This post is sponsored by Lexington Law.

In the past year, I’ve used up just over $4,000 worth of beauty-related products. My total includes different skincare, hair care, body care, and beauty products that have all found their way into my bathroom over the past few years.

Rewinding to a year ago, I decided to start tracking the retail value of the products I was using up after I realized how many products I was putting into the recycling that month. It actually ended up being over $570 worth of product when I added it up! (I’ve put screenshots from my spread sheet below so you can see exactly what I finished using.)

Where All Of This Product Came From

Before we dive into the numbers, I want to first say that I added these up by the retail value, not the price I paid necessarily.

I rarely pay full price for a beauty product. Most of the time I try to catch things on sale. And if I can’t, I try to make sure I’m at least getting something else back for it like cash back or additional points when I make the purchase.

Also, some of these products came in subscription boxes. I do get quite a few different boxes because I review boxes on GenTwenty. Additionally, some of these products were also gifts from friends and family from holidays and birthdays. So keep in mind that while the retail value may be high, it doesn’t necessarily reflect the price I paid to acquire these items.

I also want to point out that I’m tracking these products from when I finished them, not when I opened them and started using them. I finished up all of these products in within a year on the calendar, but some of them I started using awhile before. That is to say that products I finished each month weren’t used up from start to finish in a month’s time. The majority of them lasted me significantly longer than that.

My Spreadsheet and Empties Values

Here are the screenshots from my spreadsheet of what I used up within the course of the past year and some notes from each month:

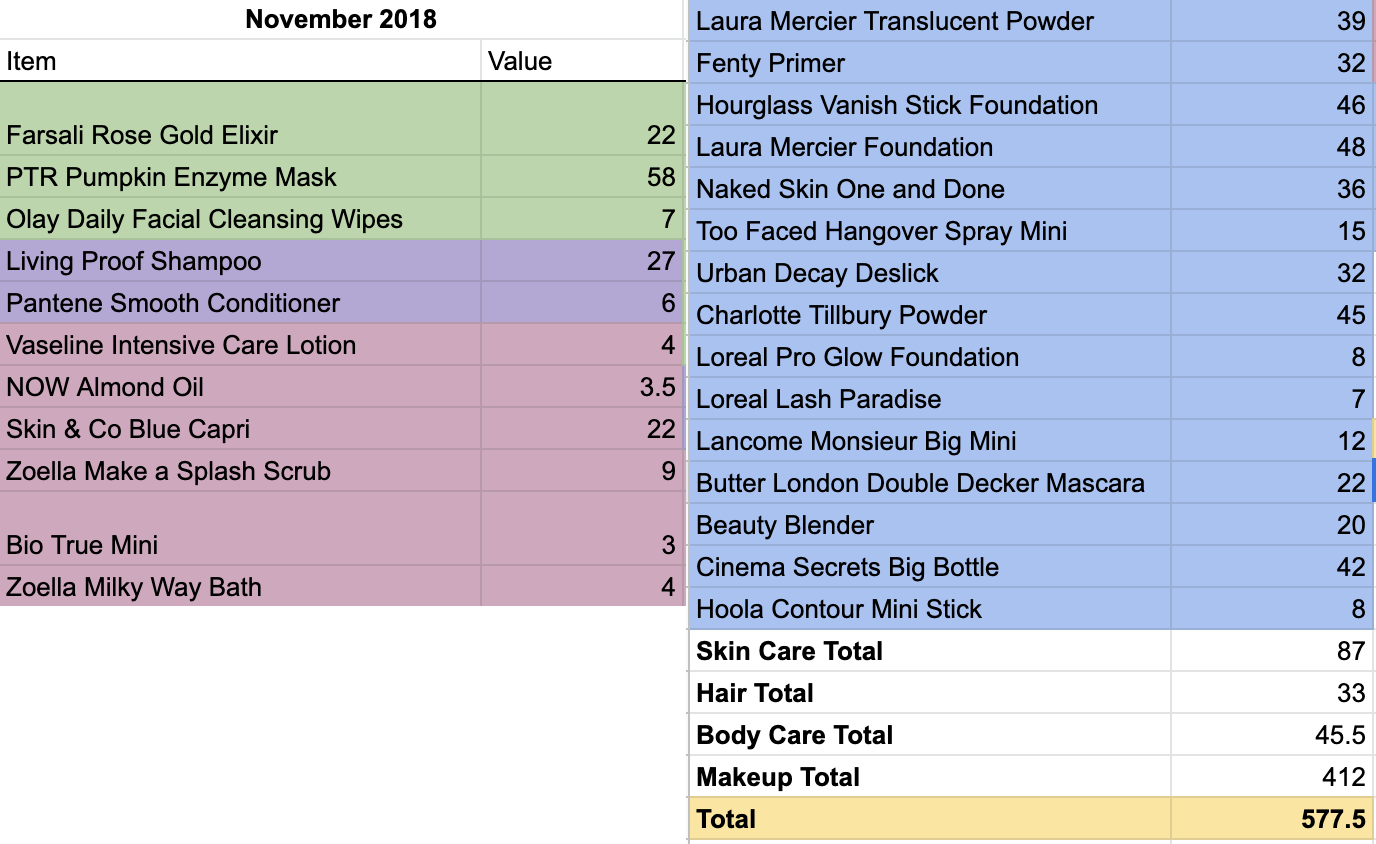

November 2018

Of these products, I purchased 23 of them. The other three came in subscription box or by another means. My total in November 2018 was $577.50.

This is the month that inspired me to start tracking how much product I was using up. As you can see, I finished up over $400 worth of makeup products alone. That is quite a significant number in my opinion!

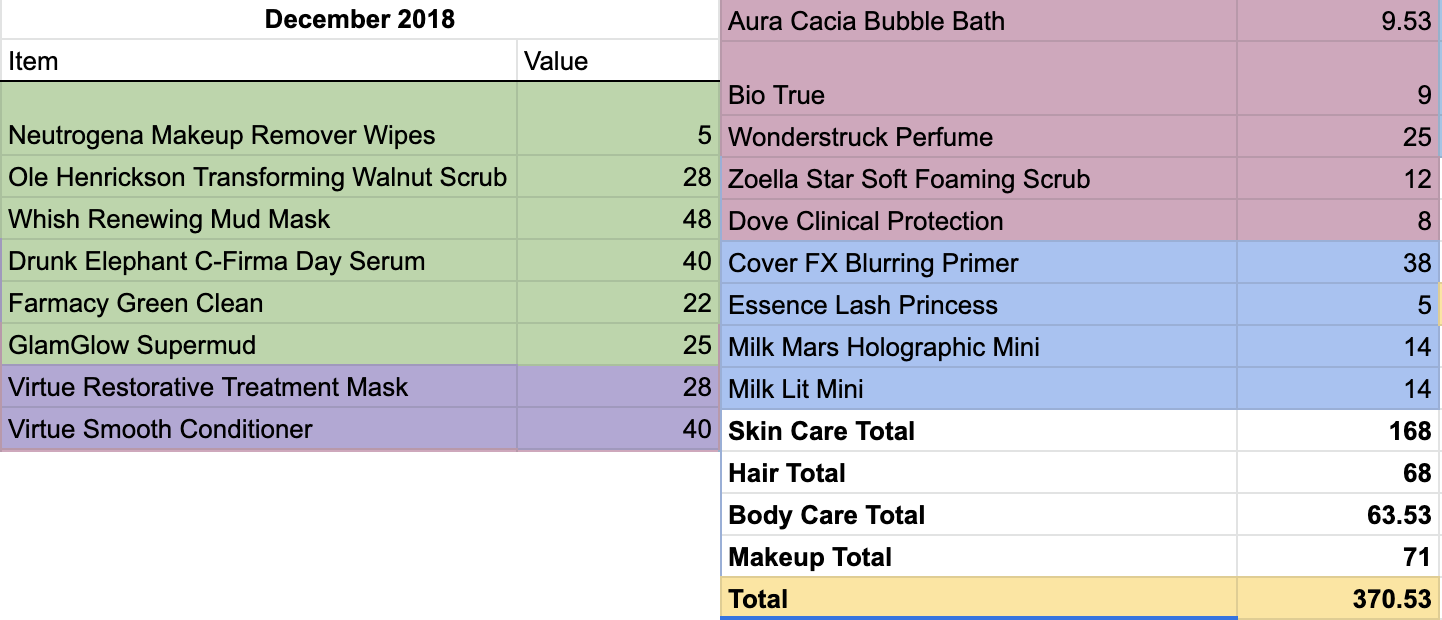

December 2018

This month, of the 17 products I used up, 11 of the products I purchased my self and 6 of the products came to me another way (including subscription boxes and through PR). This month, I used up a total of $370.53 worth of product.

This month had a couple of high-value products in the skincare and haircare categories. I used up very little makeup this month and only one of those was a higher value item.

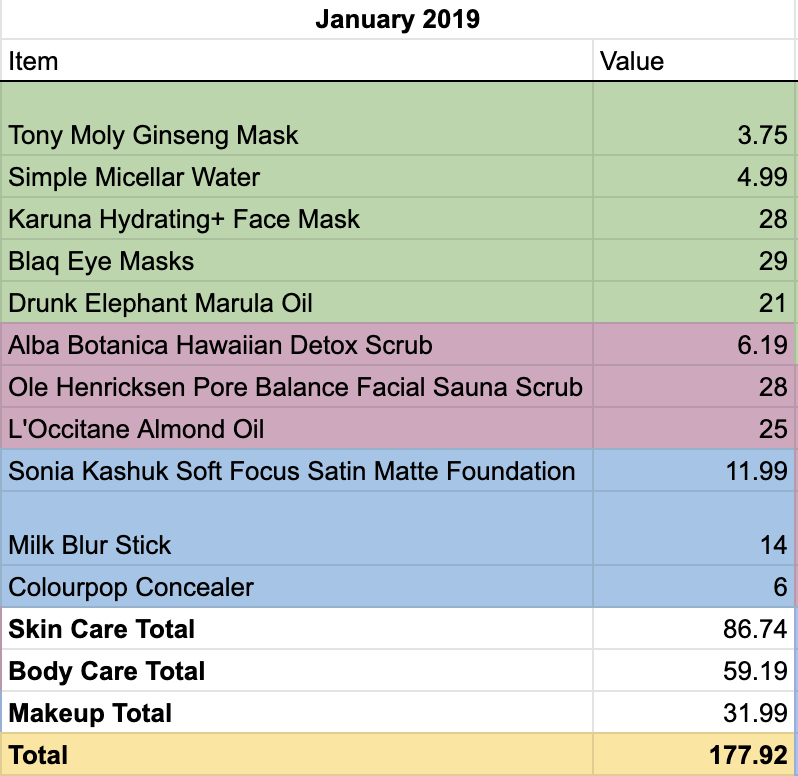

January 2019

Of the 11 products I used up this month, 8 of them I purchased myself and 3 came to me through other means. This is the month my son was born so there was a bit of slow down in the products I was able to get through. In January 2019, I used up $177.92 worth of product.

Using up a few products in the $20-$30 range helped me get the total higher but otherwise I didn’t use up many products this month.

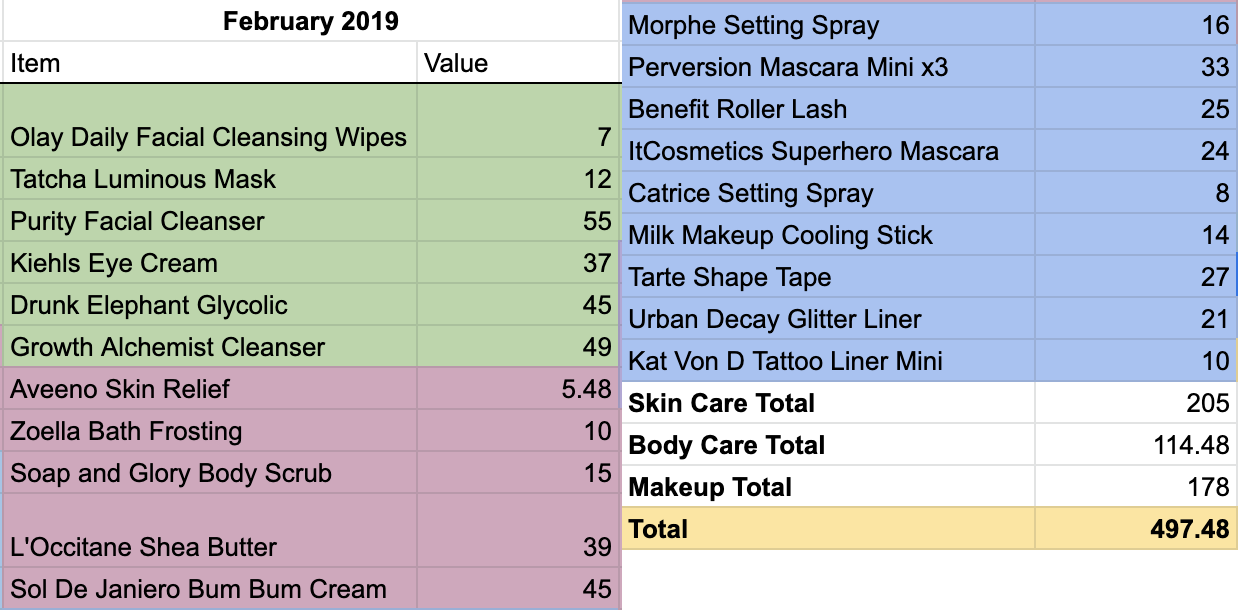

February 2019

This month, I used up 22 products. Twenty of them I purchased myself and the other two came in a

There were some high value items this month, mostly in the skin and body care categories. I did use up some staple makeup products like mascara, concealer, and setting spray that tend to run out much faster than other things for me like eyeliner or eyeshadow.

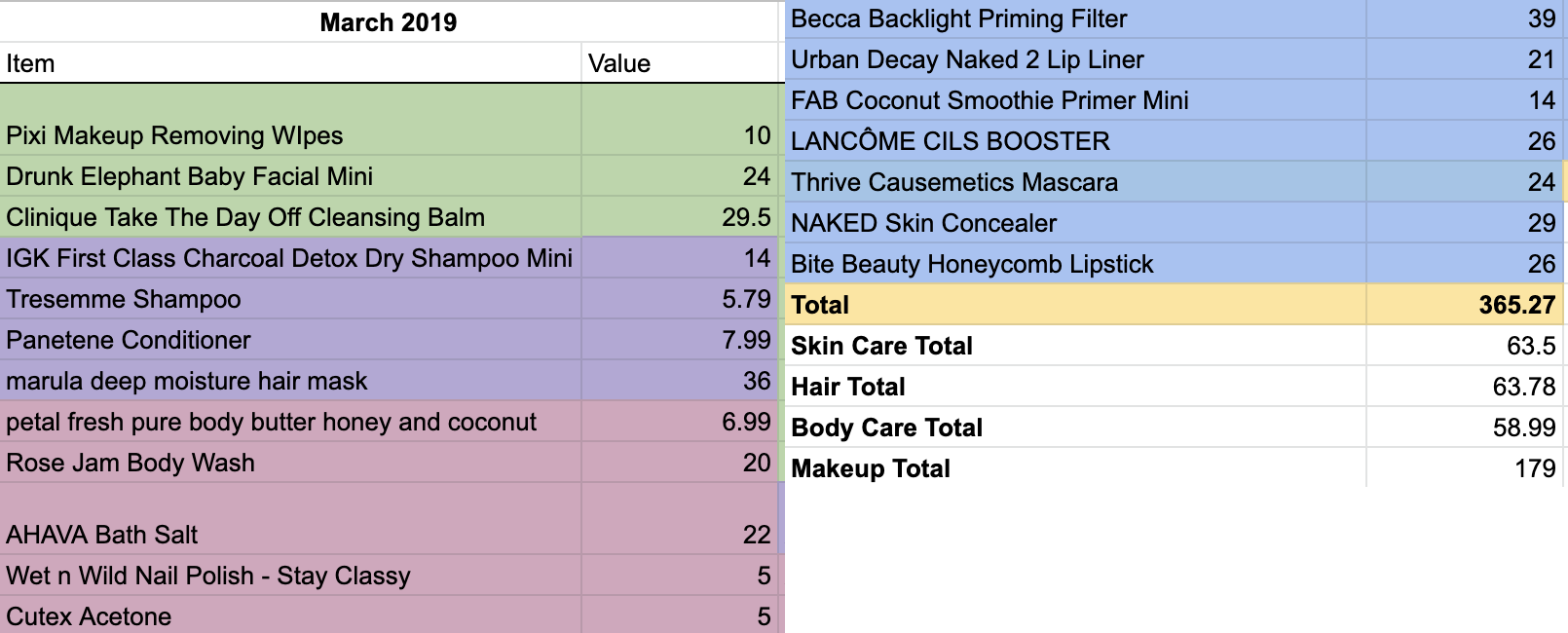

March 2019

Of the 19 products I used up this month, I purchased 15 of them myself. My total for this month was $365.27 — $179 of which was makeup. This month was also heavy on staple products including primer, mascara, lipstick, and concealer.

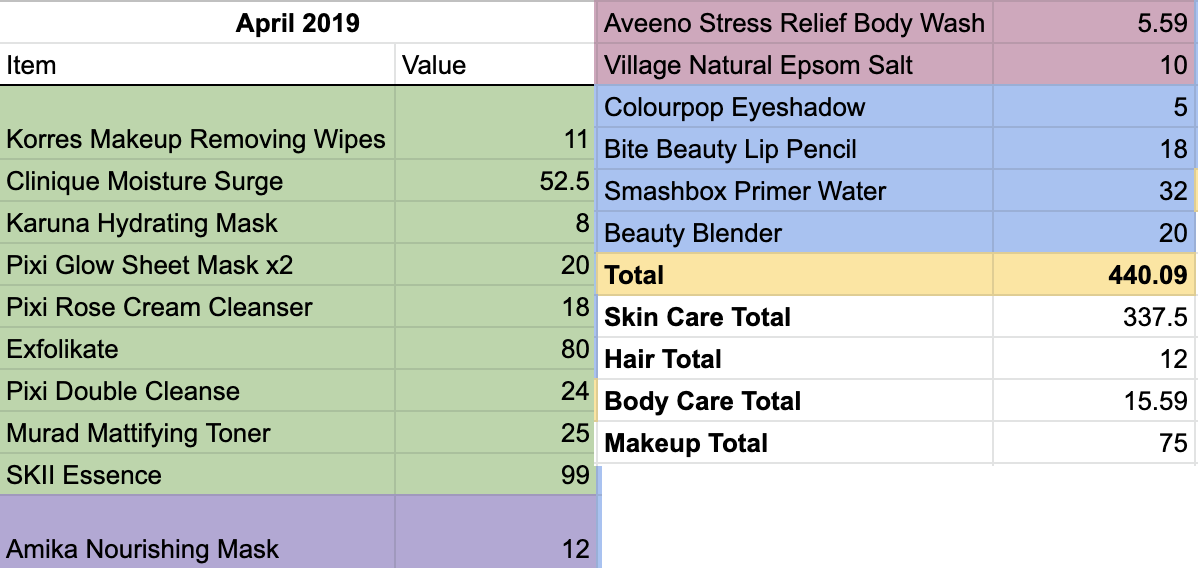

April 2019

This month I used up 16 products total. It was heavy in the skincare section this time. This month, only 8 of the products were something I bought myself.

Using up some more expensive skincare really helped the numerical value of the products I finished up this month.

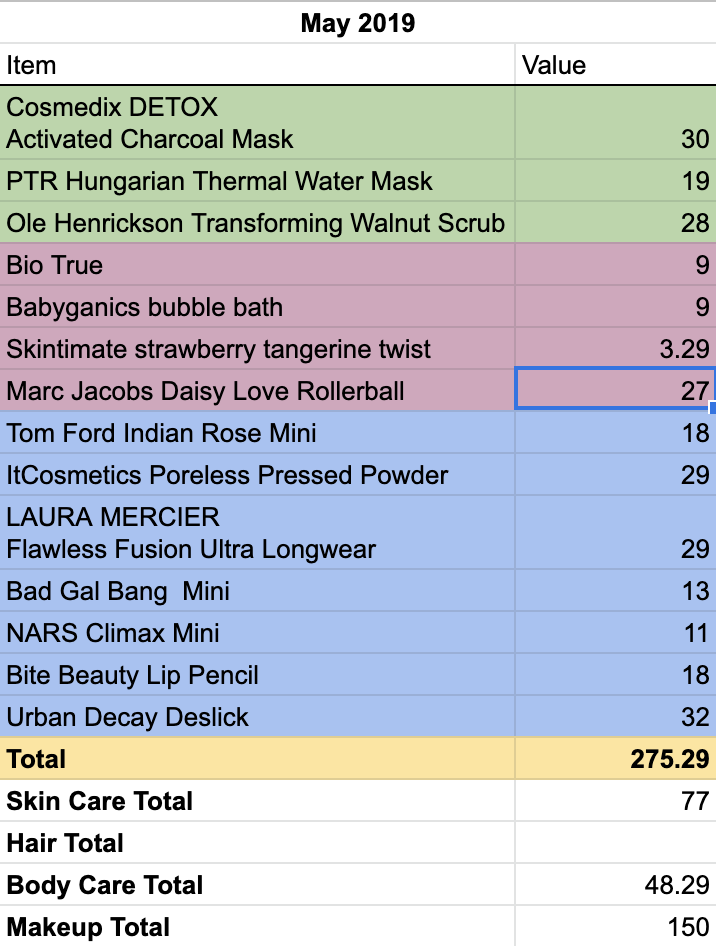

May 2019

This month I used up 14 total products and only one of them is something I didn’t purchase myself. This was also a lower value month at $275.29 total worth of products used up. The majority of that this month was from makeup products, including many staple workhorse products like mascara, setting spray, and concealer.

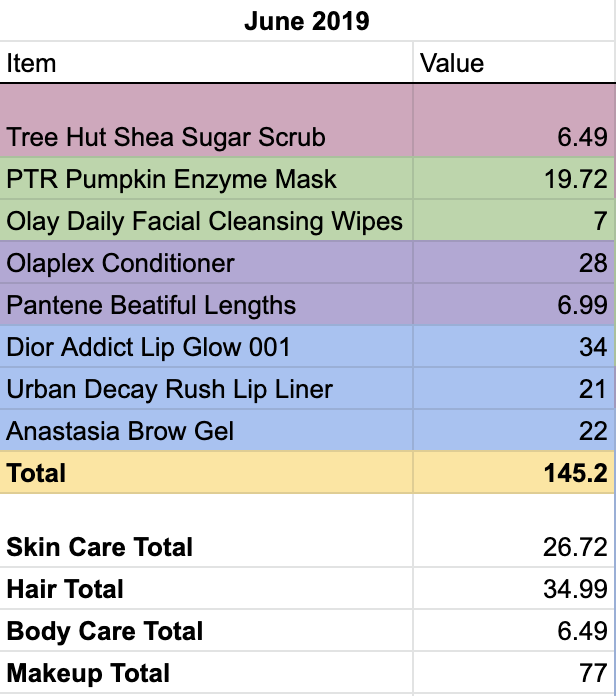

June 2019

This was my smallest month in terms of products used up (only 8) and in total value. The month came in at $145.20 with $77 of that being makeup.

I’m not sure why this was the smallest month in terms of products finished. I did have mastitis this month which had me feeling all kinds of terrible for most of the month so in retrospect, it’s likely I just didn’t feel up to using things as much.

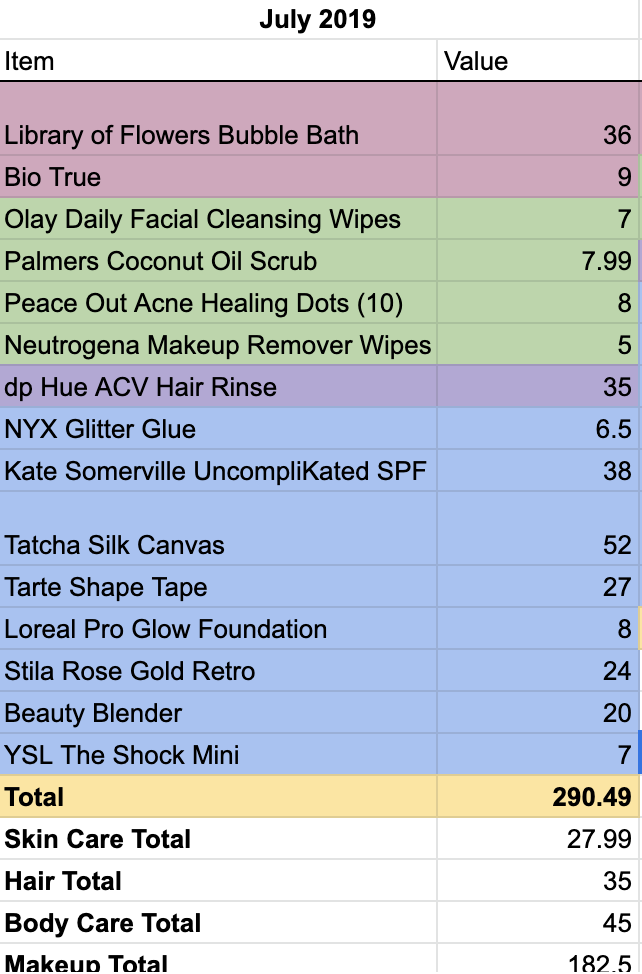

July 2019

In July 2019, I finished off 15 total products. Of those, I personally purchased 12 of them. My highest type of product used again was makeup.

This month doesn’t have anything too notable about it in my opinion. It was a mid-range value month coming in at $290.49. There were a couple of higher-value items but most of them were fairly lower cost staple products that I use frequently.

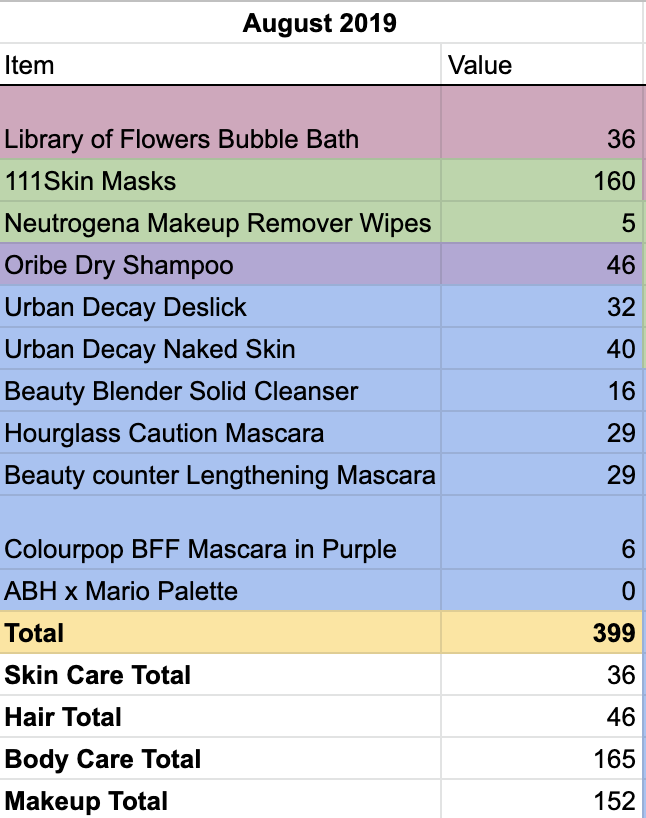

August 2019

My total this month was $399. A huge portion of this was a set of face masks that came in a

Of the 11* products I used up this month, I personally bought 7 of them.

*This month I noted that I “finished” an eyeshadow palette but didn’t count the value of it towards my total. I really debated on this because the formula of the palette has changed making it unusable. I hit pan on a couple of the shades but didn’t completely use up the entire palette. I personally feel like I got my money’s worth out of it but at the same time, I didn’t finished all of the product in it. So for the purposes of tracking for this project, I only counted things I completely used up.

September 2019

Here is the breakdown of the value amount of the different types of product I used up in September 2019:

| Skin Care Total | 26 |

| Hair Total | 0 |

| Body Care Total"}”>Body Care Total | 17 |

| Makeup Total | 193.5 |

Again this was a high value makeup month. I used up no hair products this month, which seems to be my least-used category. I used up 16 items this month, which seems fairly average.

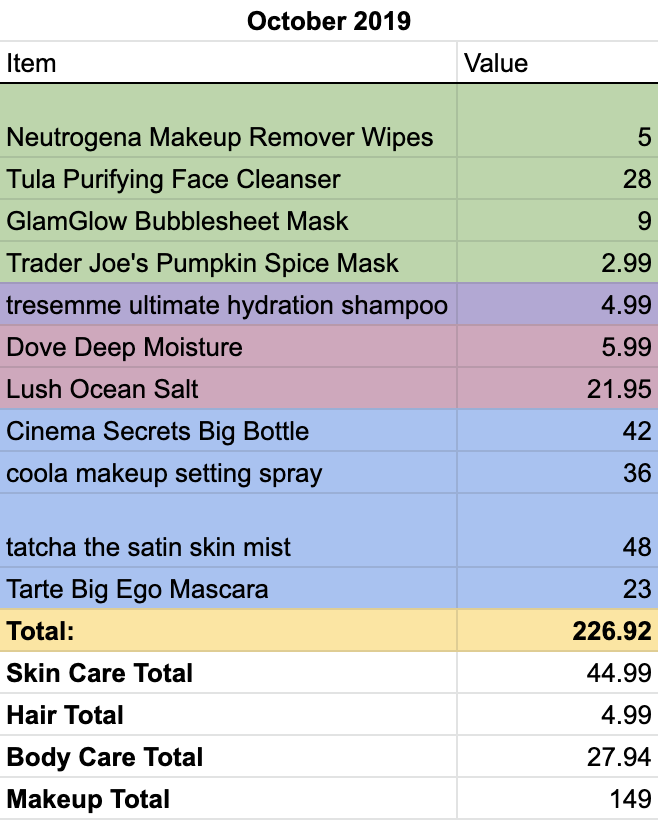

October 2019

In the final month of my year-long project, I used up 11 total items. My total for the month was $226.92, and the majority of that, as might be predictable at this point, came from makeup.

This month, only 5 of the items were things I purchased myself. The other 6 were gifts or came from subscription boxes.

My Thoughts On Using Up Over $4,000 Worth of Beauty Products

First of all, I have to say that $4,000 worth of product is quite a lot of product to use up. On average, I finished $333.51 worth of products each month. I finished up 183 items total for an average of 15.25 items per month.

Things I noticed about my habits during this project:

1. I consciously made myself use more because I was tracking it.

I think one of the reasons I was able to use up so much was because I was tracking it. Knowing that I would be adding up the value of products every month motivated me to use things like skincare and body care products when I normally might have skipped that step.

I usually wear makeup 5-6 days a week so I did go through a lot of staple products, but I do think I used more product than I would have otherwise. Because of the conscious effort to use up product, I went through products like foundation and mascara fairly quickly.

2. Some a lot products go off before I can use them up.

A few times this year I had to toss various products because they had gone bad before I could use them. Some products have a longer expiration date (like 2+ years) but some are shorter (closer to 6 months). In the future, I want to be more aware of the dates on these bottles and products. I’ve started marking on the back of each product when I bought/opened it so that I can remind myself I need to use it up.

This also made me ask myself a question: Do you only get your money’s worth if you use up a product completely? While I wasn’t able to get through some products before they expired, I felt as though I still got significant use out of them. And feeling like I got enough use out of them makes me feel like it was still worth buying the product.

3. I have an abundance of products (and you probably do too).

I don’t know if it’s because I receive a lot of products in subscription boxes or because I buy them, but it seems like products just accumulate all around me.

I recently donated over 250 items to Project Beauty Share and to family and I still have more product than I could ever reasonably get through in the next decade. Between giving these products away and using up 183 items, that’s at least 433 items I removed from my home in the past year…. and I still probably have at least 1.5x that to get through.

4. I’m probably going to keep tracking the value of what I finish up.

I quite like having these numbers to reflect on each month. Plus, I feel more motivated to actually use up things instead of just letting them sit there.

The Financial Implications

1. Products cost money. And often a lot of it.

Like I said before, I didn’t pay full retail price for most of these items. I generally try to buy things on sale or with gift cards to reduce the cost of the items I’m purchasing. But it had me thinking — what would I have done with that $4,000 if I could have had the money instead of the products?

Four thousand dollars is quite a lot of money. In this article, I found that women spend an average of $15,000 on beauty products in their lifetimes. The same article from 2017 says that the beauty industry is worth 382 billion dollars globally. So no matter how much the “average” consumer is spending, crazy money is still being spent in the beauty industry.

2. Don’t let buying things send you into debt.

Americans have a lot of consumer debt. In 2018, the total consumer debt was $3.898 trillion. Yes, with a T. What’s more, credit card debt totals $1.02 trillion with 2 in 10 adults rolling over $2,500 or more a month in credit card debt. Consumer debt has been slowly increasing over time and the trend shows no signs of slowing down.

It’s really easy to get caught up in buying the hot new thing. There’s nothing wrong with it if you can afford it and aren’t sending yourself into debt, but if you’re struggling financially and using buying things as a way to cope emotionally, there’s a deeper issue to look at here.

Having high amounts of debt can impact your credit utilization ratio which makes up 30% of your FICO credit score. Constantly spending ourselves into debt is hurting our future selves and our credit scores. Having excellent credit helps us build a financial foundation we can rely on down the road. This in turn, gives us more choices and options to access what we want in life. And that is so powerful. Credit is a tool that can help us buy a house, rent where we want, buy a car, have our dream job, and even enlist in the military.

There are ways to improve your credit and you can start taking steps towards that today.

If you do find yourself in a tough situation with your credit, I recommend contacting the credit repair consultants at Lexington Law. You likely have options and taking steps to repair your credit now will benefit you in the future.

3. Prevent yourself from overspending.

Overspending is a huge budgeting problem that many of us face. It’s easy to be tempted and sucked in by things we just don’t need. Meanwhile, things we have are off going bad or left forgotten about in our cabinets or hidden in dark corners.

To help prevent overspending, here are some things you can do:

- Challenge yourself to use stuff up. Like I did this past year, challenge yourself to use up as much product as possible. You’ll save it from going bad but will also deter yourself from buying more things you just don’t need.

- Declutter. Get rid of things you no longer use or need! If things have gone bad, recycle them properly. If they’re still good, see if you can donate them or pass them along to a friend who can give it a second life.

- Give yourself a small budget for indulging. I’m not saying don’t ever buy something you enjoy. I’m definitely a proponent of value-based spending. Whether it makes sense for your “fun money” to be $50 a month or $500 a month, allow yourself that money for simple pleasures.

- Practice delayed gratification. Any time you find yourself itching to whip out your credit card and make a purchase, write down what it is you were going to buy instead. If you still want it after a week or two, consider going back for it. If not, consider the fact that you saved yourself some cash and move on!

It takes time to work on our overspending habits. Mostly because we need to hone in on why we’re overspending in the first place. A lot of times, it becomes an emotional crutch to help us make it through a tough day or deal with negative emotions.

All in all, I’m really proud of the amount of products I was able to use up this year. I feel like I really got my money’s worth and wasn’t just throwing away thousands of dollars. Doing this project has led me to think more deeply about my spending habits and how I plan to be more critical of my purchases in the future.

Would you take on a challenge like this? What do you think you would learn?