This post is sponsored by Lexington Law.

If you’re anything like me, you tend to check in on your finances monthly. Mostly that means giving your credit card statement a quick look over, making sure all of your automatic transfers went through, and checking that you got paid on time. Sound about right?

Maybe you’re a little more lackadaisical when it comes to checking in. Or perhaps you fall in a more focused camp. Whichever your philosophy, one thing is true; The spring is a great time to do a few things you may have been putting off when it comes to your money! I have a couple of things I like to do every year to make sure I’m organized and on top of everything.

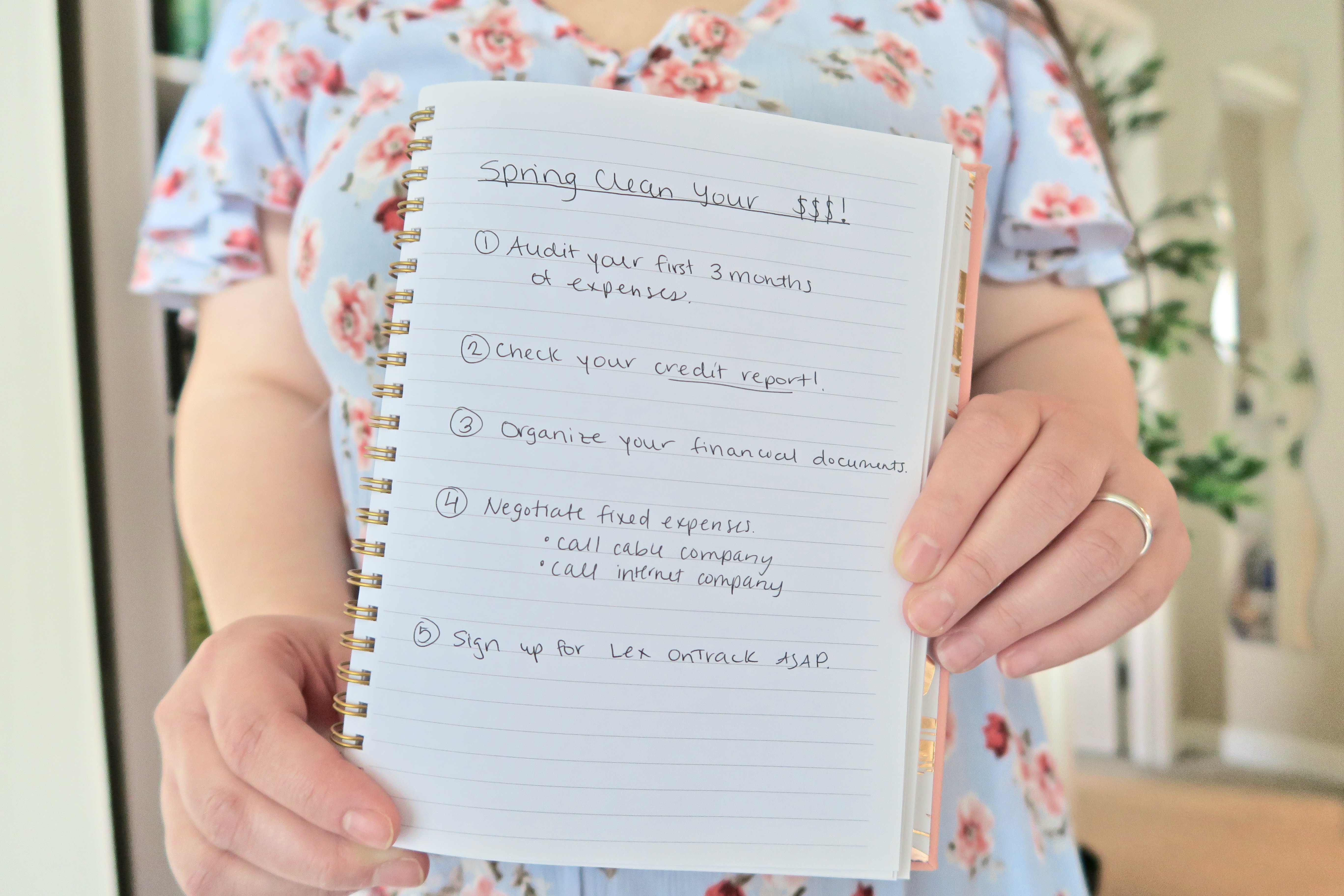

5 Ways To Spring Clean Your Finances

1. Do an audit of your first three months of expenses.

By this time of the year, we’ve experienced three full months of 2019. I always think it’s a good idea to check in on your spending at the end of every month, but quarterly is also a great bet.

Pull up all of your bank statements and credit card statements from January to March. You could use an online tool like Mint to categorize your expenses but making yourself a spreadsheet of all of your spending gives more hands-on insight into what you’re purchasing.

Make a list of your spending categories from highest spending to lowest spending.

For example, for me it looks something like this:

- Fixed expenses: rent, car insurance, internet bill, phone bill, life insurance premiums, etc

- Savings account transfers

- Food: Freshly, eating out/take out, miscellaneous groceries, etc

- Baby expenses: diapers, wipes, clothes, bottle accessories, etc

- Discretionary spending: clothes, makeup, household items, etc

Then ask yourself if these line up with what you want to be spending your money on. Are you overspending in any area? Wish you could cut back? Do you want to be putting more money towards something else (like savings)?

Make some adjustments to your budget to make your spending more in-line with your goals. Like our friends at Lexington Law say, “Understanding how and when to spend your money is the best way to build a stable lifestyle.” If you’re not spending strategically, take some time to understand the holes in your budget. Then make a plan to do something about it.

For example, try to be more mindful of your food spending by planning out your meals for the week. You don’t need to deprive yourself of eating out, but see if you can limit yourself to once or twice a week. Test out different budgeting strategies for this next quarter and see where it gets you.

Related: 5 Top Tips To Make Managing Your Money Easier

2. Check your credit report for inaccuracies.

When was the last time you checked your credit report? Did you know you’re entitled to a free copy of your report every year? Set an annual reminder on your calendar to get yours from annualcreditreport.com. You’ll be able to see your credit report from each of the three credit bureaus: Equifax, Experian and TransUnion.

Go through each line on your report. Is everything accurate? Every person has a unique set of accounts and account types, length of credit history, debt to credit ratio, and more that is part of our credit history. All of this information together makes up our credit reports.

Those reports are what make up our credit scores, and those are what lenders use to determine your trustworthiness as a borrower. It can mean a difference of percentage points in interest on a car or home loan that will cost you thousands of dollars in interest over the years.

The details really matter. Pay close attention to dates, missed payments, accounts you didn’t open, and incorrect information. The law says that the information creditors report to the bureaus has to be fair, accurate, relevant, substantiated, and verifiable. However, it’s up to you to check your credit report for inaccurate information!

If you do find inaccuracies, don’t panic. Consider contacting the credit consultants at Lexington Law. They will be able to assess your unique situation, explain your credit rights, and prepare a plan of action for removing the unfair and/or inaccurate items found on your credit report.

Checking your credit report at least once per year is always worth the effort.

Related: How To Build Good Credit

3. Physically organize your financial documents.

Do you keep your financial documents somewhere safe? My husband and I try to eliminate the amount of paper documents we receive from our financial institutions and opt for paperless billing as often as possible.

However, there are some documents we need to keep handy and accessible. If your file system is out of control, take an afternoon and get to organizing! Make sure your files are clearly labeled so you know where to find things when you need them.

If there are things you no longer need, take care and shred them. Not doing so can leave you financially vulnerable and open to identity theft in the future.

You may also need to keep things on hand that you don’t have physical documentation for. An example of that would be pay stubs as a self-employed professional. You can use Form Pros, a pay stub solution, to generate pay stubs if you need them for proof of income.

While you’re at it, it’s also a good time to update your online passwords. Put that on your calendar every spring!

4. Negotiate your fixed expenses.

Since you did an audit of your first three months of expenses for the year, you should have a clear idea of what your regular fixed expenses are every month. Did you know you have a good chance of negotiating these down? Simply by calling your providers and asking for a discounted or loyalty rate could save you money every month.

Most bills, even medicals bills, are negotiable. If you’re not comfortable calling and asking for a discount, take a look at what other similar providers would cost you. If a competitor company would save you $25/month on your internet bill, call your current provider with that information. It never hurts to ask but having some leverage to back you up can help you feel more confident while negotiating.

In this post, I shared how I helped someone negotiate their car insurance bill, saving over $1,800 a year with this strategy. It really is simpler than you might think!

5. Protect your future self with Lex OnTrack.

Now that you’ve audited your expenses, checked your credit reports, organized your documents, and negotiated some bills, it’s time to do something to protect your future self.

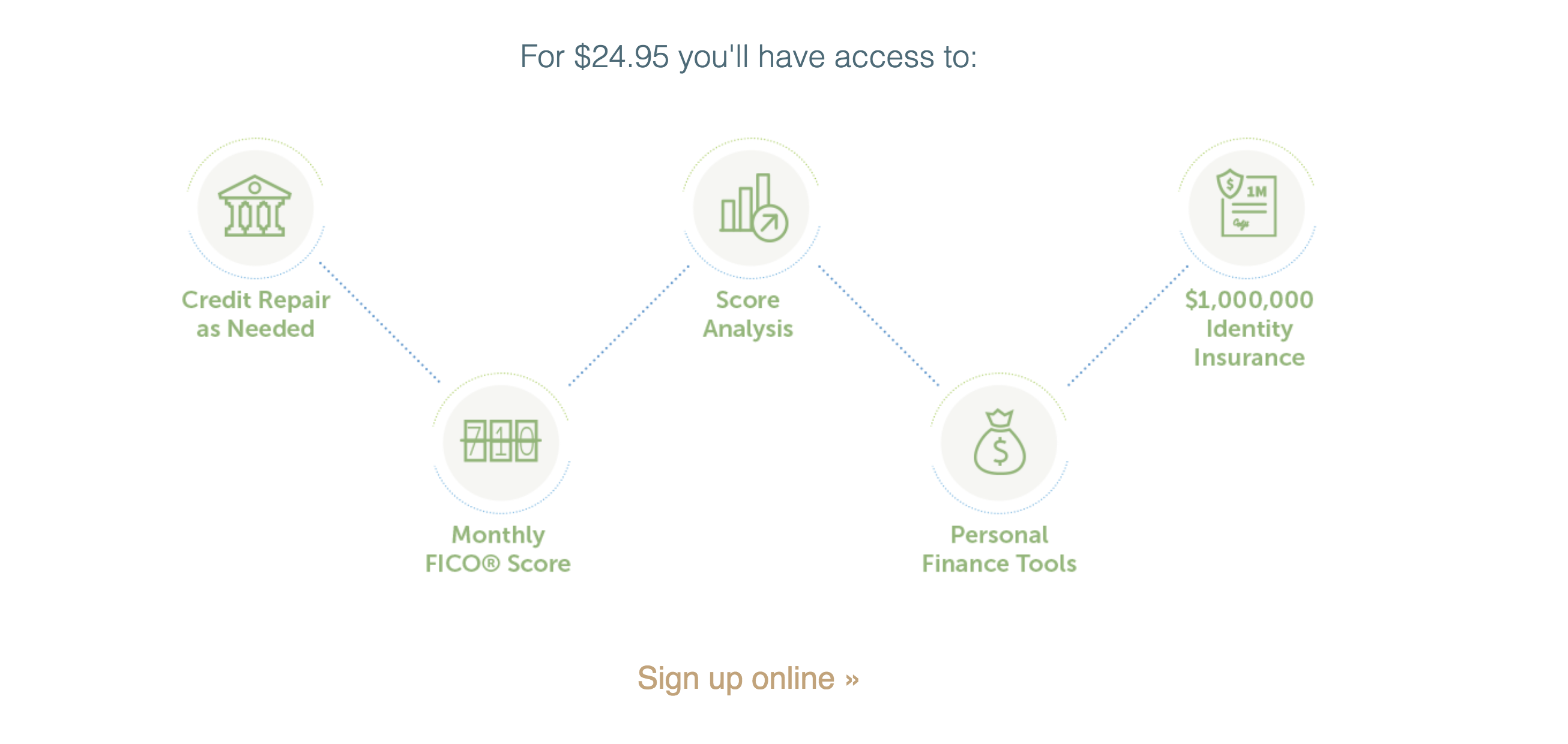

I highly suggest utilizing a credit monitoring service like Lex OnTrack to be quickly alerted of any changes on your credit reports. Having any changes brought to your attention as soon as possible means you’ll be able to resolve the issue in a more timely manner.

Plus with Lex OnTrack, you’ll see your FICO credit score, receive a score analysis, have access to credit repair as needed, and have $1,000,000 in identity insurance. Learn more and sign up here.

It’s important to take some time to spring clean your finances in order to set yourself up for financial success. With this list, you’ll be better off for the rest of the year!