This post is sponsored by Lexington Law.

Do you ever feel like an 800+ credit score is like a unicorn? Does anyone actually have one of those? And if they do, how do you get one? As someone with a credit score over 800, I can tell you it takes smart financial habits, knowledge, and time to end up with a very good or exceptional credit score. That said, there are some habits you can easily implement into your life to start improving your score.

Below we’ll be discussing some credit facts and habits that, if practiced regularly, can help improve your credit score.

4 Habits To Practice To Regularly Improve Your Credit Score

1. Keeping your utilization ratios and balances low.

So what exactly is a utilization ratio? It’s the percent of credit you’re using over the credit you have available to you. This percent is important because it makes us 30% of your FICO credit score.

There are two types of utilization: line item and aggregate. Line item utilization refers to each individual line of credit whereas aggregate refers to all of your available credit. A utilization ratio — both line item and aggregate — below 30% will have little impact on your credit score.

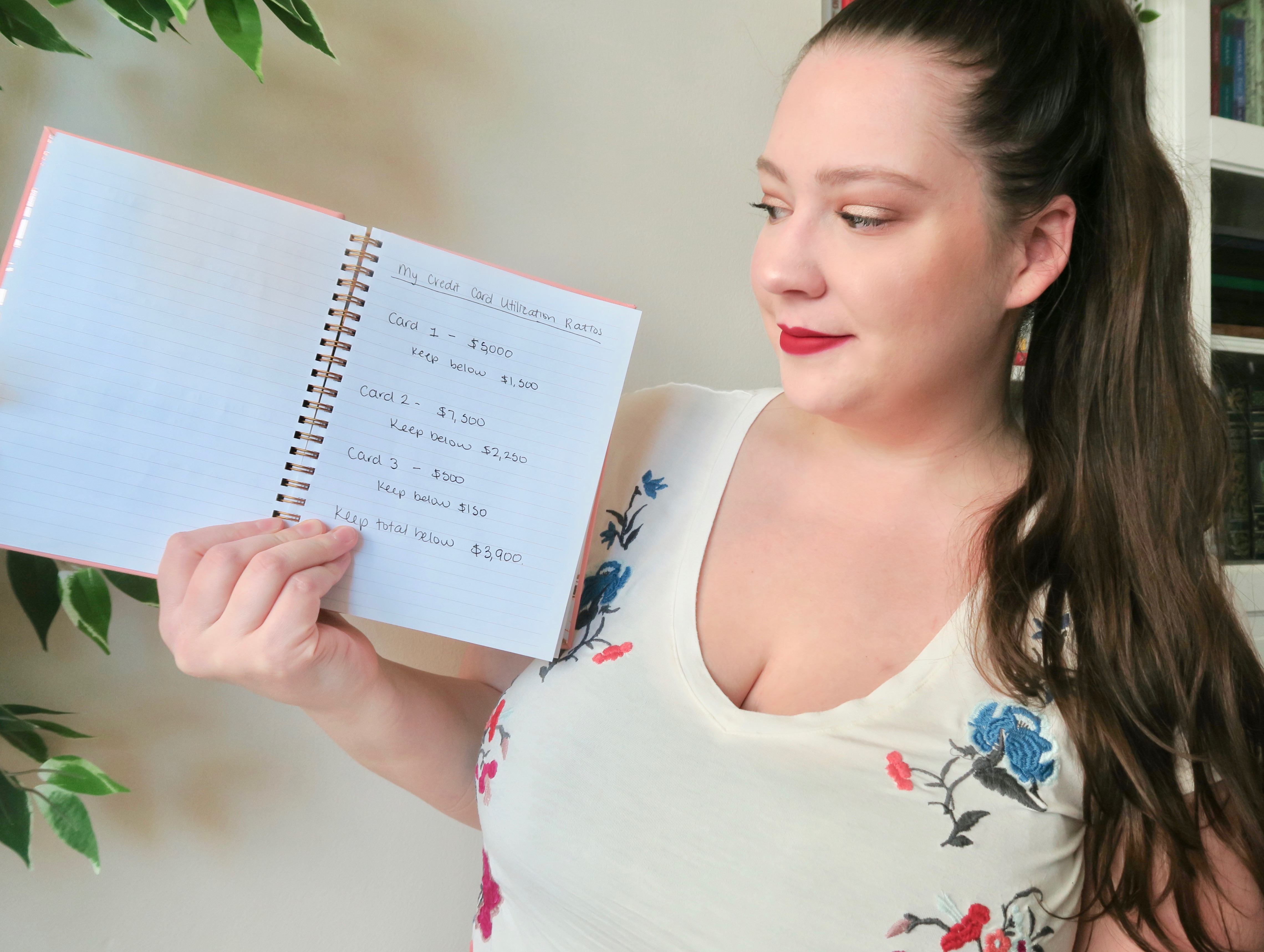

So let’s say you have three credit cards. One has a limit of $5,000, another has a limit of $7,500, and your third card has a $500 limit. So your total available credit is $13,000. Your aggregate utilization should be below 30% of $13,000 or below $3,900.

For each card you have, you should keep your balance below $1,500, $2,250, and $150, respectively. To be safe, though, I would recommend aiming for a 20% or even 10% utilization ratio. It’s easy to let those balances creep up, so give yourself some wiggle room to be sure you don’t exceed 30%.

Calculate your line item utilization for each of your individual lines of credit and aggregate for all of your lines of credit. That way you’ll know what number not to exceed.

2. Opening lines of credit strategically.

There are two types of inquiries that occur when your credit is checked: hard and soft.

A hard inquiry is a formal request by another party or lender to see your credit report. Creditors are checking your credit score and report for potential red flags that would make you a risky borrower. Things like credit card, auto loan, student loan, mortgage, and apartment rental applications may trigger a hard inquiry.

A soft inquiry is when an individual or company checks your report. A few common soft inquiries include personal credit report checks, credit card pre-approvals, background checks by employers, and applying for certain utilities. They’re only visible to you when you check your report and will not be seen by someone doing a hard inquiry.

Inquiries on your credit report account for 10% of your score, but how much your score decreases varies based on your individual credit history. A single hard inquiry may decrease your score by five points or fewer, but again, it depends on your history.

There might be a greater impact if you have few or no credit accounts, have a short history, or authorize a lot of inquiries in a short period of time.

This last point is important because opening lines of credit triggers hard inquiries. And doing so can have a significant impact on your credit score.

According to Lexington Law:

A hard inquiry will stay on your credit report for two years. However, they only impact your credit score for 12 months, with those from the past six months counting the most against your score.

If your credit history is substantial, a few hard inquiries on your credit report will likely not have a significant impact over the two years they are listed on your account. But be cautious of authorizing too many hard inquiries in a short amount of time. The more closely spaced hard inquiries are on your credit report, the more they will hurt your credit score.

So if you know you’re planning to make a big purchase soon, like a home or a car, avoid opening any new lines for credit for at least six months, but preferably up to a year.

Likewise, only open lines of credit that you know are going to help you reach your credit and financial goals. And if you find yourself in a situation where an inquiry on your credit report is on the table, ask questions about whether or not it is a soft or hard inquiry.

Hard inquiries cannot be removed. However, If you do have hard inquiries on your report that are inaccurate or unauthorized, these can be disputed with the credit bureaus. If you’re unsure about what your rights are as a consumer, contact the credit repair professionals at Lexington Law for information on your unique situation.

3. Paying all of your bills on time.

Your payment history makes up 35% of your FICO credit score. So needless to say, just making sure your payments are made on time can have a huge impact on your score overall.

One late payment on a single account can lower your credit score by 15 to 40 points. And missing payments for all of your accounts in one month can lower your score by 150 points or more. So making your payments on time is a pretty big deal!

Also, consecutive late payments are even more harmful to your score because each late payment is weighted more heavily as they accrue.

If you find yourself forgetting to make your payments on time, set up automated payments to combat that. Even making the minimum payment will keep your payment history intact and likely hurt you less than carrying a balance, presuming you can pay the balance off quickly and it’s below 30% utilization.

4. Keeping an eye on your credit reports and scores.

This last one might seem like an obvious one, but it’s one so many people miss that leaves you susceptible to errors and inaccuracies on your credit report. Approximately 79% of credit reports contain errors. These errors can negatively impact your credit score, and therefore your ability to do things like buy a house or even get a job.

Related: How Your Credit Impacts Your Life

You can check your credit report for free once a year at annualcreditreport.com. Here’s how to do it.

I also strongly recommend using a credit monitoring service. You’ll be alerted to changes on your credit report. Having those notifications can give you peace of mind but also the ability to act quickly in case of something like identity theft.

Lex OnTrack gives you your FICO credit score, a score analysis, access to credit repair as needed, and $1,000,000 in identity insurance. You can learn more and sign up here.

In the event that you do find unfair negative items on your credit report, there is still hope. You do have rights for those negative items like charge offs, collections, medical bills, and late payments. Contact the credit repair professionals at Lexington Law for a consultation for your unique situation.

A good or excellent credit score is possible to achieve. Even with a not-so-positive financial past, practicing good financial habits and making smart moves can help you improve your score over time.