This is a sponsored conversation written by me on behalf of SunTrust. The opinions and text are all mine.

With the holidays just around the corner, we’re all starting to feel extra generous, sometimes more than our budgets will allow.

It’s easy to get carried away with gift giving around the holidays. The look on someone’s face when they open up the perfect gift is thrilling, but is it worth the financial crisis many of us go through around this time of year?

SunTrust wants us all to move onUp — going from financial stress to financial confidence by focusing on the moments that really matter this time of year.

Here are four tips for keeping your spending in check this holiday season:

1. Plan your budget ahead of time and stick to it.

When it comes to the holidays, many of us tend to spend more than our budgets will allow. There’s just something about the holiday spirit that makes us want to be overly generous when it comes to gift-giving with our friends and family.

On that note, it’s a good idea to map out your gift purchases and projected budget ahead of time so you can know where you stand through the holidays. Unexpected expenses tend to arise, so don’t forget to factor in things like shipping costs, gift wrapping, and gas.

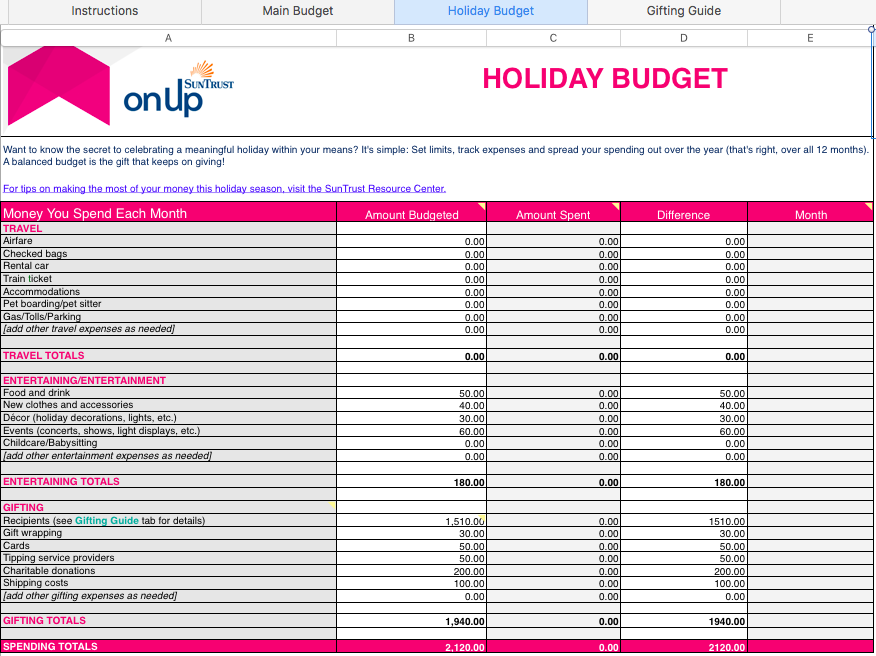

To make it easy, SunTrust has created a holiday budget spreadsheet for your use. With this tool, you can be less stressed about the money that you’re spending during the holidays (and in turn feel financially confident!) while still treating your loved ones.

I used the spreadsheet to map out this year’s expenses. My husband and I aren’t traveling for the holidays this year so we can focus the majority of our budget on gifts and giving.

I haven’t started my holiday shopping just yet, but here is a look at my projected spending for this year:

I overestimated a bit on each category with the hopes that I will be under budget at the end of the holidays. This is also factoring in a 10% charitable donation of my total holiday spending.

2. Plan your purchases so you can catch items on sale.

If you start mapping out who you are purchasing gifts for and what you want to buy for them, you can begin to look for sales, coupons, and deals that will help you save extra money when buying gifts.

You can use the “Gifting Guide” tab in the budget spreadsheet to plan your purchases!

3. Consider your shipping options.

If your friends and family live far away it’s tempting to want to make them a special gift and package everything up in a box that you send yourself. Unfortunately, this can begin to get expensive, especially if you have things shipped to you first. Plus, with all of the holiday mail, you risk your package getting lost.

If at all possible, try to shop websites that offer free shipping. Even more, ship directly to the recipient as most online retailers allow you to select from a variety of gift options.

4. Project your spending for next year so you know how much you need to save each month.

Another excellent thing about this spreadsheet from SunTrust is that you can use it to project your holiday spending for next year. Once it’s all said and done, look at the total you spent on gifts for this year. Is it more or less than what you expected?

Take that number and divide it by 12 — that’s how much you’ll need to save each month to match this year’s holiday spending for next year. If you already have the money saved, you’ll be much less stressed next holiday season!

This year I’m really looking forward to spending quality time with my husband around the holidays, watching cozy movies, decorating, and drinking hot cocoa, as well as video chatting with my family as we celebrate with each other from across the country. It’s really those moments that matter the most.

At SunTrust Bank their purpose is lighting the way to financial well-being. When you feel confident about your money, you can save for your goals and spend knowingly on what matters most to you.

The onUp movement was created to guide millions of people one step at a time towards a more financially confident life without ever losing sight of the moments that matter along the way.

Join the growing number of people transforming their stress into positive motivation to move onUp.

Join the movement

This is a sponsored conversation written by me on behalf of SunTrust. The opinions and text are all mine.