This post is sponsored by Lexington Law.

Deciding to get married as a couple is a big step in your relationship. Whether you’re recently engaged, are about to tie the knot, or have recently done so, now is a good time to talk about money. Based on my experience, these are the money conversations to have as a couple before marriage.

Money is one of the top five reasons couples argue. I personally think it’s important to get on the same page as quickly as possible. Talk about your spending habits, your financial goals, what you hope for retirement, how much of your income you put into savings each month. Get open with each other and be honest. Financial infidelity is a real thing and can cause a rift to form in your relationship.

If the topic of money makes you uncomfortable, slowly ease into the conversation. You could start by discussing your fixed expenses as individuals and how you plan to combine them. Another place to start is with your income, your current budget, and savings plan. Once you’re comfortable with that, move into investing, large purchases like a house or a car, and your retirement savings plan.

My husband and I have always been very open in regards to discussing our finances with each other. We make all of our financial decisions together and have fully combined our finances from day one (and we’ve been married for seven years now). We even dated six years before getting married and spoke openly about money during that time as well. As we go through each of these conversation topics that I think are worth discussing, I’ll share a little more abut my personal experiences as well.

5 Money Conversations To Have as a Couple Before Marriage

1. Are we combining our finances?

There’s no right way to go about handling your money as couple. Some partnerships do best keeping everything completely separate and splitting expenses 50/50. Others prefer to combine everything into one joint checking/savings account. And other couples choose to keep the majority of their money separate and share an account for specific fixed expenses. It’s really up to the two of you for how you want to do it.

The important thing here is that it feels fair to both of you. If it feels unfair to either person, it’s likely to breed resentment and cause tension in the relationship.

If one person makes more money than the other for example, should that person contribute more or should the split still be 50/50 even if it might take longer to achieve certain goals? There’s no right way or wrong way to manage your finances as a couple. But it is important to be able to talk about money openly, honestly, and without fear.

One study shows that:

- 1 in 4 couples split their finances evenly with their partner, and 1 in 2 share their account completely

- Half would split their debt with their partners, and half would share their bank accounts with their partner

- 40 percent of couples talk about finances weekly, and up to 30 percent discuss finances daily

As I mentioned above, my husband and I have fully combined finances. All of our money goes into the same accounts and all of our accounts are joint accounts with the exception of our tax-advantage retirement accounts. We have a joint spreadsheet where we discuss our spending every month and our plans for the upcoming months. We each also have a budget every month to spend on whatever we want. Additionally, we each put $100 into a different savings account for splurge purchases that we might want to make in the future that are larger than our typical budgets. This is what works best for us and keeps us both comfortable when discussing our money.

If you and your partner would prefer to have one joint account that you pay your combined bills out of and keep everything else separate, that’s totally fine too. Money can be emotional but there’s no need to overcomplicate it.

[Tweet “5 Money Conversations To Have as a Couple Before Marriage”]

2. What are our debts?

Oh, debt. This little four letter word can cause a lot of problems in an otherwise stable relationship. Many people have student loan debt to various degrees, but also other debts like medical expenses, credit card debt, car loans, mortgages, etc. And it can make a relationship feel unbalanced.

I think it’s important to let your partner know how much debt you have and then decide as a couple if you will be paying it off together or as individuals. Be open about your progress, too. Debt can hold us back from reaching our other goals like moving abroad or buying a home, so it’s important to keep your partner up to date on how you’re working towards your mutual goals on a monthly basis.

I’ve written frequently on how I paid off my $25k of student loan debt in 18 months. My husband also had about $5k in debt when we got married. We decided that we would pay this off together to knock it out as quickly as possible to begin saving up for our other goals. This is what felt most comfortable for us.

When having these conversations, though, it’s important to remember that a partner and a relationship are not a financial plan. Relying on someone else to float you financially can lead to financial abuse. This can leave you feeling trapped in a relationship, and unable to leave. If your partner tries to take your money and “manage” it without letting you have a say, this is a huge red flag.

[Tweet “A relationship is not a financial plan.”]

3. Do we plan to make big purchases (and how will we pay for them)?

If you’re planning to get married, it’s fairly likely that you’ll also have other big expenses coming up in a few years.

Do you plan to rent for a while or buy a home? If you plan to buy, where is the down payment coming from? Have either of you been saving up for it or is it something you’re going to do together?

These might not be on the immediate financial agenda, but they’re worth discussing at least once a year in my opinion. You’ve got to consider what makes the most financial sense for your situation now and your future. Where do you see yourselves in 10 years?

My husband and I have recently decided that we will be purchasing a home in the next couple of years. After having a child, we’re feeling ready to move our of our two bedroom apartment and into something a little more spacious for the three of us. Since we’ve paid off our debt, we’ve been saving for a house since we knew it was something we were considering in the near future. Because that deadline is getting closer, we’re now beginning to save more aggressively.

[Tweet “Talking about money can have a positive impact on your marriage for decades to come.”]

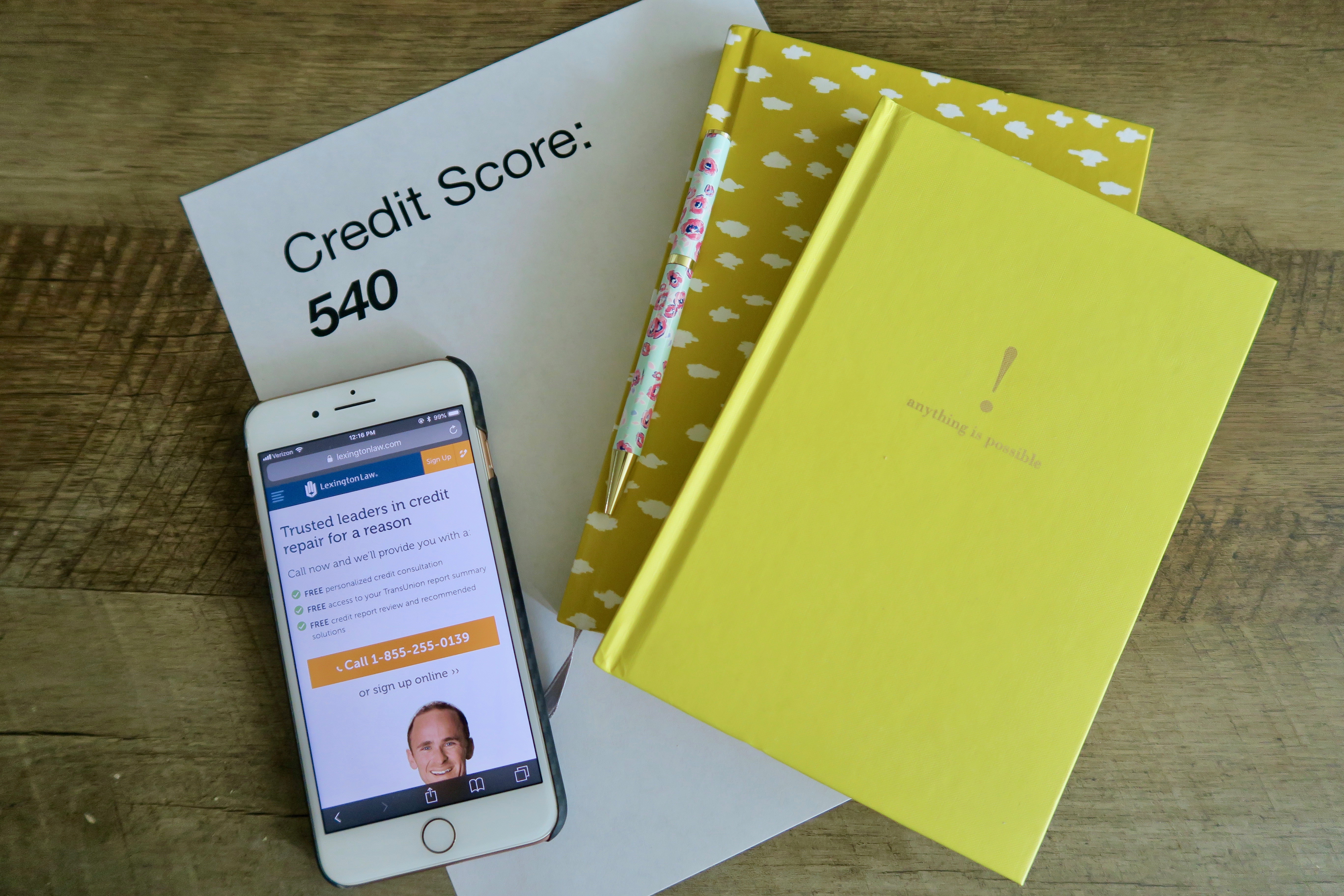

4.What are our credit scores?

Improving your credit score is something I’m extremely passionate about. My credit experience started with my first student loan. After I had my identity stolen, I checked my credit report for the first time. I realized I needed to start building credit. Though, at the time, I didn’t realize how much of my life it could potentially impact.

In college, I opened up my first credit card because it’s all I could get approved for with so little history. I used my $300 limit store card to start building up my credit and improving my score. Eventually, I was able to open up a bigger card (with a $1,500 limit). Because I was learning so much about it, I got my husband (then boyfriend) to do the same. We both have excellent scores now thanks to those past steps.

Some people think that once you get married, your credit scores merge. This is a myth! That said, there are impacts of your credit as a married couple. For example, lenders base the final interest rate on one spouse’s credit score. According to Lexington Law:

Consider, however, the responsibility involved when either taking on new debt with a spouse or working to erase outstanding debt obligations. In some states, both spouses can be held fully responsible for new but existing debts – creating some tricky issues in case of divorce or the early death of a spouse.

By taking on a spouse’s debt, this could have an impact on your credit score because of your credit utilization ratio. Additionally, if a spouse were to make a late payment, that could impact your score as well.

You’ll want to know each other’s credit scores so that you can make better financial decisions as a couple. Work together to try to improve your scores together — it will help build a better future for both of you.

In the case that one of you needs credit repair, I recommend reaching out to the consultants at Lexington Law. They can help assess your unique situation and help you understand the impact of credit repair on your life.

[Tweet “Credit repair is worth the effort.”]

5. How do you spend your money now?

Talking about plans and debt is really all about your spending in the future and in the past. But what about how you spend your money now? It’s a smart move to go over your current budget together. You can also go over the past couple of months of credit card statements so you know where you truly stand. How does your ideal spending (budget) compare with your actual spending (statements)? Talk about it!

There are many positive benefits of talking about your money. For example, according to this survey, one in three people said that their partner encouraged them to spend less money overall. That’s an awesome outcome! Discussing how you spend your money now can also help you get on the same page about paying off debt, saving for big purchases, and saving for retirement.

Talking about money can have a positive impact on your marriage for decades to come. Honesty, openness, and trust are all important parts of a healthy relationship — and money is a good topic to include in your conversations!