This post is sponsored by Lexington Law.

Military life has its ups, downs, and uncertainties. Despite the emotional and physical challenges, military life also presents some unique financial challenges that can have serious effects on families through moves and deployments.

To help get ahead of these financial challenges and cope with them efficiently, here are 10 tips for those in the military. If you know someone who is serving or plans to enlist, send this post to them!

10 Financial Tips For Those In The Military

1. Check your credit report before a deployment.

Checking your credit report should be something you’re doing at least once a year anyway. But if you’re in the military, one of the most efficient times to do it is before a deployment because you’ll be away for an extended period of time. I suggest starting this process three to four months ahead of time. This way you give yourself ample time to review the documents and take appropriate action steps if need be.

You can get a free copy of your credit report from annualcreditreport.com. Once you’ve downloaded it, review it line by line. Do you recognize every item? Is everything correct? You’re specifically looking for any unfair negative items or inaccuracies.

If you find any inaccuracies or unfair negative items on your credit report, now is the time to take action. I recommend reaching out to the credit repair professionals at Lexington Law for a free consultation. You can read more here about how the credit repair process with Lexington Law works.

2. Keep all of your sensitive documents secured in a document safe.

While this is good advice for anyone, it’s especially helpful if you are moving frequently, spend long periods away from your home, or need to get organized.

Keeping your sensitive documents like your birth certificate, tax documents, your social security card, anything with your social security number, etc. locked in a fireproof safe is a step that helps ensure they are protected under lock and key.

Plus, you will know where to find these documents if you were to need them.

3. Shred all unneeded documents with sensitive information.

Members of the military are particularly vulnerable to identity theft because they move around frequently and are away from the home for long periods of time. Not to mention that many documents are passed around and potentially left in different places for anyone to pick up and walk away with.

A good tip is to keep track of how many copies you made of something and who you gave them to. You can do this easily in your document safe by organizing documents by type and writing the number of copies on the folder you put them in. When you take one out, just write down what you did with it.

If you have documents you no longer need, like an old lease, old tax documents, or outdated banking information, take care to shred them and not just throw them away. Throwing away documents with sensitive information on them opens you up to identity theft because someone could go through the trash and walk away with them to use your information for nefarious purposes.

Before shredding your documents, black out all sensitive information with a permanent marker. This includes your social security number, names, addresses, or account numbers. The n shred them in a paper shredder or even considering burning them if that is an option available to you.

4. Put an Active Duty Alert on your credit report.

To put an Active Duty Alert for your credit report, you’ll need to contact one of the three credit bureaus. After that, the bureau you contacted will contact the remaining bureaus on your behalf.

According to Experian:

An Active Duty Alert remains on the report for one year. It notifies creditors that you are a member of the U.S. military and that you are currently on active duty. An Active Duty Alert does not require a lender to contact you directly to get your approval before granting credit in your name, but it does ask them to verify the identity of the applicant first. If you choose, you can add a telephone number where you can be reached to the alert.

An Active Duty Alert requires lenders to apply certain procedures and policies to verify your identity before issuing a line of credit. This helps to prevent fraudulent accounts being opened in your name and adds an extra layer of protection against identity theft when you’re vulnerable abroad.

5. Consider a Power of Attorney (POA) for while you are deployed.

Our friends at Lexington Law say,

While you are away, you will have more peace of mind if you know that a trustworthy friend or family member can handle any financial issues for you, especially those that could have an impact on your credit score.

Also remember that POAs may include limits on the scope of what your appointed person can and cannot do on your behalf. These legal appointments can also be set for specific amounts of time. This way you are not giving someone more power than you trust them to have.

And make sure you leave them with the information they need to act on your behalf, such as account numbers and login information. Leave them with instructions on how to properly dispose of this sensitive information when they no longer need it or how to protect it until you return.

6. Take advantage of a free credit freeze.

A credit freeze (sometimes called a security freeze) is another layer of protection against fraud and identity theft. When you place a freeze on your credit report, no one is able to access your report for any reason. The freeze can only be lifted using the PIN (personal identification number) given to you when the freeze is applied.

In order for any potential lenders (like a credit card provider, insurance company, cell phone company or even your employer for background checks) to gain access to your credit report, the freeze will need to be lifted.

To place a freeze on your Experian credit report, go to the Experian Freeze Center or call 1-888-EXPERIAN. There is more information here on placing a security freeze.

7. Set up mail monitoring.

Monitoring your mail can be a helpful step to not only know what mail is coming your way and needs to be looked out for but it can also be beneficial if you need to hold your mail.

I use USPS Informed Delivery for a daily email update about what mail is scheduled to be delivered each day. FedEx also has a delivery manager service and UPS has UPS My Choice as a similar service.

8. Opt out of junk mail.

Having mail piling up can let people know that you’re not home. And some of those junk mail offers often contain personal information like special invitation codes or blank checks that leave you open to identity theft.

You can opt our of junk mail by going to optoutprescreen.com. You can also go to your banking websites and look for options that are “green” and send emails only versus paper mail. Some institutions might still send you mail but hopefully taking this step will help reduce the volume of mail you receive, especially if you are deployed.

9. Monitor your identity.

This is an important thing for anyone to do, in my opinion, but especially important for members of the military.

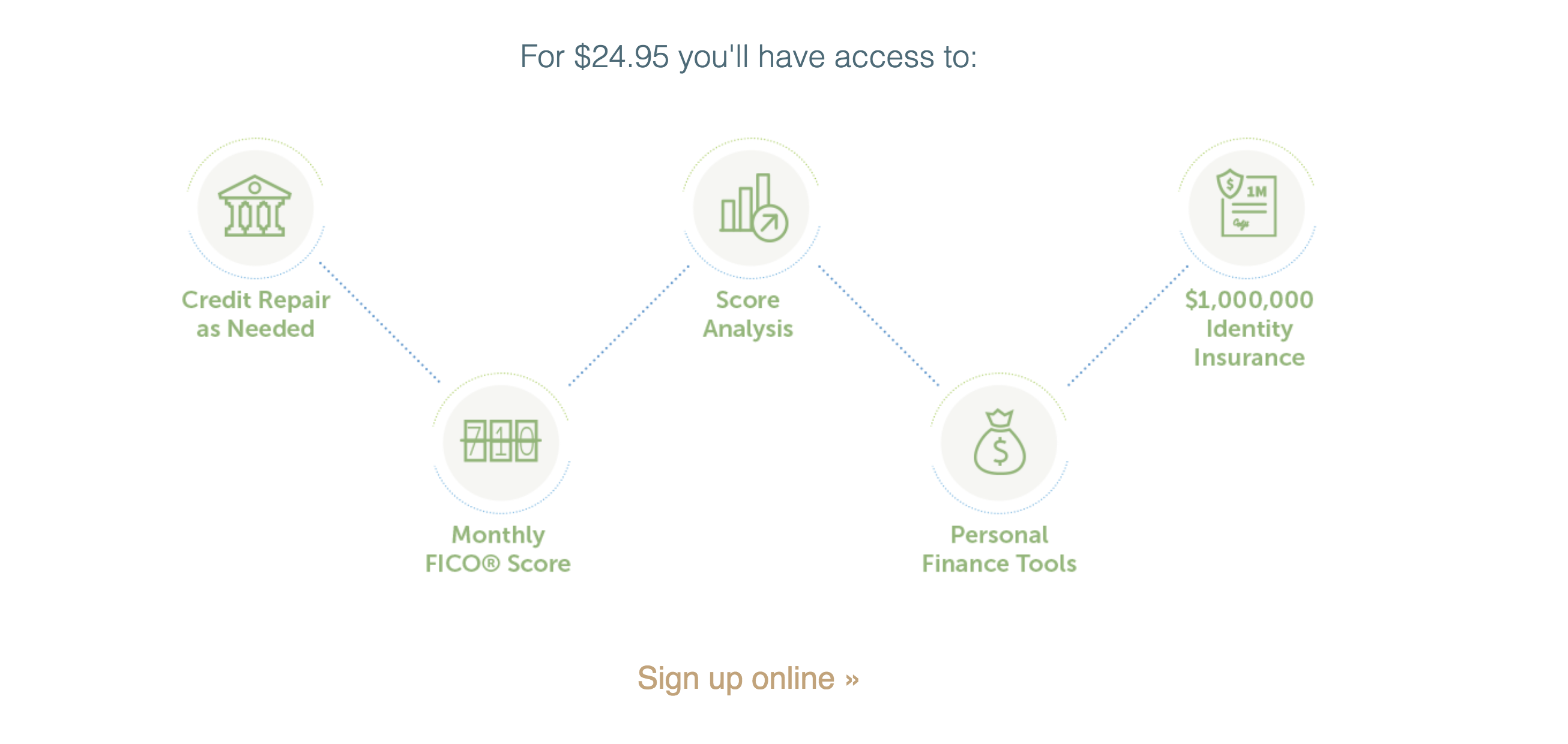

I highly recommend signing up for an identity monitoring service like Lex OnTrack. Lex OnTrack will notify you of changes to your credit report, give you your FICO® Score, provide a credit score analysis, offers basic credit repair, and includes $1,000,000 in identity insurance. It gives peace of mind to know that you have this available to you just in case something happens like having your identity stolen. Learn more about Lex OnTrack here.

Related: Lex OnTrack Review: Why You Should Monitor Your Credit

10. Set up auto-pay for your bills.

With a variable schedule and location, it’s easy to miss payment dates. Missing payments can too easily go unnoticed until they have impacted your credit score.

Make sure you have auto-pay set up for as many bills as you can. It might not be possible for some things if they payments aren’t able to be made online, for example. Do your best to make other payment arrangements in those cases. For example, see if you can pay in cash for six months in advance. But make sure you get a receipt so you have a paper trail of your payment!

While military life has unique financial challenges, there are certainly steps you can take to make managing your finances easier. If you’re in the military, do you have any other financial tips to share? Leave them in the comments!