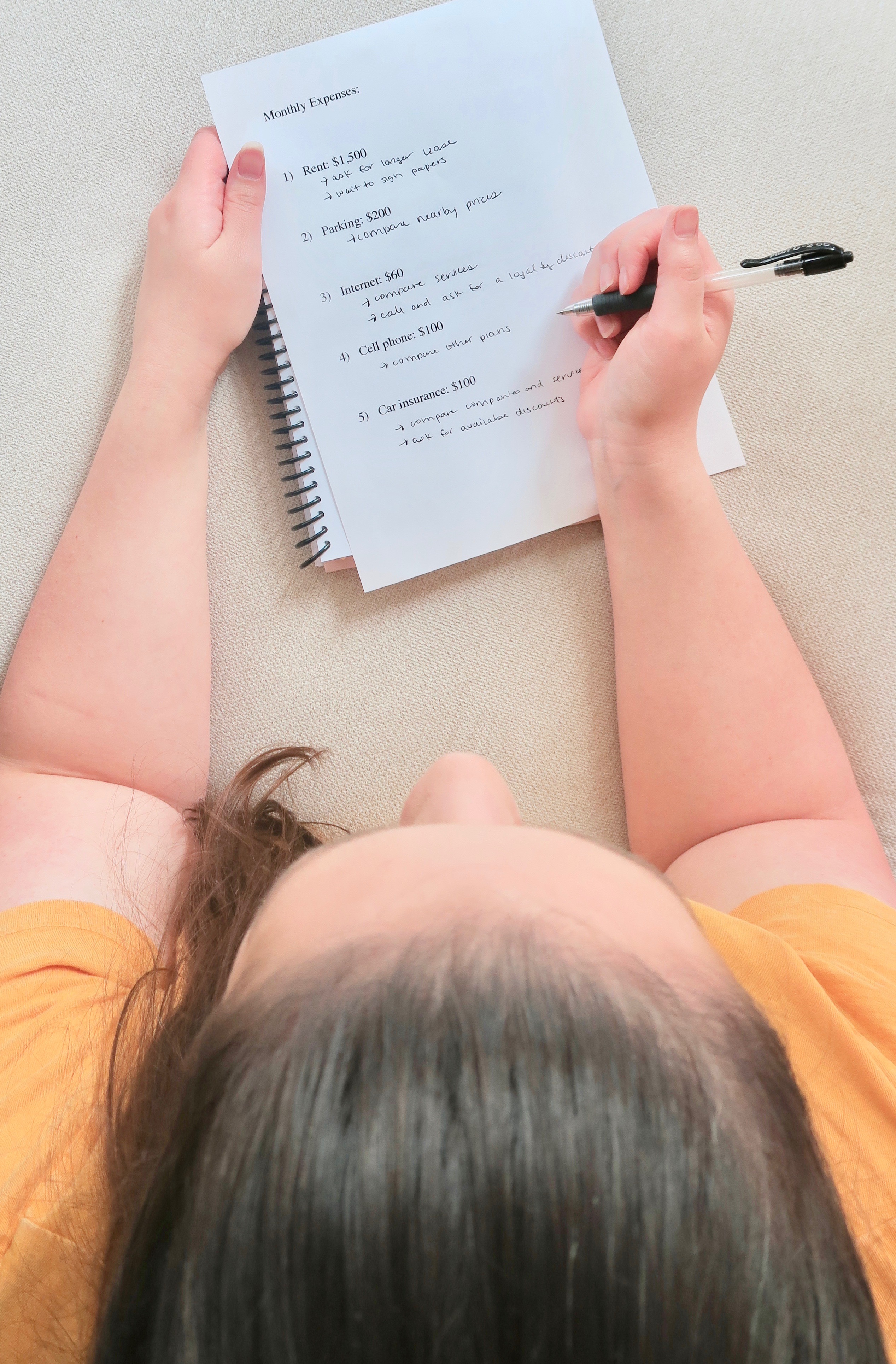

Start by listing out all of your fixed expenses each month.

For example, my list looks like this:

- Rent

- Parking fee

- Internet

- Cell phone bill

- Car insurance (every six months)

- Utilities

Some of my other expenses that are most likely not negotiable are Netflix, Amazon Prime, etc. These services are pretty firm in price so unless you want to do away with them completely, there’s not many options there.

Another thing to note is to keep track of the things you use. Are you paying an extra $10/month for a service you don’t even use? Cancel it and automate that payment to your savings instead.

The next step is to decide which of your fixed expenses might be able to be reduced.

Rent for example has only a short period of when you might be able to negotiate (when your lease is up for renewal). I’ve never spoken with my building about lowering the rent, BUT I have found that waiting closer to the deadline to sign your lease will typically get you a second, lower offer.

When my lease renewal was coming up a few months ago, I received the paperwork at an $150/month increase. I waited a few weeks and as the deadline got closer, my building sent a second offer that was only an $80/month increase in rent. Waiting saved me $840/year over signing the lease as soon as I received it.

In the past, I’ve also negotiated longer lease terms with my building, which meant I was able to keep a lower rent for a longer period of time. I still have to pay rent, obviously, but keeping it lower saves me more money in the long-term.

I’ve also helped a friend negotiate a lower car insurance premium. She was paying nearly $300/month for coverage. All I did was look for comparable coverage from other insurance companies and was able to find her the exact same coverage for $80/month with another company. That’s a savings of $220/month.

Come prepared for negotiation.

Most companies typically want to retain you as a customer so they are open to some level of negotiation when it comes to the pricing of your plan.

Sometimes, all you have to do is ask if they can reduce the fee. But it’s also a good idea to do your research and get on the phone prepared. If another company is giving you a lower offer for the same service, mention this to your providers. They are most likely going to reduce what the charge you to keep you as a customer. And if they don’t, you are free to leave that company and go to another.

I’ve also found that companies can be generous with giving you future credits if something goes wrong. For example, if you have an outage with your internet company, they might pro-rate you a week next month. It’s just something to keep in mind to ask about if it happens to you.

5. Maximize every dollar: get more back for what you already spend.

Things cost money. From groceries to rent to fun money to car payments… we’re all spending money and that’s pretty much unavoidable. So why not maximize your spending and get more in return?

For example, Ebates offers cash back both online and in store. I earned over $200 back in cash last holiday season with the gifts I ordered. I waited to purchase things until Ebates offered double cash back and bonuses at certain stores so I would get even more back. It was money I was already planning to spend for the holidays, but I was able to get more money back for it.

You can also use a cash back or rewards credit card to maximize your purchases. With one of my cards, I get bonuses for booking through their online portal and I use my rewards for things like free airfare and rental cars. Some cards also let you put your rewards towards your credit card bill which is another worthwhile option too.

Explore your credit card rewards programs and see what they offer. There are also apps like Ibotta, Swagbucks, the Target app, etc. that give you money back or extra discounts and gift cards for shopping.

So there we have it — five ways to make more money, maximize your income, and get the most out of every dollar you spend. If you currently have a side hustle or income-raising success story, we’d love to hear it and cheer you on in the comments!