This post is sponsored by Lexington Law.

Ah, the holidays. Arguably one of the best times of the entire year. There’s lots of joy, cheer, family, friends, delicious treats, and of course, holiday gifting. Which typically involves shopping of some sort.

Whether you do most of your holiday shopping online or in-store, it’s also the time to be aware of your spending and your budget as things can get out of control really quickly! This time of year you might also be shopping at new places both online and in-store so these are some healthy financial habits that will help you notice if anything is amiss.

Today, I want to share with you a couple of tips that will help protect your credit when holiday shopping this season. It’s a busy time of year and things can go unnoticed, which is why I’ve also created a free checklist for you to download. It has reminders for you to check before, during, and after your holiday shopping. Get it here:

How To Protect Your Credit When Holiday Shopping

1. Check your statements.

The holidays are one of the busiest times of year and they can leave us particularly vulnerable financially if we’re not careful. We’re making a lot of purchases, probably more than usual in most cases. This leaves more room for double charges and mistakes.

You never know when you might have been charged twice for a big purchase, so keep an eye on your statements to avoid mistakes! These kinds of things can be easily overlooked, especially during such a busy time of year if we’re not diligent about checking them.

What you’ll want to do is to check your credit card statements at least once a week. Just make sure everything is in order and nothing seems suspicious. If you can’t account for every charge on the statement, contact your credit card company as soon as possible. They’ll likely want to send you a new card just to be safe while they investigate the error.

2. Monitor your identity.

Identity theft is one of the fastest growing crimes in America. Millions of Americans are victims of this crime every year, and billions of dollars are lost because of it. As someone who has had her identity stolen previously, it’s something you’ll want to take every precaution to protect yourself against.

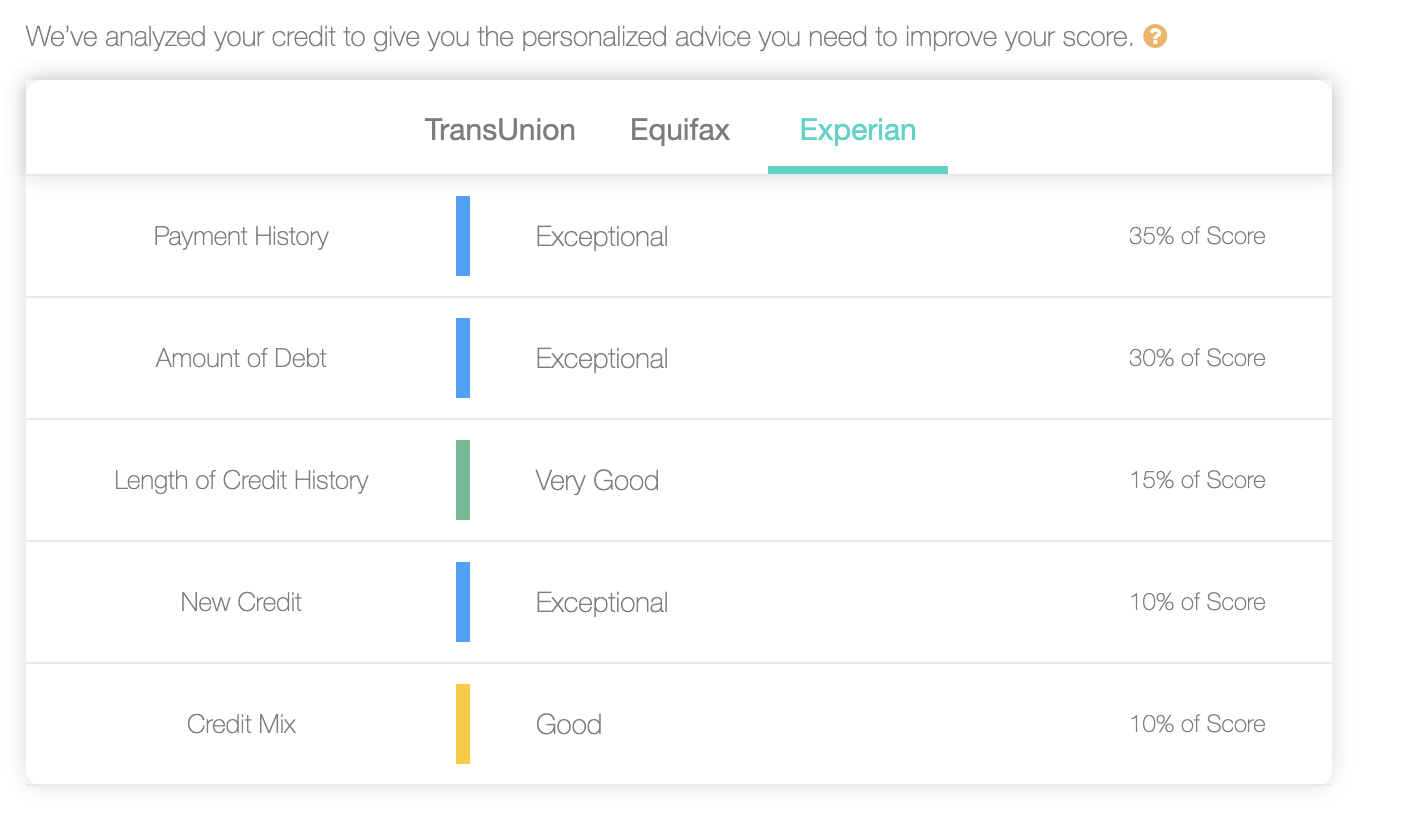

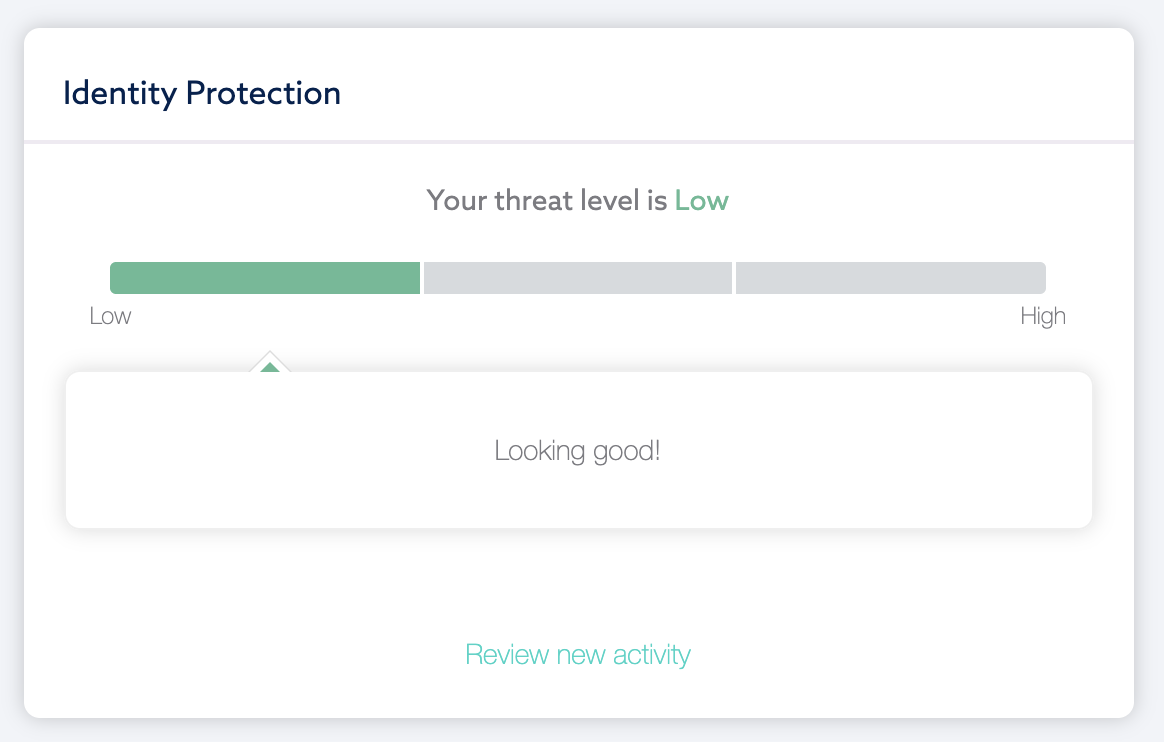

I recommend using an identity monitoring service, like Lex OnTrack, to keep tabs on your identity. Lex OnTrack will notify you of changes to your credit report, give you your FICO® Score, provide a credit score analysis, offers basic credit repair, and includes $1,000,000 in identity insurance.

Related: Lex OnTrack Review: Why You Should Monitor Your Credit

Here are a few snapshots from my own Lex OnTrack dashboard:

Actively monitoring your credit means you’ll be alerted quickly to changes and potentially devastating problems like identity theft. Your credit report, score, and history is important, and it’s something you should be taking very seriously. Using a reputable service can provide you with peace of mind and with protection, should you need it.

How to protect yourself during the holidays (and all times of the year):

- Don’t share your personal information like a credit card number, password or Social Security number over the phone, text or email — especially if you did not call the person requesting the information.

- Don’t use public or unsecured Wi-Fi to send access your personal information like your bank or credit card login.

- Don’t respond to or click on links in suspicious emails. Immediately send them to the trash.

- Avoid using stand-alone ATMs to avoid skimming scams.

- Stay aware of your surroundings and keep your credit cards, debit cards, and ID protected at all times. Even consider using an RFID-blocking wallet to play it safe.

- Sign up for credit monitoring alerts to be notified of your credit activity. It’ll help you know if someone is using your personal information to open new accounts.

3. Stick to your budget.

I know it’s easier said than done, but keeping to your budget (AKA only buy what you have the cash to pay for!) is going to help protect your credit.

Your credit utilization ratio (the percentage of the revolving credit that you’re using over the credit you have available to you), makes up 30 percent of your credit score. If you take on debt that makes this ratio exceed 30 percent, then you are putting your credit score at risk. Don’t treat your friends and family to something nice only to leave yourself in a tough financial spot.

I love to give gifts, especially well-thought-out and personal gifts. I take my time choosing each item carefully for each person in my life. But it can quickly get out of control financially. Stores lure us in with beautiful displays and deals around the holidays. The season of giving can quickly become the season of overspending if we’re not careful!

If you’re finding yourself on a limited budget this holiday season, don’t let the pressure to spend get to you. Instead of spending money on someone, why not give your time or your talents?

Here are a few ideas to spend less over the holiday season:

- Do a secret gift exchange: One of my friends does this with her friend group every year. Instead of exchanging gifts for everyone, they do a “secret Santa” type of gift exchange and buy only a $50 (or another set limit) gift for one person.

- Map out your purchases in advance: Start thinking now about what you’d like to gift everyone in your life. That way, if there’s a specific item you have in mind, you can catch it on sale before the holidays get going.

- Go handmade: Instead of buying things, why not make something special? It could be edible, like cookies, or something special like a friendship ornament.

- Give used books: A well-loved copy of one of your favorite books is not only a personal, thoughtful gift, but can help give you more common ground.

- Share a potluck meal: Get your best pals together and have everyone bring a dish. Have the friend with the most spacious apartment host and share a meal while you reflect on the year together.

- Make a no-gift rule: From the get go, share with your friends that you aren’t giving gifts this year.

- Make a donation in their name: Some of my friends prefer this in place of a gift so instead of getting them something, I donate to a cause they care about.

Remember, you don’t have to spend money to have a nice, memorable holiday season! The joy of the season is found in our attitude towards each other.

4. Check your credit report.

If you haven’t already, the end of your holiday shopping is a good time to pull your credit report and check it for the year.

You can get yours for free once a year at annualcreditreport.com. Go through line by line and make sure everything is correct. You can also see what else we recommend checking for in my post on how to do an annual financial audit (also with a free download).

If you do find any inaccuracies or unfair negative items on your credit report, I recommend reaching out to the credit repair professionals at Lexington Law for a free consultation. After the initial consultation, if you then decide to move forward with Lexington Law’s credit repair service, you’ll pay $14.99 to pull your full credit reports from TransUnion, Equifax and Experian. You won’t be charged for additional services for five days afterwards. You can read more here about how the credit repair process with Lexington Law works.

5. Use your credit card over a debit card.

Most credit cards have purchase protection or fraud protection that can come in handy in case of fraudulent charges on your card.

As far as I am aware, most debit cards don’t offer this protection. What’s more, debit cards can leave your entire account balance vulnerable (this is bad news because this is your liquid cash). If someone were to gain access to your bank account, money that would likely be gone forever. Otherwise, it would be more difficult to recover.

6. Stay aware of charity scams.

It’s a shame that during a time of giving that charity scams are unfortunately something we have to look out for. Scammers will try to take advantage of the generosity of the season to get money from unsuspecting people.

Here is a tip from Lexington Law to help make sure the charity you are donating to is legitimate:

Fake charities often design themselves after legitimate organizations, using similar names and page layouts to fool you. You can check if an organization is legitimate on the IRS website. Don’t give out personal information to anyone claiming to represent a charity and solicit donations. And when you do make donations, use a credit card or check rather than cash or wire transfer. They’re easier to recover if the charity ends up being bogus.

When you donate, make sure to verify the charity and recipient and don’t expose your financial information in the process.

The holidays are one of the most wonderful times of the year. But they are often a time of year that can leave us feeling financially vulnerable if we’re not careful!

Make sure you are protecting your future self and your credit by checking your statements, reviewing your credit report, monitoring your identity, not sharing personal information, using your credit card responsibly, sticking to your budget, and keeping abreast of potential scams. Happy holidays!