This is a sponsored conversation written by me on behalf of SunTrust. The opinions and text are all mine.

Now that the holidays are over and a new year is here, it’s the perfect time to evaluate our spending habits and goals to put our money in the right places.

One of my financial goals last year was to set aside money in a separate savings account specifically for holiday gifts. In previous years, gift giving made the holidays so stressful. Come December, my budget would be stretched so thin that it would be impossible to start the next year out on the right foot. This year, I decided to change that:

Setting aside $$$ for Christmas presents every month has made such a difference. I haven’t felt stressed at all and I got to spoil my people

— Nicole Booz (@nicolebooz) December 21, 2016

I’m proud to say that I stuck to my savings plan and my holiday budget. As a result, the holidays this year were stress-free. I got to spend time relaxing with Christmas movies, doing holiday baking, and Skyping with long-distance friends and family. It was wonderful!

Since this worked so well, I’m going to be doing it again this year (and hopefully every year after, too). Money is a taboo topic for many, but SunTrust is working to change that with the #onUp movement encouraging us to gain confidence and knowledge to take control of our finances.

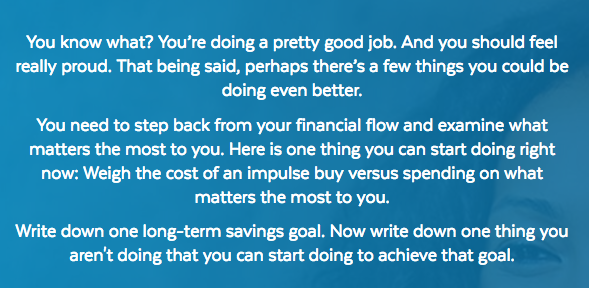

I recently took SunTrust’s Mental Wealth Quiz, answering as honestly as possible about my current spending habits and my long-term goals. Here is a screenshot of my results:

I personally feel this result was spot on for me. In general, I feel as though I manage my money well, but I need to avoid those impulse purchases. With these results, I can set my financial goals and resolutions for the coming year with this point in mind.

That said, here are my #onp Goals for 2017:

1. Increase my monthly savings amount for my house down payment.

One long-term savings goal I have is to save for a house. I don’t plan to buy one for another five to seven years so I have ample time to save for a hefty down payment.

While I have been saving for this goal, one thing I’m not doing that I could be doing to achieve that goal is to increase the amount I put towards this goal every year. As my income grows, I can easily adjust the amount I save towards this goal. This year, I want to increase the amount I am saving towards this goal by 25 percent.

If you have a similar goal, use the onUp savings calculator to calculate your savings plan.

2. Donate to charity regularly.

Because there are many causes I am passionate about, I don’t donate to one particular charity in a lump sum. I wait until my friends are fundraising or a charity is having and event or drive. Giving back to our communities and causes that matter to us makes such a difference in the world. This year, I want to donate a set amount to charities of my choice every month.

3. Spend more on experiences, spend less on things.

As noted in my quiz results, I need to spend money on what matters the most to me. Ultimately, that is travel and experiences that make my life so much richer. What is a house full of things if you’ve never seen the world with the people who matter to you?

4. Save 50 percent of my income for at least one month.

This is what I consider to be a savings challenge. Saving 50 percent of my income isn’t going to be easy — at all. Otherwise I would already be doing it! I need to push myself to do this to prove that I can and also to break my habit of impulse buying!

Would you be up for a 50 percent savings challenge? Budget for it here.

5. Move a set amount of money into a holiday-dedicated savings account each month.

Like I mentioned before, this was a goal that really worked for me last year. It made for a completely stress-free holiday season and I just know I need to do it again. Especially because we will most likely be traveling next holiday season so I can’t wait to buy gifts last minute!

Now that you know my goals for this year, I would love to know yours! What is it that you’re saving for?

At SunTrust Bank their purpose is lighting the way to financial well-being. When you feel confident about your money, you can save for your goals and spend knowingly on what matters most to you.

The onUp movement was created to guide millions of people one step at a time towards a more financially confident life without ever losing sight of the moments that matter along the way.

Join the growing number of people transforming their stress into positive motivation to move onUp.

Join the movement

This is a sponsored conversation written by me on behalf of SunTrust. The opinions and text are all mine.