This post is sponsored by Lexington Law.

Earlier this year I wrote a blog post on how I buy back my time with money. Every time I share that post I get messages and replies from people sharing how it has inspired them to think of their time and money differently.

On a walk the other day, I was thinking about that post and how I have gotten even more strategic about how I spend my money, and things I’ve done in the past that have improved my life.

There were some things that immediately jumped to mind, but upon deeper reflection, I realized that there are a lot of ways I strategically spend money and budget my money that improve my life. I’m always an advocate for putting your money where your values are. As long as you are within your budget and not overspending to take on debt, I think it’s smart to spend your money in ways that makes life easier for you.

8 Life-Improving Ways I Spend My Money

1. I use a meal delivery service.

This is definitely one of the most life-improving ways I choose to budget money. I don’t hate cooking but it’s something that I’ve found that takes up a lot of time in my day. I also find it hard to focus on making dinner and keeping everything straight and organized in the kitchen with a baby around now. It was leading to too much eating out (or ordering in) and it wasn’t good for my budget.

Enter Factor. Factor is a meal delivery service where the meals are prepared for you ahead of time. They are cooked so you only have to heat them up (usually in between 2.5 – 3.5 minutes). They are quick, healthy, and cater to many different dietary preferences. Plus, they have a rotating menu so you can almost always mix it up and try different dishes.

While I still do like to cook sometimes, I find that Factor gives me healthy meal options that are quicker (and cheaper) than eating out. I’ve also done quite a bit of meal prepping in my day, but at this point in my life, it takes a bit more time than I realistically want to give.

2. I monitor my credit.

I am personally a huge fan of credit monitoring. I’ve had my identity stolen in the past, and it was not a pleasant experience. Luckily I caught it early and my situation was quickly resolved but if it hadn’t been able to spot it quickly, I don’t know what might have happened.

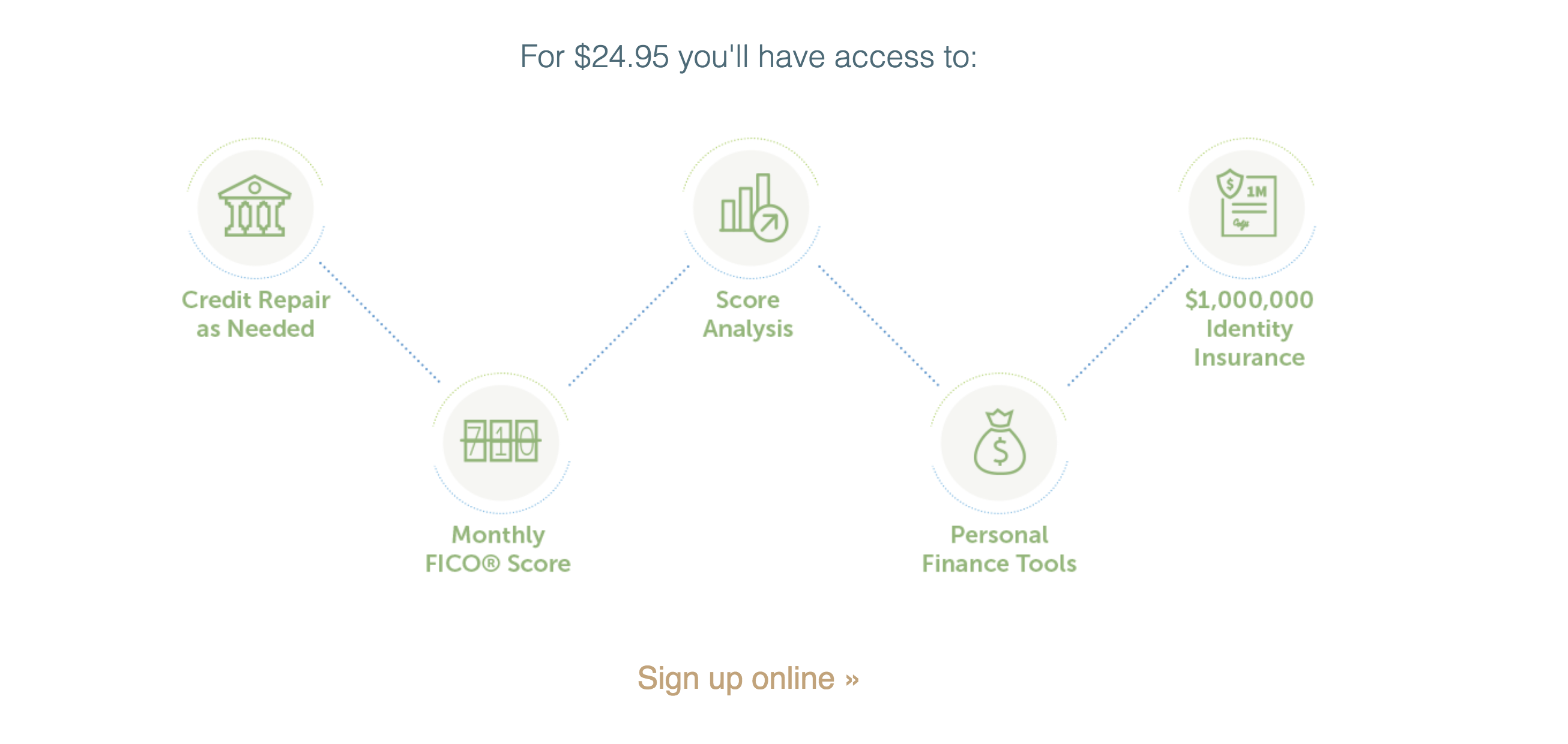

I pay for credit monitoring through Lex OnTrack. This gives me peace of mind because it will alert me to any activity that might pop up on my credit report that I might not have noticed otherwise Lex OnTrack will notify you of changes to your credit report, give you your FICO® Score, provide a credit score analysis, offers basic credit repair, and includes $1,000,000 in identity insurance.

Related: Lex OnTrack Review: Why You Should Monitor Your Credit

This has also been helpful in other ways that I didn’t expect. For example, my credit score dropped about 10 points earlier this year. At first I didn’t understand why but when I realized that when my husband and I changed our credit card payment date, it was altering my credit utilization ratio. As a refresher, that makes up 30% of your FICO® Score. Luckily we were able to adjust the payment date quickly and my score bounced right back up.

My credit score is something I’m paying a lot of attention to right now because we are looking to buy a house in the next year or so. I want my score to be as high as possible to help me get the best interest rate as possible. Monitoring my identity is helping me reach that goal and is something I’m happy to spend money on every month.

I also take the time every year to check my credit report. You can check yours for free once a year at annualcreditreport.com. I recommend going through line by line to make sure everything is correct.

Related: How To Do An Annual Financial Audit (FREE Download)

If you do find any inaccuracies or unfair negative items on your credit report, I recommend reaching out to the credit repair professionals at Lexington Law for a free consultation. After the initial consultation, if you then decide to move forward with Lexington Law’s credit repair service, you’ll pay $14.99 to pull your full credit reports from TransUnion, Equifax and Experian. You won’t be charged for additional services for five days afterwards. You can read more here about how the credit repair process with Lexington Law works.

3. I paid off my highest interest rate debt first.

When I graduated from college, I had about $25k in student loan debt and some credit card debt. I’ve discussed before how I finally made headway in paying off my debt. My real secret was doubling and tripling my payments.

I know this isn’t always an option, but paying as much as I possible could have a huge impact on paying off my debt in 18 months. Within my debt payoff strategy, I chose to tackle the highest interest rate debt first. That interest adds up quickly and while I don’t have an exact figure on what it saved me over time, paying that debt off quickly and efficiently surely saved me some money.

Related: How Much Is Your Debt Really Costing You?

I could have been blindly throwing money at my balances but taking a deeper look into the terms allowed me to pay off that debt more strategically which saved me more money in the long run.

4. I earn points for travel with my credit card.

After I paid off all of my credit card debt and improved my spending habits, I started dabbling in travel hacking. Travel hacking, in essence, is taking advantage of credit card rewards to travel at a reduced cost of even free.

I started by opening a Chase Sapphire Rewards card (and eventually a Reserve card) and started saving up my points. Opening a card that maximized my personal spending (with extra points/rewards on groceries, gas, etc. AKA things you’re already spending money on) helped me rack up points faster.

I also opened cards strategically. For example, when my husband and I planned our trip to Spain, I opened an American Airlines card a few months ahead of time, hit the minimum spend, and got enough points just for opening the card to get our flights for free.

Related: 8 Questions To Ask Yourself Before Opening Up a New Credit Card

I’ve flown to Spain and Japan for free, taken multiple free trips to Hawaii, and stayed in the Shangri-la in Tokyo for free (in a room that goes for over $1,000 a night). Not to mention many cross-country flights, hotel stays, and car rentals that cost me nothing but a few dollars in taxes. Strategically spending to maximize my credit card rewards was a huge life-improving way I spend money.

5. I buy a coffee almost every day.

This is one of those “frivolous” expenses that some personal finances experts might tell you you need to cut out. And while I don’t necessarily disagree that if something like this is keeping you from reaching a major goal, then it could be a smart move to cut back. Like for instance, getting coffee three times a week instead of five. But realistically, that’s not what’s killing your budget (and that is perhaps a topic for another day).

I spend around $4-5 on coffee a day, usually 4-5 days a week. I pick up a latte from one of my favorite coffee spots and have a chat with my barista on my daily walk with my son. On Sundays, my husband and I have started taking a long walk where we get coffee and pastries and eat them near the lake we walk to. I enjoy this time we spend together, and yes, also the coffee we buy.

Do I need to buy coffee everyday? No. I don’t need to. But I enjoy it. I look forward to it everyday and it’s still a special moment for me.

Related: How To Budget To Improve Your Credit

6. I bought a handheld vacuum.

This goes back to the concept of “buying back your time.” In my previous post, I shared that I bought a Roomba. That was before I had a baby.

My son is almost 10 months old and is into everything. We believe in a free-range baby and allow him to explore our childproofed home on his with little restriction. However, there occasionally (read: every day, all the time) ends up being things on the floor. Like random leaves from outside. Or crumbs below his highchair. And accidents, like the time he dumped over our shredded documents.

Having a handheld vacuum has been such a timesaver when it comes to cleaning up these messes. Even though we already have a vacuum (a Roomba, which isn’t ideal for spot cleaning messes, and an upright vacuum that has to be plugged in at all times), a handheld vacuum has been so helpful in keeping our home clean for our babe.

It’s quick to get out, easy to use, and fast to put away. We’ve also used it to clean out our car and it’s been really handy. We use ours almost every day and it’s been an awesome thing to have.

Related: How I Prepared My Finances For a Baby

7. We rent an apartment close to my husband’s job.

We’ve lived in the same area for over seven years now. From where we are, it’s a 10 to 15 minute walk to my husband’s office depending how you catch the lights.

Yes, it is pricey to live where we do, but it saves him so much time in commuting. The average commute is around 26 minutes but much longer in some areas. Not only does living close by cut out the commute time, but we’re able to have lunch together almost every single day. This was important to us before we had our son, but now that he is in the picture, this is more time we get to spend together as a family each day.

Before we had a baby, we had roommates and lived in a studio apartment so we could save a huge portion of our income. Yes, we desperately wanted more space, but we also wanted to save money (and pay off our debt in the early years). This was a tradeoff, of course, but one that was entirely worth it.

Living close to my husband’s office might cost us more money but it saves us more time and gives us more time together, which is more valuable to us right now.

8. I make every dollar spent do something else for me.

This is something I’ve extended into my life now back from my travel hacking days. The idea is that you want every dollar you spend to earn you something back on it. Whether it’s credit card points, reward points or cash back, try to get something back from every dollar you’re paying out.

For example, when shopping online I either use TopCashback (more on getting cash back here) to get extra cash back or shop through my credit card’s online portal for point multipliers to earn even more rewards points. I have a store card at Amazon that earns me 5% back on all of my Amazon purchases that I apply as a credit to future purchases.

Another way I like to do this is to stack systems. For example, many of my online beauty purchases are made through Ulta. If you’re a rewards member at the store, they frequently do points multipliers on different brands.

When these multipliers happen, I’ll stock up on products I know I’ll need soon so that I can get the extra points. Once you hit a certain amount of points, you can redeem them just as if they were dollars. At Ulta, 2000 points is $125 you can apply towards a purchase.

I also use Rakuten whenever I make a purchase so I’m earning cash back that way as well. I also always redeem my 2000 points towards a purchase when they send out a 20% off coupon. That means I’m actually able to purchase $150 worth of product for free.

It might seem complicated, but once you look deeper into where you spend your money and what you spend it one you will get a better idea of how you can maximize those purchases through rewards programs. And sometimes even through multiple rewards programs!

Most of us are spending money every single day in some capacity. Over the years, I’ve learned many ways to make the dollars I’m spending work a little harder and go a little farther for me. I generally try to be extremely intentional about how I am budgeting and spending my money each month.

Some of these life-improving ways are surface-level helpful and others are a deeper, more value-aligned way of spending and allocating our funds.

Looking at your current budget, do you feel that your funds are being directed in ways that improve your life or get make this challenging? I’d love to hear from you in the comments.