This post is sponsored by Lexington Law.

My first child was born in January 2019, and as soon as I found out I was pregnant, my financial priorities changed. Adding a member to your family is an exciting time, but also a big responsibility. At least that’s what it felt like to me.

Several of my preparations were years in the making as I’ve been preparing myself for the eventuality of starting a family. That said, there are also things I did while pregnant to get ready for the expenses that come with a little one.

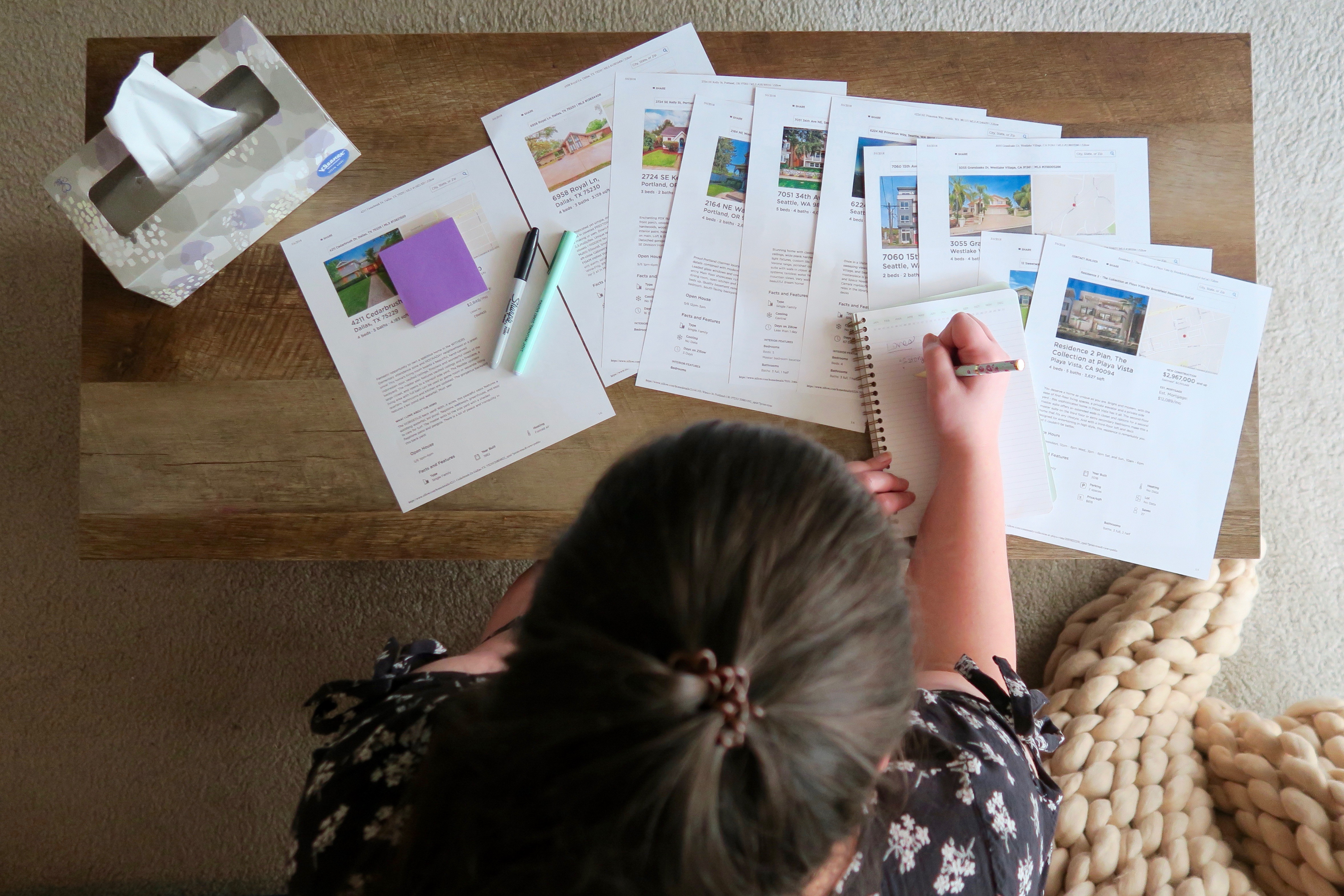

How I Prepared My Finances For a Baby

1. I tightened my budget.

My husband and I are a dual income household. We rent, and before this year, didn’t own a car, so our bills and financial responsibilities were fairly limited in quantity. We budget loosely and aim to not go over a certain number each month. However, with a little one on the way, we needed to tighten up our spending to make sure we could afford another person and also to start saving more for this new addition and his future expenses (and all of those cute baby pajamas and baby shoes I want to buy).

We went over our budget and removed everything we were paying for that we weren’t *actually* using. Including things like a forgotten about Hulu subscription.

We also aimed to reduce our spending in areas like food and groceries and our personal budgeting allowances. We moved some of this money to the “Baby Booz” fund each month so our savings was growing as our baby was growing.

It helped us to overestimate future expenses so we could create more reasonable spending habits for both now and the future. Trimming the fat so to speak from the budget and cutting extra expenses also helped us to put more money into savings!

2. I didn’t open any new lines of credit.

As someone who has previously travel hacked her way to a free trip to Japan, free flights to Spain, and multiple free flights and trips to Hawaii with credit card rewards, this surprises even me. But we knew we might be buying a car soon (more on that in a minute) and we didn’t have any additional travel planned after our babymoon.

Hard inquiries can ding your credit score, so unless there’s a real reason for them, they are beneficial to avoid. With such a big life change coming up, I wanted to be prepared financially. We’re also keeping our options open for buying a home in the next couple of years so we’re also preparing for that as well.

I also always keep an eye on my credit using a credit monitoring service like Lex OnTrack. It’s hard enough to keep track of what day it is with a newborn, so I never wanted to worry about my credit, especially at a time I was also dealing with medical bills. Lex OnTrack gives you your FICO credit score, a score analysis, access to credit repair as needed, and $1,000,000 in identity insurance. You can learn more and sign up here.

Related: Lex OnTrack Review: Why You Should Monitor Your Credit

3. I opened new savings and investment accounts.

We started socking money away into a savings account in anticipation our baby’s arrival. Babies are expensive. Take those newborn “one month supply of diapers” claims for example. We went through three of those $45 boxes in his first month of life even though they supposedly last a month. Not for us they didn’t!

This may or may not be typical (everyone I talked to also seems to go through diapers quickly, though), but the costs still add up. And they are only going to get higher. It was important to me to be able to build a savings habit now so that we can provide for our family in the future. Having these habits built into our life gives us financial freedom. And that is the power of choice. We can choose to do things because we want to, not because we have to.

4. I made sure all of my debt was paid off.

This part of the plan started years ago. I carried about $25k in student loan debt and I’ve discussed at length the measures I took to pay it off. Including how I doubled my loan payments without making more money.

Student loan debt is a big deal in America. The class of 2017 had an average student loan debt of $39,400 per student? And that number is expected to be over $40,000 for the class of 2018. What’s more, over 44 million Americans have student loan debt, totaling over $1.52 trillion. Nearly 60% of borrowers are expected to be paying on their loans into their 40s. I really did not want that to be my experience going forward.

I started preparing for all of this in my early twenties. It was always in my loose plan to start having kids in my late twenties. (If it happened before, that was okay too! And if it happened later, I was also fine with that.) My husband and I made it a priority to pay off our student loan debt as quickly as possible.

We also carry no credit card debt and aim to keep our credit utilization below 10% at all times as utilization makes up 30% of your FICO credit score. Setting up automatic payments (more on this in a second) made a huge difference for us in making sure that ratio stayed low.

5. I bought a car.

As you previously read, I didn’t open any new lines of credit. After six years of being car-less, my husband and I quickly decided now was the time. So a whole five days after our soon was born, we went to a dealership and purchased a new car in full.

Living without a car for so long gave us the ability to save quite a bit of money which is part of the reason we were able to do so. We also knew that after having a child, our need and desire for our own vehicle might increase. And it did.

We previously used a car sharing program and ride sharing apps for when we needed wheels to get around town but with our own child, we felt we needed to be much more cautious.

If we hadn’t had the money to purchase a car in full, I am confident our financing options would have been easier to swallow because we both have credit scores over 800. Because we knew purchasing a car was on our radar, I did my research on car buying options ahead of time. And don’t forget when you’re budgeting to include car insurance — here are 8 ways to save on car insurance for when it’s time to choose your coverage.

If your credit score isn’t as good as it could be, now is the time to start improving it! Here are six ways you can start improving your credit score in the next six months.

Your credit is extremely important and should be a financial priority. I advocate for checking your credit report at least once a year and building smart habits to improve your score over time. In the event that do you find unfair negative items on your credit report, know that you do have credit rights that protect you from unfair reporting. Contact the team at Lexington Law for a consultation and more information.

6. I set up automatic payments.

The first couple of months with a newborn are a whirlwind. There’s so much to remember, and paying my bills on time was unfortunately not at the front of my mind when I was just trying to survive and keep a small human alive. I also had to be briefly hospitalized a week after my delivery for a rare postpartum complication. Everything was okay, but with all that going on, some bills could have easily slipped through the cracks!

Having automatic payments set up is an excellent thing to do whether you have a child or not. Late payments impact your credit varying on how late your payment actually is, but delinquent accounts will show up on your credit report. Plus, you’ll likely be hit with late fees which is something that can definitely be avoided!

Having a baby is an exciting time in your life. I feel much more confident in my role as a new parent knowing that I took the time to financially prepare. It’s especially important as your child gets older, starts walking, and requires more from you that you can run as much on autopilot as possible.

These are just the steps I took to be ready for when the time came to grow my family. Are you expecting? How are you preparing financially for a new addition?