This post is sponsored by Lexington Law.

Investing seems like one of those “adult” things you know you should probably be doing but aren’t quite sure how. Even if you heard a thing or two about investing from a family member or friend, there’s still a lot to learn!

Let’s start with what investing really is. Investing is about building wealth. To do so, you’ll need a strong financial foundation to grow from. Today, we’re going to discuss building the foundation for your future investments. These are essentially the things you should be able to check off before moving to the actual investing part. If you’re not quite there yet, I also cover a few ways to improve your situation before moving to the next step.

6 Things To Do Before You Start Investing

1. Check your credit report and know your score.

Because investing is about the long-term, a high credit score typically means you have less debt-related obligations every month. (This will especially be important if you choose to invest in real estate for rental properties!)

Being aware of what is reported to credit bureaus will help you reduce the risk of unfair negative items on your credit report. These could potentially damage your financial foundation making it harder to put your money towards investments in the future.

Knowing your credit score will also be beneficial because it give you an idea of how you stand financially. Start by getting your free credit score. The higher your credit score the better, however, there isn’t necessarily the perfect credit score to start investing. Anything above 700 is considered to be a “good” score. If you’re currently below that, knowing what makes up your credit score can help you increase it.

If your credit score is on the low end, it might mean you are prioritizing your financial life in the short term. Investing is a long-term strategy and isn’t meant for quick gains. Take your credit score into account when you look at your budget. Are you really putting your money towards what you value? If you have a high utilization ratio, the answer is probably no.

Work on improving the factors that make up your credit score to see improvements. If you aren’t able to take care of this yourself, work with someone who specializes in credit repair who will advocate on your behalf and navigate tough situations.

[click_to_tweet tweet=”6 Things To Do Before You Start Investing” quote=”6 Things To Do Before You Start Investing”]

2. Sign up for identity and credit monitoring.

Whether investing is on your mind or not, I personally think this should be on everyone’s financial to do list. Yes, you may check your budget every month but you’re not checking your credit report manually. That often means you find out about incorrect or potentially damaging information late.

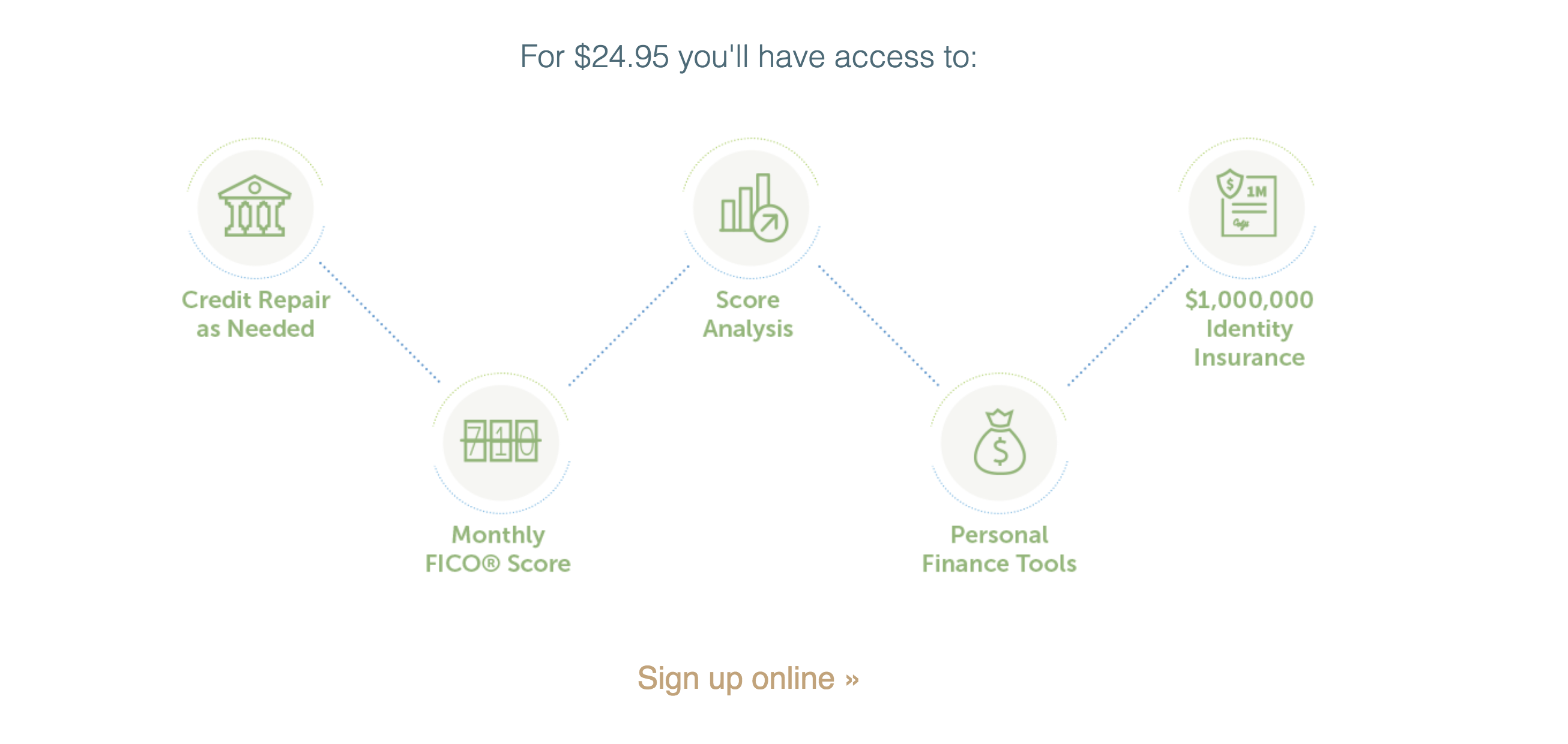

Working with a service like Lex OnTrack alerts you if there any changes to your reports. This way you can easily identify what you actually did versus what might be fraud or incorrect. Plus with Lex OnTrack you have experts who can help you in the event that you need it. It’s worth it for peace of mind and protecting your assets. Click here to learn more and sign up.

3. Reduce your high interest debt.

A good rule of thumb before you begin investing is to pay off all of your debt with an 7% or higher interest rate. The reason for this is because the money you invest is not going to grow that quickly (7% is the average long-term market growth rate). The interest you pay on your loan will be more than what you’re earning investing. At the end of the day, it’s just not worth it.

If you do have high interest debt but would like to start investing, start paying those loans down as quickly as possible. Paying down debt is absolutely doable but does take discipline and focus. I paid down nearly $25k in student loan debt in 18 months with these methods. Even if you do have debt, you can still work to be financially confident while you pay it down.

The faster you pay if down, the sooner you can start investing! And that’s a very positive thing because the longer you have money invested, the more chance it has to grow over time.

4. Already be making all of your payments on time.

You might be wondering what this has to do with investing. Making all of your payments on time shows that you have financial accountability and money managing skills. It’s a sign that you know how to prioritize the right thing and can start considering taking the next steps.

Our friends at Lexington Law say that “avoiding late payments [is] extremely crucial to building wealth and maintaining healthy credit ratings.” Ultimately, this is because it is the largest factor that goes into your credit score. Missing payments can undo your hard work. You might also be hit with fees and higher interest rates in the future.

If you are struggling making your payments on time, consider calling your lenders and providers to switch your payment dates to be something more convenient for your pay schedule. You can also negotiate many of your services for decreased bills. If you’re still struggling, consider how you can rearrange your budget and expenses according to priority.

5. Know your net worth.

Investing is about building wealth over time. It’s not meant to grow what’s in your pocket everyday but rather to increase your net worth. If you’re planning to use this money for every day expenses now, you’re in the wrong mindset when it comes to investing.

If you don’t know you net worth, you calculate it by subtracting your liabilities from your assets. Here is a good description and a spreadsheet that you can use.

6. Have a full emergency fund.

The reason I say this is because in case of the loss of income, you’ll need immediate access to funds to see you through. You’d want to avoid pulling money out of your investment accounts for this purpose. It will interrupt your strategy and long term gains. Building your emergency fund does take time, however, if you prioritize it and use these methods, you’ll be on your way in no time.

And there we have it — six things to do before you start investing. In the next post, we’ll go over Investing 101 — including how to pick the right investment options for you and terms to know. Have questions? Leave them below!