Like it or not, credit is a major and important part of our world. Unless you can pay with everything in cash it is something we all end up relying on at some point or another.

When it comes to buying groceries, home goods and clothes, most people pay for these items upfront with cash or a debit card. There’s a simple exchange of currency and the transaction, for the most part, is finalized. For larger purchases like a house or car, most people will finance the purchase. That is, a lender will cover most or all of the purchase, and over a period of time, you repay that loan with interest. This seems pretty straightforward until you take a closer look at the terms and conditions governing that loan and its repayment.

Banks, credit unions and other lenders don’t just hand out loans without taking a closer look at your finances and financial history. They make several considerations before deciding whether or not to approve the loan and at what interest rate they are willing to lend to you.

Your borrowing history and the likelihood of you paying back the loan factor heavily into their decision. This is what’s known as your creditworthiness and it is often represented as a three-digit number called a credit score.

Understanding a Credit Score

When it comes to checking your borrowing history, a potential lender isn’t going to track down your creditors to determine the type of borrower you are.

Your credit score or credit rating lets a lender, or in some cases, insurance providers, utility companies and employers see how responsible you are when it comes to debt management.

A higher credit score indicates to lenders that you are a trustworthy borrower, meaning you are more like to pay back the entire loan with timely payments. A higher credit score means that lending you money is less risky as compared to someone with a low credit score.

Better scores usually make you eligible for more favorable loan terms such as the amount you can borrow, the interest rate, length of repayment period and the size of a minimum down payment.

Having a strong credit history is more than just the terms of your loan. If a lender or employer is reviewing your application, you may be rejected in favor or an applicant with a higher score.

Running the Numbers

Now that you know what a credit score is, you should know that technically you have multiple scores.

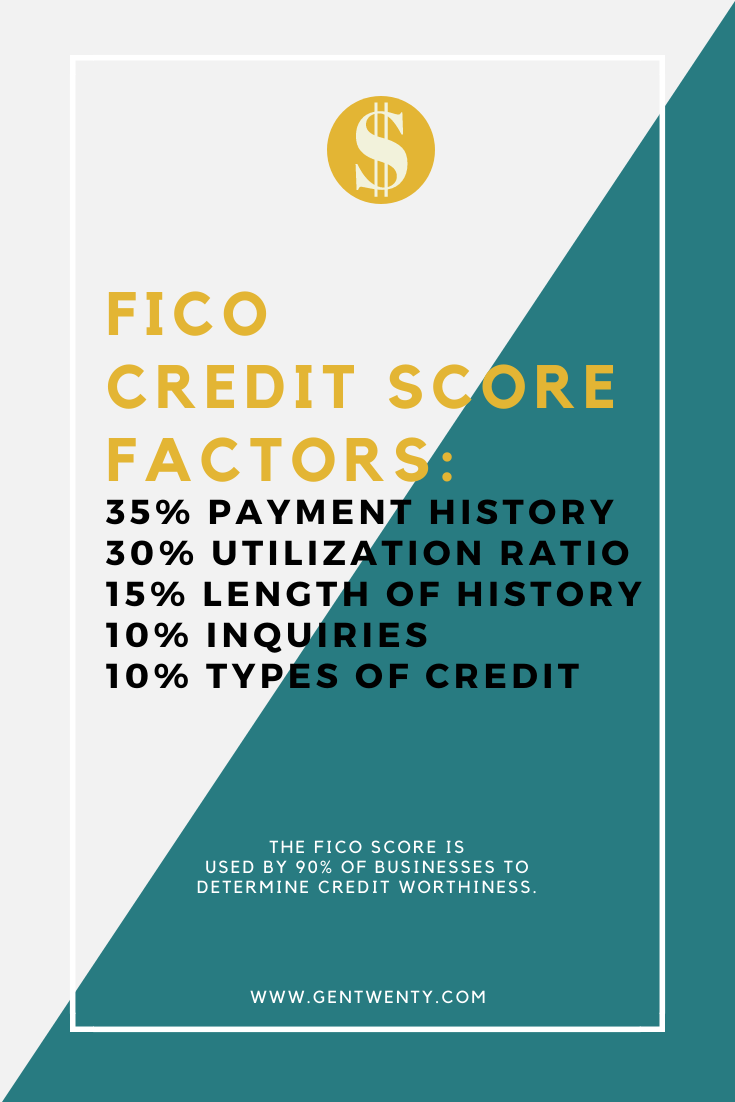

Fair Isaac Corporation or FICO, has developed several rating models based on your debt history, specifically the types of debt you have. Many of these models provide insights on how you handle different types of debt, including mortgages, auto loans, credit cards and more.

A credit inquiry is when an entity checks your history to determine the risk in offering you a loan, coverage or other services. A mortgage lender is going to consider mortgage-based models while a credit card company is more interested in how you’ve handled that particular type of debt.

Checking Your Credit Report

Everyone is entitled to a free credit report. You should check your scores at least once a year to make sure there are no delinquent accounts, fraudulent activity or identity theft on your record.

Three companies or reporting bureaus are responsible for providing the information in your record. Experian, TransUnion and Equifax offer details about your past and existing debts and the status of your various accounts. This report also includes details regarding bankruptcies, delinquent accounts and closed accounts. The reporting bureaus determine your credit rating based on the information in your report.

Determining Your Score

Now that we’ve established how important your credit history is, you may be wondering what’s the best way to raise credit scores. First, you need to see what makes up your score.

The following details factor into your score:

- Payment History: Your history accounts for 35% of your rating. Make sure that you pay your bills on time each month.

- Credit Utilization: 30% of your score is measured based on your total debt vs your total available credit. If you have a credit card with a limit of $5,000 and a balance of $500, your utilization ratio is 10%. A maximum ratio of 30% is recommended by experts – though as low as possible is the goal. Maxing out cards can lower your overall score dramatically.

- Credit History: This refers to the average length of all your accounts. The more history you have reflects favorably on your ability to manage credit. This accounts for 15% of your rating. Try to avoid closing accounts once you’ve paid them down as that lowers your average age.

- Credit Mix: 10% of your score is based on the diversity of your accounts. Lenders like to see that you can responsibly manage different kinds of debt. Mortgages, student loans and credit cards are different types of debt. Having good standing in all of your accounts helps raise your rating.

- New Credit: Applying for new credit accounts is responsible for 10% of your score. A credit request triggers a hard inquiry on your account which lowers your score. Too many requests in a particular time frame gives the impression that you’re desperate for new credit. So with the exception of mortgages, you need to be careful about applying for too many new loans within a certain time period.

Comparing Your Score

It’s important to have a general sense of how your credit stacks up, especially if you’re contemplating taking out a loan soon.

You should know that many reviewers have their own criteria for making loan offers. Still, FICO’s ranges are usually the benchmark for most lenders:

- Poor: 579 and below

- Fair: 580 to 669

- Good: 670 to 739

- Very Good: 740 to 799

- Exceptional: 800 and above

Most creditors use these ranges to establish your creditworthiness. People with exceptional and very good scores tend to get the best offers on loan terms. They are considered low-risk when it comes to repayment. The average FICO rating in the US is over 700.

The credit score is a very important number that can dramatically affect your life. If you’re ready to buy a home, you don’t want to discover that you can’t get a good mortgage due to having poor credit.

Now is the time to get a free credit report and set goals to boost your numbers. Take an honest look at your borrowing and spending habits and come up with a plan for improvement.