This post is sponsored by Lexington Law.

Credit is one of those adulting things many of us try not to think about. It’s confusing and challenging to understand at more than a basic level. And if something goes wrong? Well, luckily there are professionals for that. That said, even with a basic understanding, you can still have excellent credit.

At any rate, it’s all a learning process. And the more you know, the better the decisions you can make moving forward.

4 Surprising Things You Might Not Know About Your Credit:

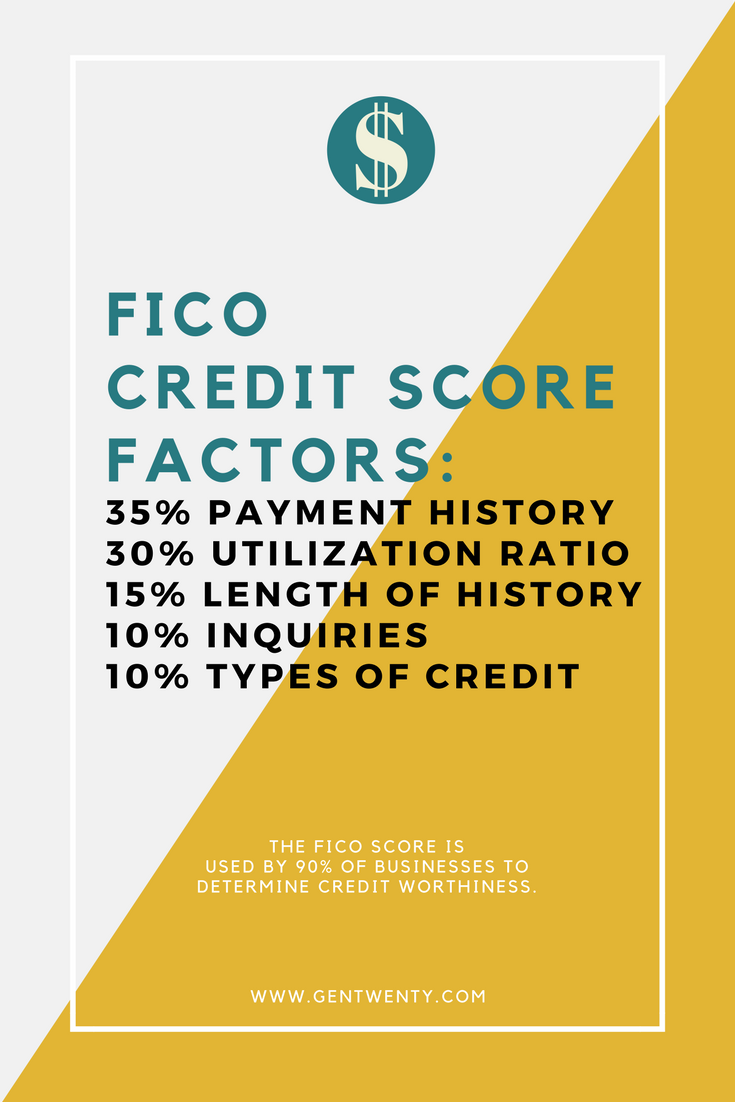

1. There are 5 factors that make up your FICO credit score that can both help you and hurt you.

Fun fact: FICO stands for Fair Isaac Corporation. They are the biggest and most well-known company that provides software for calculating credit scores; more than 90% of businesses use this score to review credit applications. This calculation is comprised of the following five factors:

- Payment history — 35%

- Utilization ratio — 30%

- Length of credit history — 15%

- New credit or inquiries (this hurts!) — 10%

- Types of credit/Credit Mix — 10%

Here’s what they mean:

Your payment history is the biggest of all of the factors. Essentially, that’s if you’ve made all of your payments on time. If you do, it shows that you are a reliable and dependable borrower. If you don’t, it can indicate the opposite.

The second biggest factor, utilization ratio, is super important because it’s what lenders use to predict future risk and behavior. Utilization is how much of your available credit that you’re currently using. The ratio is determined by dividing available credit by used credit to get a percentage. For example, if your credit card has a $3,000 dollar limit and you have charged $1,000 to the card, your utilization ratio is 1,000/3,000 or about 33%. When it comes to utilization, both Line Item Utilization and Aggregate Utilization affect your credit score and could have a huge impact on your overall strategy if used incorrectly. Your total utilization should generally not be higher than 30%. Read more here on how to keep your credit utilization low (tip number four is a total game-changer).

Length of credit history is something you can plant seeds for in your twenties. Time is something we have on our sides at this point in our lives and taking advantage of that now by building excellent credit. Having a long, positive credit history will benefit you in the future when you want to buy a house (or maybe a second home or rental property), a vehicle, or need a loan for personal reasons or medical expenses.

Hard inquiries (when you give a lender or organization permission to check your credit) are something that will dip your score around 5-10 points per inquiry. The more checks on your credit, the lower your score will dip. These inquiries stay on your credit report for 2 years before they are removed, but there could be options for you. A credit repair service can help you determine which hard inquiries can be removed and fix your credit.

The final 10% of your credit score is determined by your types of credit. Varying types of credit at different interest rates and different lengths shows that you are a reliable borrower in multiple ways.

[clickToTweet tweet=”Here’s what makes up your FICO credit score:” quote=”Here’s what makes up your FICO credit score:”]

What other scores exist?

You should also note that there is a newer credit score called the VantageScore developed by VantageScore Solutions that calculates your score differently. It was created by the three credit bureaus—Equifax, Experian, and TransUnion—as an alternative to the FICO score. It takes into account different types of data and calculations that may affect your positively or negatively depending on your situation. Learn more about it here.

2. There are 3 Federal statutes that protect your rights as a consumer.

The legal terms can get dense here, so bear with me. Here’s a rundown of the three statutes and what they mean in very high-level language:

1. Fair Credit Reporting Act (FCRA), requires that credit reporting agencies give an accurate report of a consumer’s credit history. This is to ensure that misreported information isn’t used against a consumer.

a. The Fair and Accurate Credit Transactions Act (FACTA) was created to amend the FCRA. In a nutshell, it focuses primarily on the prevention of of identity theft and resolving consumer disputes. It also improves the accuracy of consumer records and the access consumers have to credit information.

2. Next, The Fair Credit Billing Act (FCBA) of 1974 is what protects you as a consumer from unfair billing practices from companies and organizations that result in billing errors.

3. Finally, The Fair Debt Collection Practices Act, protects you against “abusive, deceptive, and unfair debt collection practices.” There are certain things debt collectors can and can’t do. Many times, though, they will toe the line in order to get their money back. That’s where this statute steps in. You can work with a collection service agency to manage your debt.

All of these legal acronyms can be a bit overwhelming. Unless you’re familiar with them, it can be hard to know what’s right from left. If you’re already familiar with your report and history, it will be easy to spot discrepancies get ahead of them. Lex OnTrack, a tool from Lexington Law, tracks and protects your identity, credit, and finances. To help decide if this is a worthwhile option for you, see more Lexington Law reviews here.

3. Credit isn’t necessarily the only thing lenders will look at, but it matters the most.

Depending on the lender or organization, they might ask you for more information about your income, living expenses, and other debts.

This can work in your favor to still secure a loan, however, it’s important to note that your interest rates and payments will be outrageous because you are a high risk to the lender. If you ever find yourself needing a quick loan, consider exploring My-quickloan options to meet your financial needs.

And that really just means you are going to be paying way more money over time than you would if you just had good credit in the first place.

A low credit score indicates that you aren’t reliable as a borrower. Whether or not this is true versus in real life hardly matters if you don’t look good on paper unfortunately. Taking the necessary steps to get your score high and keep your record clean could be the difference between $50,000 and $200,000 in interest payments.

[clickToTweet tweet=”Credit isn’t the only thing that matters when it comes to borrowing, but it matters the most. #personalfinance” quote=”Credit isn’t the only thing that matters when it comes to borrowing, but it matters the most. #personalfinance”]

4. You’re responsible for it.

While there are statues in place for consumer protection, it’s up to you to notice errors on your credit report. If you don’t check it to confirm, no one else will know what’s wrong! You know your history best.

You also need to make your payments on time and be aware of hard inquiries on your credit. Know how opening new cards and lines of credit will affect your score and how much credit you’re using at any given time to keep your utilization ratio low. It’s easy to wish it was someone else’s problem but making it a personal priority to manage your credit score and strengthen your history will be valuable down the road.

A credit fix might be as simple as making one phone call, however, it might also be a much more complicated endeavor. Every situation is unique and personal and usually doesn’t have one magic answer. The bottom line: if you have bad or low credit, it’s worth it to find a credit fix. Having a professional take a look at your credit report to remove errors that you’re being penalized for and give you a plan of action could save you not only tens of thousands of dollars but weeks and months of frustration and phone calls.

While credit can be tricky, knowing your rights and staying aware of the changes on your report can have a huge impact. Knowing how your actions affect your credit and future ability to borrow are both critical in having excellent credit. Don’t be afraid of it, take action today to set your future self up for success.

[clickToTweet tweet=”4 Surprising Things You Might Not Know About Your Credit” quote=”4 Surprising Things You Might Not Know About Your Credit”]