This post is sponsored by Lexington Law.

If you’re trying to improve your finances but aren’t sure where to start, you’ve come to the right place!

Here is my guide for 7 steps to better finances in 7 days! You can also sign up below to get these sent to you as daily reminder emails (with even more information on how to accomplish them). If there’s something you’ve already done, I have three bonus items to help you bridge the gap even further.

7 Steps In 7 Days To Better Finances

1. Make a list of all of the accounts you have.

This one is pretty straightforward and should only take somewhere around 15-30 minutes to complete.

Using Excel or a Google doc, make a list of all of the accounts you have. Here’s the information you’ll want to know about each:

-

- Financial institution

- Type of account (credit card, personal checking, investment, etc)

- Current balance

- Interest rate

- Date opened

- Target payoff date (if debt)

Organizing your finances is step one to a better relationship with money!

2. Set up autopay on your credit cards and automatic savings transfers.

We’re huge advocates for setting up automatic transfers and payments.

When you set up an automatic transfer to your savings account, you are paying your future self first! This is massively important in building up your savings accounts. If you have savings goals you want to hit, you need to make sure you’re prioritizing those savings.

By setting up transfers to happen automatically when you get your paycheck, you’re not even consciously thinking about the act of saving but are still doing it anyway.

Having automatic payments on your credit cards also ensures that your balances are paid on time. Late payments can hurt your credit score and balances can impact your credit utilization as well. Make sure they’re set up no later than their due date and after you get paid!

3. Check your credit score and credit report.

When’s the last time you checked in on your credit report? In the very least you should be doing it once a year.

On your credit report, you’ll be looking for things that are red flags. Including:

- names you don’t recognize

- incorrect addresses

- unknown phone numbers

- accounts you didn’t open

- charges you don’t remember

- late payments that you made on time

- reported delinquencies that you have paid off

- unfair negative items

- negative items that have been on your report for too long

- inquiries you don’t recognize

- multiple inquiries from the same creditor

Any of these things can be a warning sign that your credit is in danger. You should be familiar with everything on your report. And if you find something unfamiliar, I suggest reaching out to the credit repair professionals at Lexington Law for a free consultation. They are consumer advocates and work on your behalf to ensure the items on your credit report are fair and accurate to improve your financial life.

4. Increase your savings amount.

When we the last time you increased the amount of money you’re saving? Whether it’s a certain amount from each paycheck or a percentage, it’s time to up the amount!

Start by upping the amount you put in your 401(k) or Roth IRA account. Next, move on to upping what’s in your emergency fund and then go onto your immediate savings goals (like a house down payment).

Tip: You can do this easily by changing the amounts set for your automatic transfers! Even adding $10 to that amount will help you save money faster, and you probably won’t even notice it’s gone each month.

5. Negotiate a bill.

Negotiating a bill is one of the easiest things you can do to find hidden income in your expenses!

Take a look at the things you pay monthly, for example:

- internet/TV bill

- car payment

- insurance (car, house, etc.)

- cell phone

Then, compare with plans from other providers. Do they offer a better deal on the same service? That’s a great place to start with a negotiation! Companies want to keep you as a customer so oftentimes they’re willing to work with you on the price.

Either call the customer service line or even chat with them via a chat box on their website. Getting anything off of your bill is something I would consider a win!

6. Open an investment account.

Do you have any investment accounts yet? Now’s the time! We recommend Betterment or Ellevest for opening new accounts.

It’s a simple process and they’ll walk you through defining your goals and setting up the accounts.

We also have an entire series on investing that you can check out here:

- Investing 101: A Beginner’s Guide To Investing For Wealth

- 10 Investing Myths Busted

- 7 Times When Investing Isn’t The Smartest Financial Move

- 6 Things To Do Before You Start Investing

Investing can seem scary, but there are plenty of resources that make it more easily understood and less stressful!

7. Calculate your emergency fund.

If you haven’t started an emergency fund, you need to! Having money available in case you need it (for example, if you lose your income), can keep you from dipping into emergency lines of credit. Here I walk you through how to figure out exactly what you need in your emergency fund.

I think a good place to start with a goal for your emergency fund is three months worth of expenses. Going from there, six months would be your next goal to have in an emergency fund.

The Bonus Three:

If you’ve already done some of the above (go you!) or you need a little more of a challenge, here are three bonus to-dos to help put your finances in a better place:

1. Make a debt repayment plan.

If you have outstanding “bad” debt, like credit card debt or personal loan debt, it should be a priority to pay that off!

If you don’t currently have a plan for that, now is the time to make one. Start by figuring out how much you owe and what your monthly payment currently is. If possible, try to at least make monthly payments that are 1.5x the minimum but 2-3x is even better.

2. Meal plan for the next two weeks.

Meal planning is a great way to save time, money, and to make use of what you already have!

Take stock of what’s in your pantry as is. How can you build a full menu around the items for the next week? Basing your meal plan off of what you already have around can help eliminate waste as well a having to spend money on food unnecessarily.

To make meal planning easy for you, we’ve discussed how to do it here and have a free planning guide in our resource library.

3. Sign up for identity monitoring with Lex OnTrack.

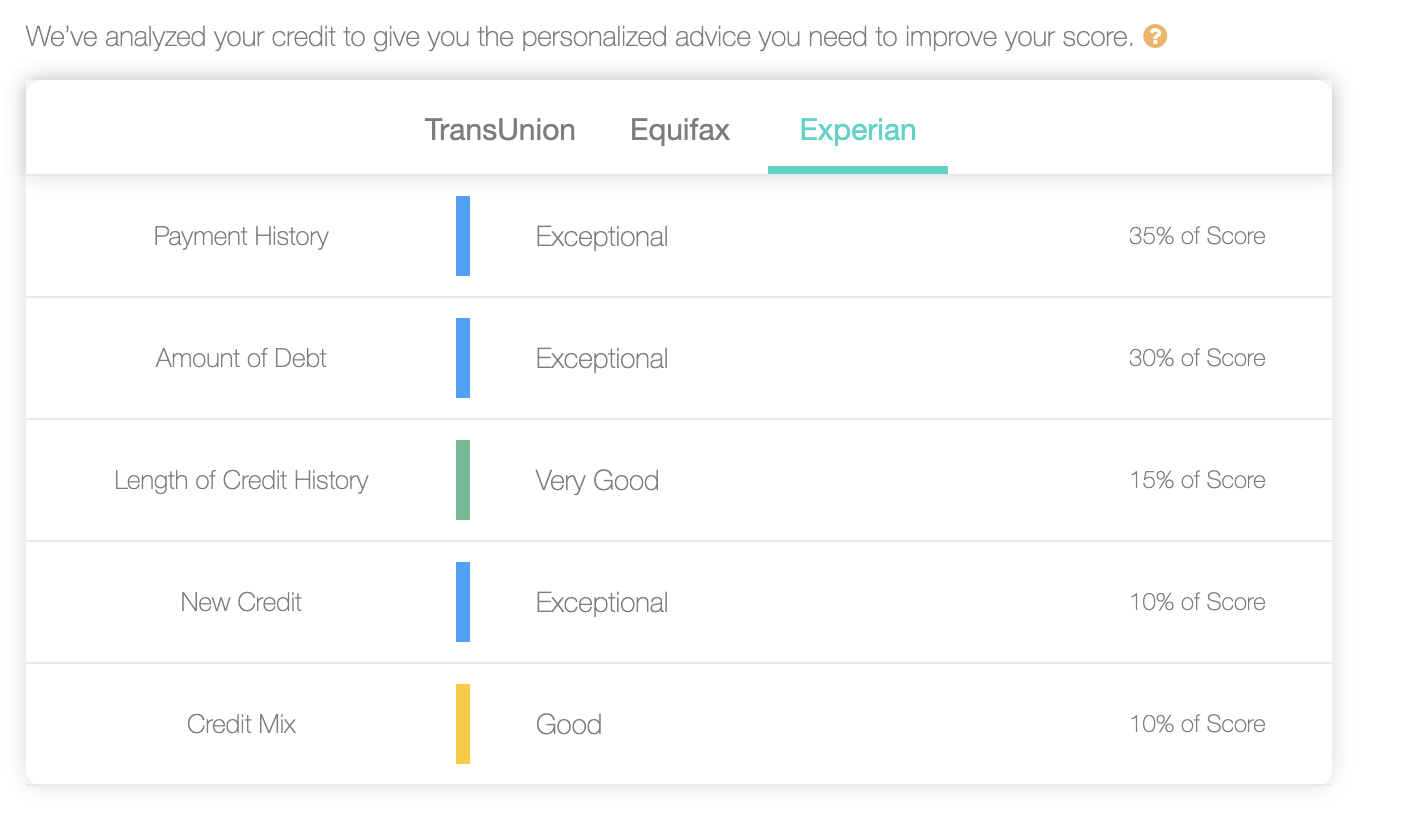

I personally use Lex OnTrack to monitor my identity. It keeps me up to date with changes on my credit report, my credit mix so I know how to improve my credit, and more.

Related: Lex OnTrack Review: Why You Should Monitor Your Credit

Here are some screenshots from my dashboard:

It helps me to rest easier knowing that these things are being monitored. Especially since my identity has been stolen before and my university and my health insurance had a data breach.

Having a better relationship with your finances happens one step at a time. It’s important to get to know them so that you can be more in tune with your spending, your savings, and your financial future. Remember, many of the decisions you make now are going to impact your life in five, ten, fifty years from now. Let’s get to it!