This post is sponsored by Lexington Law.

Have you ever heard the term credit utilization? What is it? How does it impact you? How do you use it to your advantage? Today we’re going to be answering all of these questions and demystifying credit utilization.

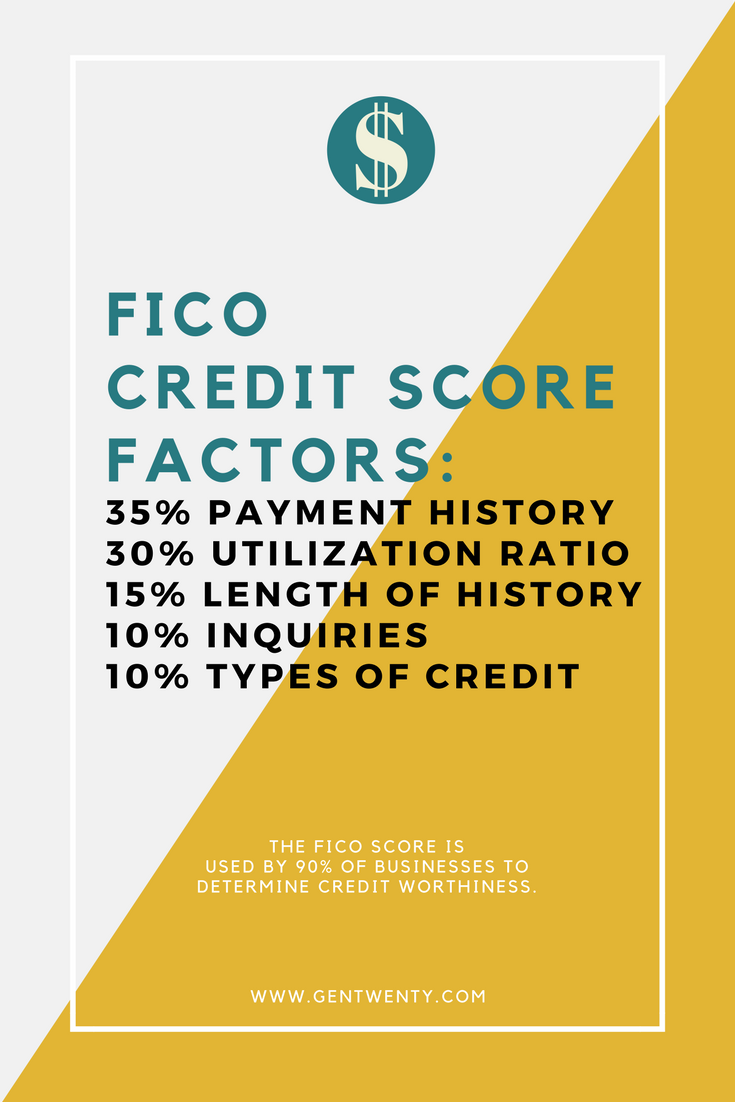

Credit utilization is a really important number when it comes to calculating your FICO credit score. As a reminder, here is the FICO credit score calculation breakdown:

As you can see, your utilization plays a big role in the calculation of your credit score! So it’s important to know what it is, how it’s calculated.

What is credit utilization?

Credit utilization is how much of your available credit that you are using. In other words, it is measuring your revolving balances against your available limit. Our friends at Lexington Law explain it as: “Credit utilization looks at your outstanding debt and compares it to your revolving credit limits to determine how much of your available credit you are using.”

Additionally, there are two types: aggregate and line item.

Aggregate utilization is how much you are using of all of your available credit. For example, let’s say you have three credit cards, each with a $1,000 limit. On Card 1, you are carrying a balance of $500. On Card 2, your balance is $300. And on Card 3, your balance is $200. You total available credit is $3,000. The balances you are carrying add up to $1,000. Using $1,000 of your total available $3,000 means you are using 30 percent of your available credit (you get this number by calculating $1,000/$3,000).

Line item, on the other hand, is the utilization of each individual line of credit. So looking again at the example above, if your balance on Card 1 is $500, your utilization for that line of credit is 50 percent ($500/$1,000). Doing the math on the two other lines of credit you have, your utilization is 30 percent ($300/$1,000) and 20 percent ($200/$1,000) respectively.

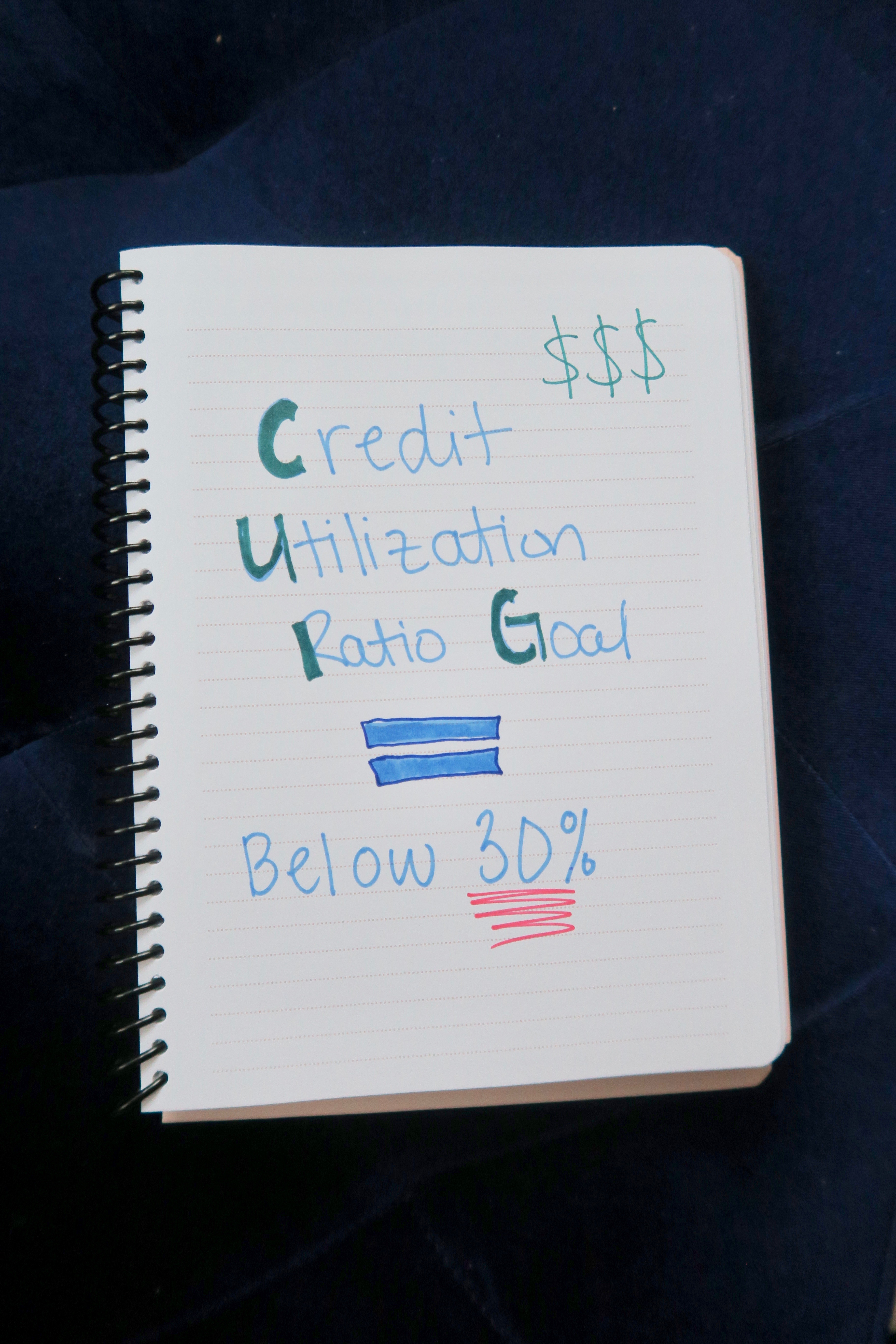

You’ll often hear your utilization percentage discussed as your “credit utilization ratio.” And the ratio makes up 30 percent of your FICO credit score.

The 30 Percent Guideline

The general guideline when it comes to credit utilization is to keep your ratios below 30 percent. Keeping your utilization below 30 percent will have less impact on your credit score.

If you can though, I suggest aiming for even below 10 percent. The lower you can get it, the better!

How To Improve Your Credit Utilization Ratio

There are a few ways you can improve your utilization ratio to benefit you and work towards improving your credit score.

1. Pay down your debt.

As we noted before, your utilization ratio plays a significant role in the calculation of your credit score. While it’s not something you might be able to do overnight, paying off your debt can help improve your utilization ratios (both aggregate and line item).

To pay off your debt faster, consider:

- making multiple payments and more than the minimum payment when possible

- earning more money

- starting a side hustle

- consolidate your debt

When it comes to strategies for paying off your debt, Lexington Law suggests prioritizing your debt with a plan:

Not all debts are created equal. There are several options for prioritizing your debt. Consider which option works best for you and your financial situation:

- Pay off the card with the lowest balance first

- Pay off the card with the highest interest rate

- Focus on the card with the highest utilization ratio

No matter how you decide to pay off your debt, it’s an excellent first step into improving your credit utilization.

2. Ask for a credit line increase.

If you aren’t able to reduce your balances immediately, you can ask your credit card company for a credit line increase.

Now, be careful because if you increase your available credit, you might be tempted to spend more money which would completely defeat the purpose of asking for the increase. If you are worried about overspending, follow these tips to work on breaking yourself of the habit.

Increasing your total available credit amount can help you improve your ratio because you have more credit available to you. Carrying a $3,000 balance on a card with a $5,000 limit is 60 percent utilization. But carrying a balance of $3,000 on a card with a $7,500 limit is 40 percent utilization. While it’s still not below the 30 percent guideline, it will impact you less and also make it easier for you to get below that 30 percent utilization goal.

3. Keep your cards open.

After you pay off a card, keep it open so that you can have that available credit factored into your credit utilization.

If you are not carrying a balance on a card, your credit utilization for that card is zero percent which is great! Remember, the lower the number the better. It can also help lower your overall utilization to have more unused credit available.

Length of credit history also factors into your credit score (it actually makes up 15 percent of your FICO score) so closing cards could impact your credit negatively that way too.

4. Adjust your payment dates.

Credit utilization can be calculate at any point in the month. If you are making your payments after the utilization has been calculated, the ratios that are being used for the calculation might not be an accurate reflection of your usage.

For example, I recently had to adjust my by automatic payments because I noticed a dip in my credit score by about 15 points. My automatic payments were going through around the 15th of the month so I adjusted them to be earlier than when my payment was officially “due.” It took about two months but my credit score increased to where it was before the dip.

5. Check your credit report for accuracy.

Your credit report is where the information for calculating your credit score comes from. It’s a record of your financial history and indicates your trustworthiness to potential lenders. To this effect, it’s important that your credit report is as accurate as possible.

You can get free copies of your credit reports here. Go over them, line by line to make sure they accurately reflect your credit history, your credit card limits, and your current balances. See this in action from this example Lexington Law shares:

Suppose Card A’s $10,000 credit limit is mistakenly listed as $6,500 on your credit reports. While it may seem like a small issue, an incorrect credit limit can drastically alter your utilization ratio and damage your credit score in the process. In this case, your line item utilization would increase from 45% to 69.2%, and your aggregate utilization would increase from 32.6% to 39.6%. You can’t afford to ignore the details.

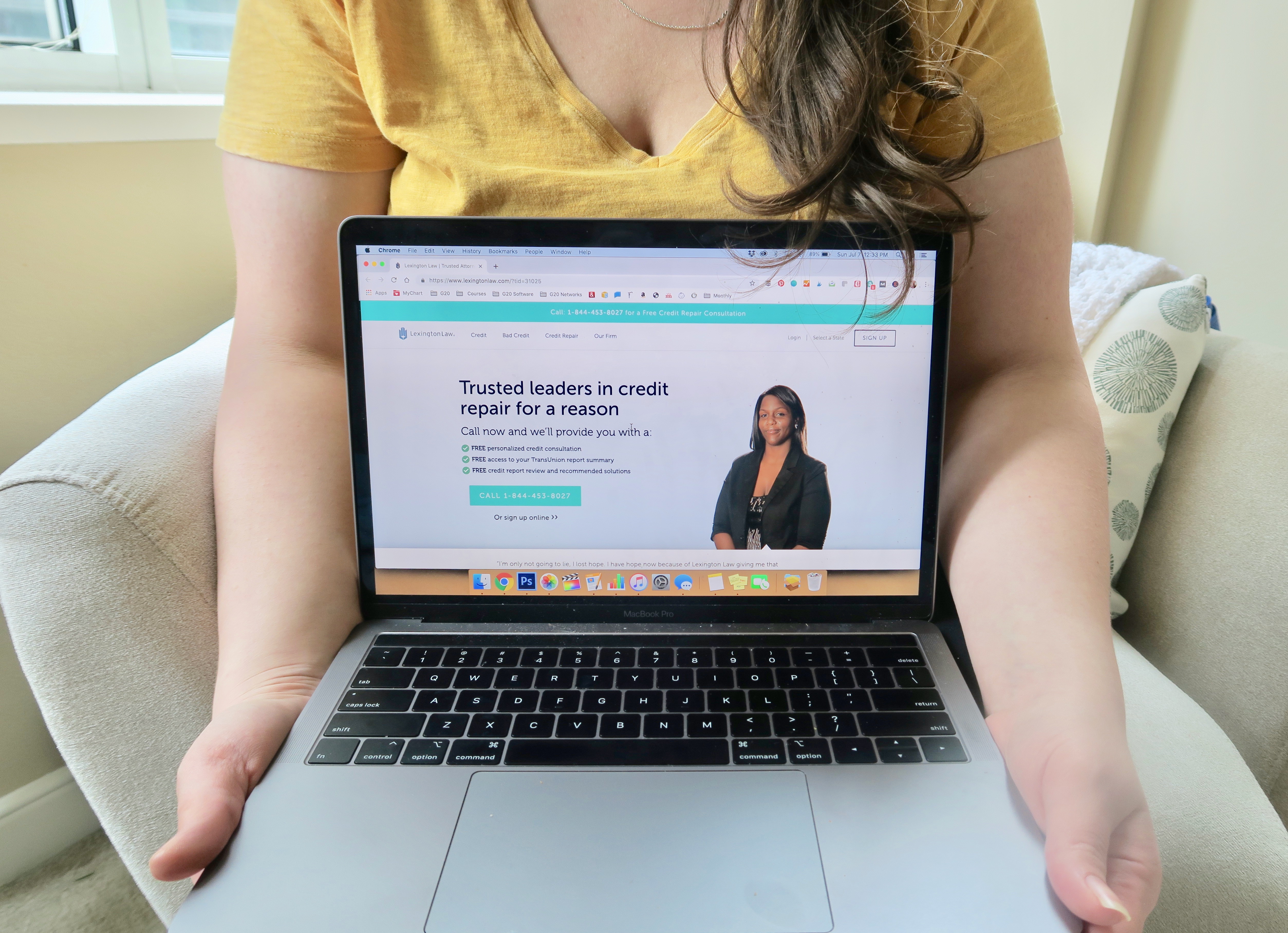

If you do find inaccuracies on your credit report, I suggest reaching out to the credit repair professionals at Lexington Law for a free consultation. Inaccurate, unfair, and unsubstantiated items on your credit report can potentially cost you thousands of dollars in additional interest paid over your lifetime.

Your credit utilization can have a big impact on your credit score, but there are also plenty of ways to keep the ratio down and use it to your advantage. Do you have any questions about credit utilization? Leave them in the comments!