This post is sponsored by Lexington Law.

Our credit is one of the most important aspects of our financial situations. Unfortunately it’s also one that we often overlook in favor of other things like paying off debt or even just sticking to our budget every month. But setting credit goals can have a positive impact on so many aspects of your finances.

When you are increasing your credit score, there’s a good chance you’re paying your bills on time. You’re also likely to be reducing your credit utilization ratio, which makes up 30 percent of your overall credit score.

Whether we like it or not, our world moves on credit. Our credit plays a role in where we can live, what home or car we can purchase, our insurance premiums, and even if we can be employed or not. Our credit scores are important numbers that lenders use to gauge how financially reliable we are. Generally speaking, a higher credit score means you are less of a risk to lenders. A lower credit score means you are more of a financial risk — and the cost of that risk is passed on to the borrower.

There is never a wrong time to set credit goals or work towards improving your credit. As consumers, there is a lot we don’t know about the laws around our credit that protect us. If you have questions about your credit or credit report, I highly suggest reaching out to the credit repair consultants at Lexington Law for a free consultation.

7 Credit Goals To Set In 2020

1. Check your credit report.

Checking your credit report is one of the easiest goals to set and reach! You can check your credit report for free once a year at annualcreditreport.com.

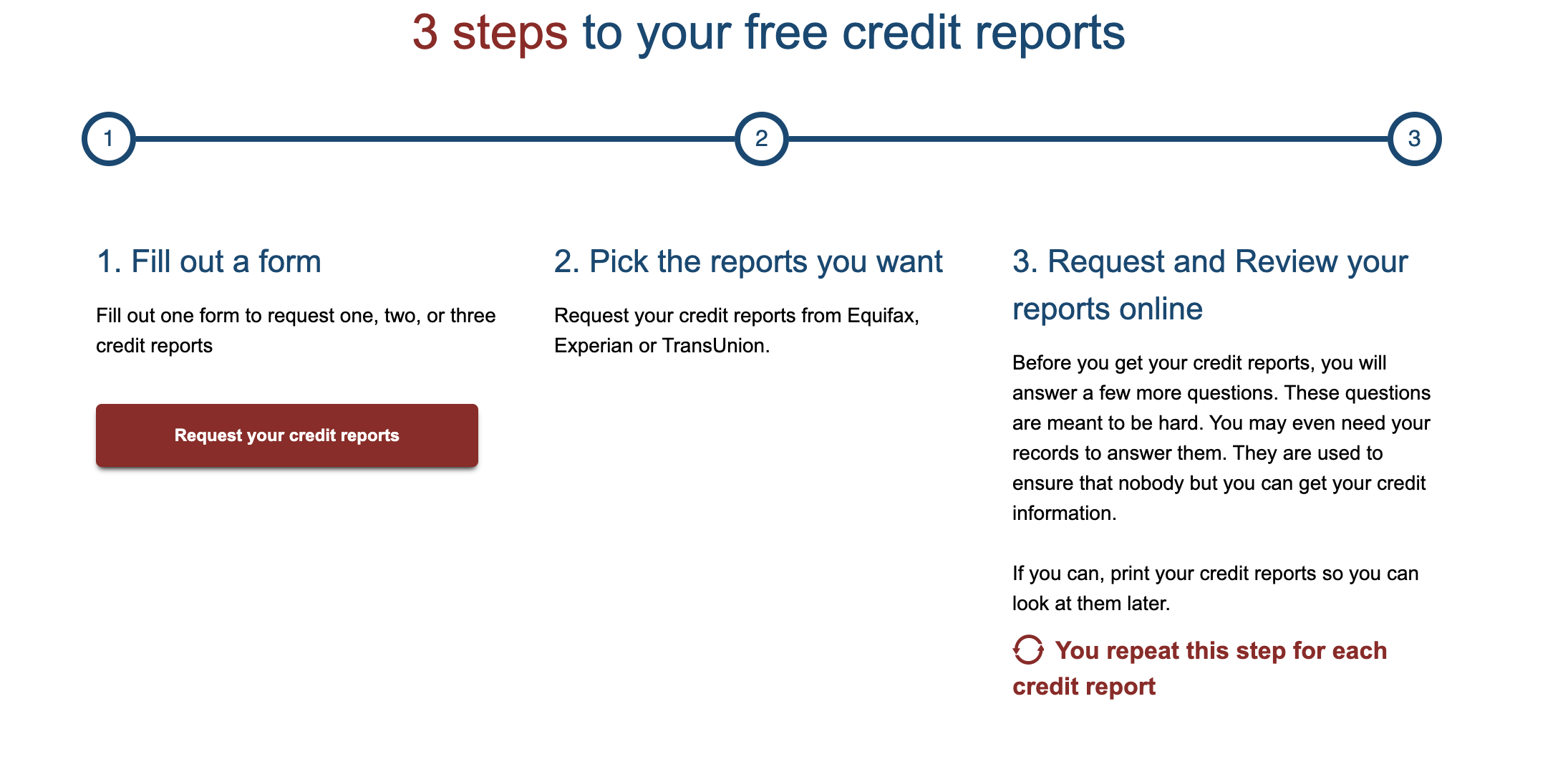

Here’s a quick look at what the process looks like:

You can request to get reports from all three of the credit bureaus (Equifax, Experian or TransUnion). Did you know that the same information isn’t always shared to all three credit bureaus? That’s why it’s so important to make sure you check all three of your credit reports.

On another note, reading a credit report can feel so overwhelming, especially if you don’t know what you’re looking for. Lexington Law has an incredible credit report guide that breaks it down and lets you know exactly what to look for.

In fact, less than 20 percent of people know how to read a credit report so there’s a chance you might overlook something going through it on your own. I highly recommend reading through their guide and reaching out to the credit repair consultants at Lexington Law for a free consultation if needed.

2. Check your credit score.

Next up is to check your credit score! There is a difference between your credit report and your credit score.

According to Lexington Law, here is the difference:

A credit score is a number used to provide an overview of your financial health and responsibility. It pulls information from your credit reports and uses an algorithm to come up with a number, somewhere between 300 and 850.

You can also learn more about the distinct differences here.

There are generally a couple of ways to see your credit score:

- check through your credit card company (many offer it for free)

- request it from your bank (again, many offer if for free each month)

- some online services like credit.com offer it as well

Knowing your credit score can help you decide what your next financial step should be. For example if you are looking to buy a home or a new car in the next year, you might want to look deeper into your credit score breakdown and start improving your credit score.

3. Improve your credit score.

Pretty much no matter where your score currently is, there’s likely room for improvement. Even though my credit score is around 800 now, I’m always checking to make sure it’s not dropping and strategically planning to improve it.

There are five factors that make up your FICO credit score:

- Payment history — 35%

- Utilization ratio — 30%

- Length of credit history — 15%

- New credit or inquiries (this hurts!) — 10%

- Types of credit/Credit Mix — 10%

Using this basic knowledge of the credit score breakdown, there are likely a few steps you can start taking today that will have an impact on your credit score over time.

I’ve written a whole guide with steps you can start taking today to start improving your credit score in the next six months. Check it out here!

4. Sign up for identity monitoring.

Having identity monitoring set up gives me so much peace of mind. Like most of us, my day-to-day life is pretty full with family, work, and social responsibilities. As much as I try to be, checking my credit card statements for fraud everyday often isn’t at the top of my to-do list.

I’ve been using Lex OnTrack for quite a while now to monitor my credit and identity. I was recently notified of a small change on my credit report. It wasn’t something I was aware of and I was able to placate the situation quickly before it dipped my credit score or spiraled out of control.

It’s a small expense to add to your budget every month but I like to think of it as a way of protecting myself from future potential mishaps that could derail my finances. I’ve had my identity stolen in the past and I was lucky enough to catch that almost immediately, but what if I hadn’t? Identity monitoring has been something I am grateful to have, especially with all of the data breeches that seem to be happening more and more frequently.

You can learn more about Lex OnTrack and sign up here.

5. Pay off as much credit card debt as possible.

No matter how much debt you have, I want you to know that there will one day be a light at the end of the tunnel! Once you are debt-free, you will feel less of a financial burden in your day to day life but will also start to feel more confident about setting future financial goals.

Looking at your debt now, how would you work backwards towards paying it off? Starting with your end date in mind, divide the number of months you have by the amount you owe to give you a rough estimate of how much you’ll need to pay every month. In the end, this exact number will probably vary slightly based on what your interest rate is and how the interest and principle is paid down, but overall it will give you a snapshot of your debt payoff plan.

Now that you can see the monthly payment you’d have to make, you can decide if this is realistic for your budget. If the number is too high, what can you do to even increase your payment from the minimum monthly payment. Anything additional that you can throw at your debt is a plus!

6. Develop a credit card plan.

Are you the kind of person who tends to open credit cards when a good offer presents itself or are you more methodical about how your credit cards can work for you?

For the first few years I was learning about credit, I was more of the opportunistic-type. My line of thinking was, “Oh a cash back card with no fee? Great.” I never thought too hard about what that meant for me long-term or how it worked itself into my bigger financial goals.

Related: 8 Questions To Ask Yourself Before Opening Up a New Credit Card

Luckily I didn’t rack up too much credit card debt and was able to pay it off fairly quickly but it is also very possible that it could have spiraled out of control very quickly.

If you are unsure of what you should do with your credit cards, ask yourself a couple of questions like:

- is what I am paying for this card (annual fee) worth the value to me?

- which is my oldest card? (you’ll likely want to keep this one open – length of your credit history is 15% of your credit score!)

- which cards have a balance?

- is opening a new card going to push me further into debt?

- what is the reason I am opening/closing this card?

All of your credit cards can play a role in your overall credit picture. So before opening or closing any cards, you’ll want to be strategic with your reasoning and your timing.

7. Map out your emergency fund.

Having an emergency fund in place means that you do not have to rely on emergency lines of credit in times of financial strain.

What if, for example, you lose your job or a large stream of income? This can happen for any reason but at the end of the day you are the one responsible for your financial commitments. Having an emergency fund means you won’t have to take on debt until you can replace your income or get through an unexpected financial hurdle.

Generally it is recommended that you have three to six months worth of expenses in your emergency fund. You can learn more about how to calculate that exact number for yourself here!

Bonus 8: Increase your income.

There is only so much you can cut back on your bills until there is nothing left to cut back. But something that will help you reach more long-term financial goals is increasing your income.

Related: The Ultimate Guide To Making More Money

Increasing your income month to month gives you more breathing room financially. It can help you pay off debt, move to a better situation, or save more money. More income can help you put a down payment on a home. It can help you go on the vacation of your dreams or fund your education. There are so many ways that increasing your income can help you reach your credit goals that, in my opinion, it should be a goal in and of itself!

Setting credit goals can help keep you on track financially. It’s easy to get caught up in the world of budgeting and debt payoff, but don’t forget that your credit plays an important and valuable role in your financial life as well.

And if you need help with credit repair, don’t hesitate to reach out to the credit repair consultants at Lexington Law. It’s always worth the effort to improve your finances.