This post is sponsored by Lexington Law.

By now you know you should have a budget. You should also be saving for retirement, at least a little bit. And should be putting money in savings and not living above your means. Check, check, and check. But what now? Are there other things you can be doing to optimize your finances and spending to make managing your money easier?

The answer is yes. There are certainly things you can be doing to improve your relationship with your money. Setting yourself up for success isn’t as hard as it might seem. Today, we’re going to discuss five ways for improving your relationship with your finances.

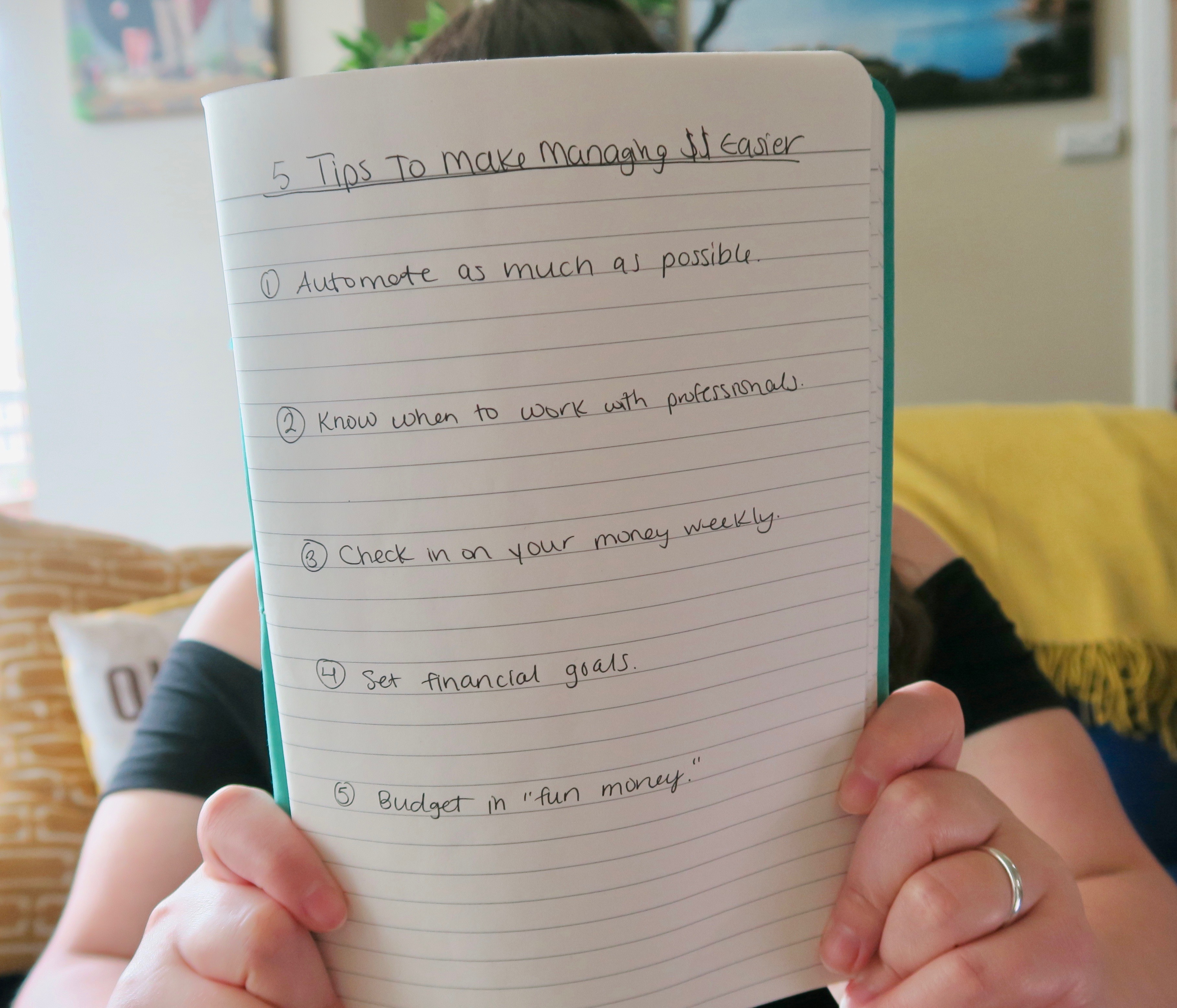

5 Top Tips To Make Managing Your Money Easier

1. Automate as much as possible.

Automating different aspects of your finances is a way to avoid sabotaging yourself. If your paycheck is direct deposited to your bank account and you have automatic transfers set up to your savings accounts, you can pay yourself first without even thinking about it!

If you can automate your other fixed monthly bills as well, that’s great! You’ll know your car payment and insurance payments are made before you can accidentally spend that money on something else. You can also consider automating a payment for your minimum monthly credit card balance so you never accidentally miss a payment and damage your credit.

I suggest marking these incoming and outgoing payments on your calendar so you know exactly when and where your money is going. For example, when my paycheck comes in on the first, I have all of my payments scheduled for the third. This way I know there is enough time for everything to clear. I check in on my accounts around the sixth just to make sure nothing was missed. This saves me a lot of time in have to manually schedule payments every month. Automating your payments will give you peace of mind and save you so much time every month.

Do be mindful, though, that some subscription services may take advantage of this. Many companies with a monthly recurring fee (usually lower in the $10-20 range) will automatically charge you. Review your credit card or bank statement to make sure you are actually using all of these services! There is no point in continuing to pay for them if you do not use them.

2. Know when to work with professionals.

While we can pursue financial education to make us more money-savvy there are sometimes things we just can’t handle by ourselves. It’s a sign of maturity and a growth-mindset to seek help when you need it.

You’ll know when to reach out when you can’t accomplish something on your own. Another sign is that you can’t easily find an accurate answer to your financial questions. For example, say in your annual review of your credit report, you’ve discovered a slew of inaccurate items on your credit report. If this is the case, I recommend contacting the credit repair professionals at Lexington Law for a consultation. With intimate knowledge of your credit rights as a consumer, they advocate on your behalf and work on a game plan to resolve inaccurate items.

Another example is in the case of identity theft. Having your identity stolen leaves you feeling vulnerable. I know because it happened to me in high school. Luckily, I was able to resolve the situation quickly, however, if this happened to me now, it could be far more devastating for my family. I always strongly recommend signing up for an identity monitoring service like Lex OnTrack for peace of mind. With notifications of changes on your credit report, your FICO score, credit score analysis, credit repair as needed, and $1,000,000 in identity insurance, that peace of mind is priceless.

Working with professionals also means seeking additional help when you need it. Whether it’s with your taxes or bank account questions, there are plenty of resources available for your needs.

[click_to_tweet tweet=”5 Top Tips To Make Managing Your Money Easier” quote=”5 Top Tips To Make Managing Your Money Easier”]

3. Check in on your money weekly.

Most people have at least one bad money habit that can wreak havoc on their finances if they’re not careful. Most people don’t mean to have these habits but do have to actively work to make sure they don’t sabotage themselves. For example, one area people often overspend in is food and dining out. These costs can get expensive and add up very quickly! One way to combat this is meal planning. By planning out meals, prepping food early, and scheduling days to eat out, it makes it so much easier to not overspend on food.

When you check in on your money on weekly basis, you can keep yourself in line with your budget all month long. This way, if you have unexpected one-time expenses that arise throughout the month, you won’t go over budget because you’ll be able to self-correct by cutting back in other areas.

When it comes to spending, we’re often swayed by external factors. Everything from the media, to our emotions and stress, to our ingrained habits can cause us to get off course. If retail therapy is a way you tend to deal with stress or cope with a hard week, it might be a good idea to consider other stress-busting and not credit-ruining activities. There are plenty of other low-cost ways to reduce your stress levels. Checking in on your money on a weekly basis can help you identify these negative patterns and stay focused on your financial goals.

4. Set financial goals.

We here at GenTwenty are strong advocates for having goals. We believe that it’s key to have something to work towards on a regular basis. Not only does it give you a powerful sense of accomplishment and a confidence boost, but you have something to guide your actions. Having financial goals, and revisiting them often, keeps you on a stable financial path.

It’s important to recognize that your goals may change over time — and that’s okay! Maybe in the beginning of the year you’re saving up to go on a Mediterranean cruise this summer. Perhaps your goal is to get your credit score into the excellent range. By the time summer rolls around, you’ve gotten a promotion and you’re ready to max out your 401(k) and start investing. Maybe your goal for this year is to pay off the last $10k of your student loan debt and nothing is going to stop you! Whatever your primary and secondary goals for your twenties are, make sure your money is working towards achieving them!

If you’re not currently working towards any financial goals, why not? What is keeping you from being in intentional with your money? Many times, it’s fear that causes us to self-sabotage. We’re afraid we can’t reach a goal, will fail, or will not know what to do once we achieve it. However, reaching goals gives us confidence. Consider where you want to be in life five or ten years from now. What will it take to get there? That’s an excellent exercise to start determining what your financial goals should be!

5. Give yourself some “fun money” in your budget.

I’m going to let you in on a little secret: You don’t always have to be incredibly strict with your money! Having financial goals is the way to manage your money and ensure you stay on track. BUT a crucial part of that is letting yourself live a little! After you’re paid all of your bills and moved money to savings, leave yourself a small part of your budget (somewhere around 2-4% or so) just for treats.

Your money is a tool to give you a better life. It’s a tool to ensure security for you and your family. And it’s a tool to live in your dream house or take a dream trip. It’s a tool to ensure you can retire and be taken care of. Life should be enjoyed, and it’s okay to treat yourself for that enjoyment.

Your fun money might be spent on a night out with your family. It could be a day trip with your niece to a nearby museum. You might spend it on a luxury foundation or a new outfit that makes you feel like a million bucks. Treating ourselves to something nice is a way to be nice to ourselves. It’s a way of telling yourself that you’re worth the extra effort.

And there we have it – five tops to make managing your money easier. Let me know in the comments – are any of these tips new to you? How do you make managing your money easier? I’d love to know!