This post is in partnership with H&R Block. Get started on your taxes here!

One of my favorite topics is personal finance. I love to understand how people spend and save their money. And I also love to talk about financial goals! It’s important to me to always have short-term financial goals to strive for so that I know I’m working towards my long-term goals as well.

The end of one year and the start of a new year means it’s time for me to reflect on what I achieved the past year and what I’d like to do differently next year. To inspire you to set some financial goals — even if you think you might not achieve them now, I bet you’ll surprise yourself! — here are seven short-term financial goals to set going into next year.

7 Short-Term Financial Goals to Focus On In 2021

1. Start your taxes early.

Oh, taxes. The dreaded T word. For some reason, doing your taxes always feels like a never-ending to-do list looming over your head, right? They can seem unnecessarily exhausting for many of us. I think a lot of that comes from not knowing what to expect, not knowing exactly what to do, and rushing around to gather all the appropriate documents and information, right?

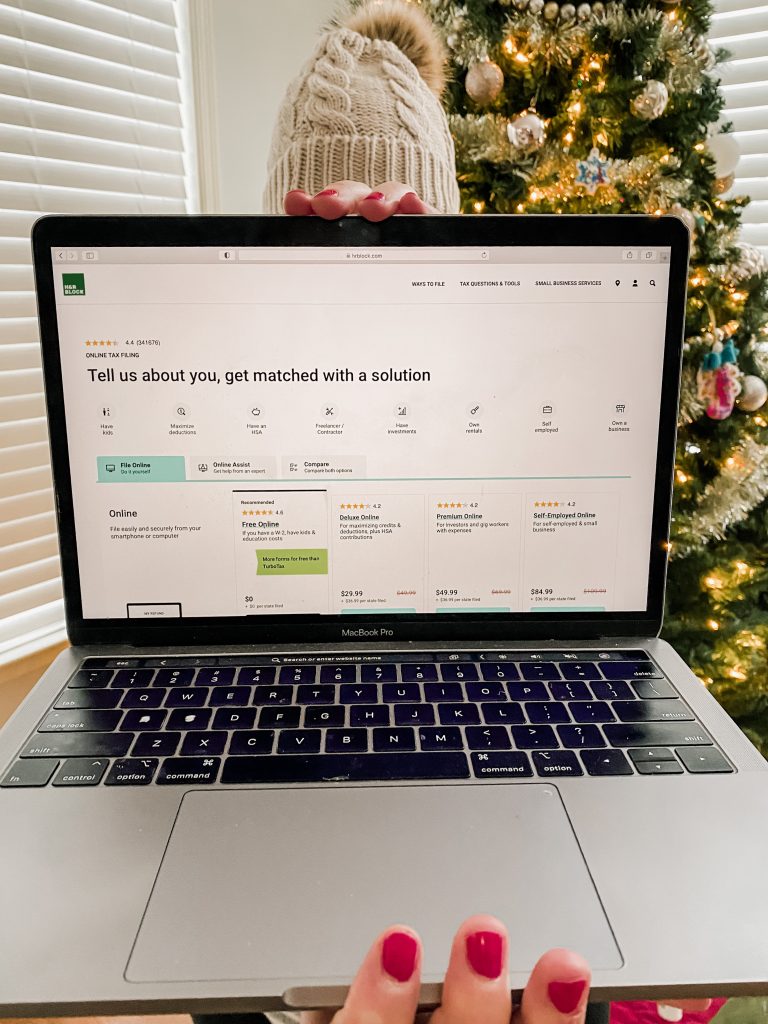

I love that H&R Block has completely simplified that process. They help direct you to the simplest filing solution for you and your family by asking you straightforward questions about finances:

From there, you have two primary options to pick from:

- File Online – the do it yourself option

- Online Assist – where you can get help from an expert

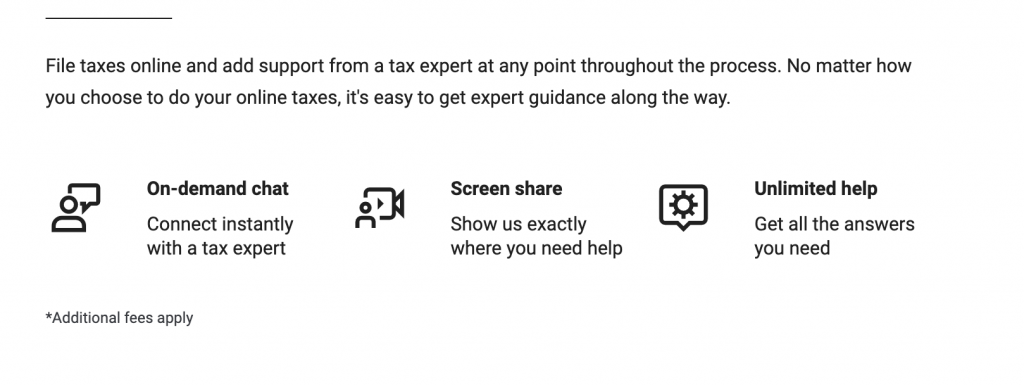

You can also get help from tax experts available via chat 24/7 and even share your screen with them to make it easy, no matter which option you choose:

Taxes can be overwhelming to even think about. Getting started early relieves so much stress from tax season. I used to wait until early April to file and I’d be such a mess! Now, I file as soon as I can — which is typically early January when I get all of my tax documents. I love having my taxes filed and finished. I highly recommend using H&R Block’s tools to file your taxes early this year!

Taxes can be overwhelming to even think about. Getting started early relieves so much stress from tax season. I used to wait until early April to file and I’d be such a mess! Now, I file as soon as I can — which is typically early January when I get all of my tax documents. I love having my taxes filed and finished. I highly recommend using H&R Block’s tools to file your taxes early this year!

2. Save $100/more a month than you did last year.

I love challenging myself to save more money. If you ask me in any given year, two of my biggest goals are probably to increase my income and save more money.

My husband and I go over our finances weekly so I am intimately aware of how much money we save every month. But there are other ways you could, at least loosely, figure this number out.

Looking at your savings accounts, how much did they increase in the past year? Then divide that number by 12 to get a loose amount that you saved every month. Then, add $100 to it, and you have your goal for this year!

Increasing your savings means you could pay off your debt faster, fill up an emergency fund, go on the vacation you’ve been dreaming of or save more for retirement. Saving your money is an investment in your future self.

3. Do a no-spend challenge to better understand your emotional spending.

Coming off the holidays, January always feels like a good month to implement a no-spend challenge. We’re basically inundated with sales and spending from early November to the end fo the year, so it’s a nice change of pace to not be bombarded with that messaging constantly.

A no-spend challenge is essentially avoiding excess spending for a set period of time. Usually these things fall in the “want” or “treat yourself” category of your budget. Basically, you’re committing to not buying anything you don’t expressly need.

For example, say you usually budget yourself $100 for fun money every month. The month of the no-spend challenge, you’ll avoid spending those extra dollars and save them instead. I like doing this simply to cut down on the things that I bring into my home but it also helps me curb my spending.

Especially after a year that has been particularly challenging with mental health, I often found myself buying things out of convenience, boredom, sadness, or even happiness. Knowing that I had packages on the way was like a surprise from my past self. It almost didn’t even matter what it was! Having a package arrive at your door is something to look forward to.

Buying from our emotions isn’t really a healthy coping mechanism, though. It doesn’t actually solve our emotional woes. The end result is usually less money in our bank accounts and more junk in our homes.

Stopping yourself from buying things is the first step in a no-spend challenge. The second is understanding why you’re buying what you’re buying.

I’ll be doing a no-spend challenge this January — will you join me?

4. Boost your emergency fund by $1,000.

I’m a huge fan of having an emergency fund. Emergency funds are just that: for emergencies. It’s reassuring to know that should an unexpected expense pop up that you can cover it with funds in your bank account instead of having to rely on a line of credit.

Emergency expenses happen to everyone. I’ve had to purchase last minute plane tickets which could have potentially set me back a month or two if I didn’t have an emergency savings account.

The general rule of thumb is to keep three to six months worth of expenses in your emergency fund.

For these expenses, you need to make sure you are saving enough to cover everything you have to pay for. All of your fixed and variable expenses should be covered. In my opinion, if it is really an emergency (like a job loss and subsequent loss of income) and you won’t be including discretionary spending. Your emergency fund will cover your rent or mortgage, and insurance payments, car payment, utilities (water, electricity, etc.), internet or cable, plus your groceries, gas budget, and a buffer of 5-10 percent to be safe. Your expenses might vary a bit from this list — it’s not all-inclusive! Consult your own budget to figure out where you stand.

To figure this out, take the expenses number from your budget and add five to ten percent.

For example, say your expenses are $2,500. Multiple 2500 by .05 to get your additional five percent. Double that to get your ten percent number. So 2500 x .05 = 125. So your expenses plus five percent is $2,625. Your expenses plus ten percent is $2,750. That is your savings target!

No matter where your emergency fund is, make it a short-term financial goal to boost your emergency fund by $1,000. You can read more here about how to save money in short period of time.

5. Pay off at least one debt.

If you have debt, you’re not alone. Many people have debt of some sort. Whether it’s student loans, credit card debt, a mortgage — most of us have something we want to pay off.

If you’re having trouble choosing what debt to pay off, my suggestion is to start with a debt that has a high interest rate. This is often a student loan or a credit card debt. These high interest debts mean you’re paying a significant premium in interest. Basically, the lender is making a lot of money off of you while they hold your debt.

If you don’t have any debt other than a car payment or a mortgage payment, try to make at least one extra payment per year! Some lenders allow you to add an additional percentage towards the principle each month with the click of a button through their online payment system. Otherwise, divide your monthly payment by 12 to get how much you need to pay in addition to your regular payment each month to get that payment in!

6. Lower at least one monthly fixed expense.

One of my budgeting rules is to keep fixed expenses as low as possible. This has served me well over time while I paid off debt, built my emergency fund, and bought my house. Having low monthly expenses means you are spending as little as possible on what you absolutely have to pay each month. This typically leaves more room in your budget for saving, investing, and spending.

Negotiating a fixed expense is generally pretty straightforward. Here are some examples of things you can negotiate:

- internet/TV bill

- car payment

- insurance (car, house, etc.)

- cell phone

Next, compare what you currently pay to plans from other providers. Do they offer a better deal on the exact same service? That’s a great place to start with a negotiation! Companies want to keep you as a customer so more often than not they’re willing to work with you on the price of the service!

For example, we recently were able to cut our car insurance bill in half and I’ve helped a friend save hundreds of dollars per month on car insurance just be comparing prices.

Finally, either call the customer service line or chat with them via a chat box on their website and come to the table with your research. Getting anything off of your monthly bill is something I would consider a win!

7. Open a high-yield savings account.

A high-yield savings account is a place you should keep money you need to access or might need to access (like your emergency fund) quickly. But instead of paying the average rate of 0.08 percent annual percentage yield (APY) like most regular savings accounts offer, high-yield savings accounts pay up to .5, .6, and even .7 percent APY.

This means your money grows faster and you can reach your goal more quickly! Now it’s not going to be hundreds of dollars per month, but having your money in a high-yield savings account will help it do more for you than if it was in a regular account. Here is a list of high-yield savings accounts to look into.

Reaching Your Short-Term Financial Goals

Whether you decide to focus on one of these, like paying your taxes early, or multiple, know that these goals are achievable when you make a plan!

Start by giving yourself a deadline to reach them. Then work backwards on what you need to do weekly or even daily to help reach that goal on your time.