Thank you Navient for sponsoring this post.

Choosing to take out student loans to cover the cost of your college education is a big decision, to say the least.

I didn’t really have much of a choice when it came to taking out student loans to finance my education. I chose to go to an in-state school decently close to home which cut costs significantly. Luckily, scholarships, grants, and gift money from graduating high school covered most of my expenses and fees.

Student loans covered the rest. And when it came down to it? It was either take out a few loans or not go at all. The bottom line is that I never would have been able to afford my education without student loans, and for that, I am grateful.

Going into college, I wasn’t sure what I wanted to major in. I wasn’t even sure what I wanted to do when I graduated! I gradually landed on a major in psychology and a minor in human development.

By junior year, I opted to take the biology track for my major (my school by default offered a B.A. in Psychology). This meant I needed to take a few extra classes over the summer and winter term — which absolutely would not have been possible without my loans.

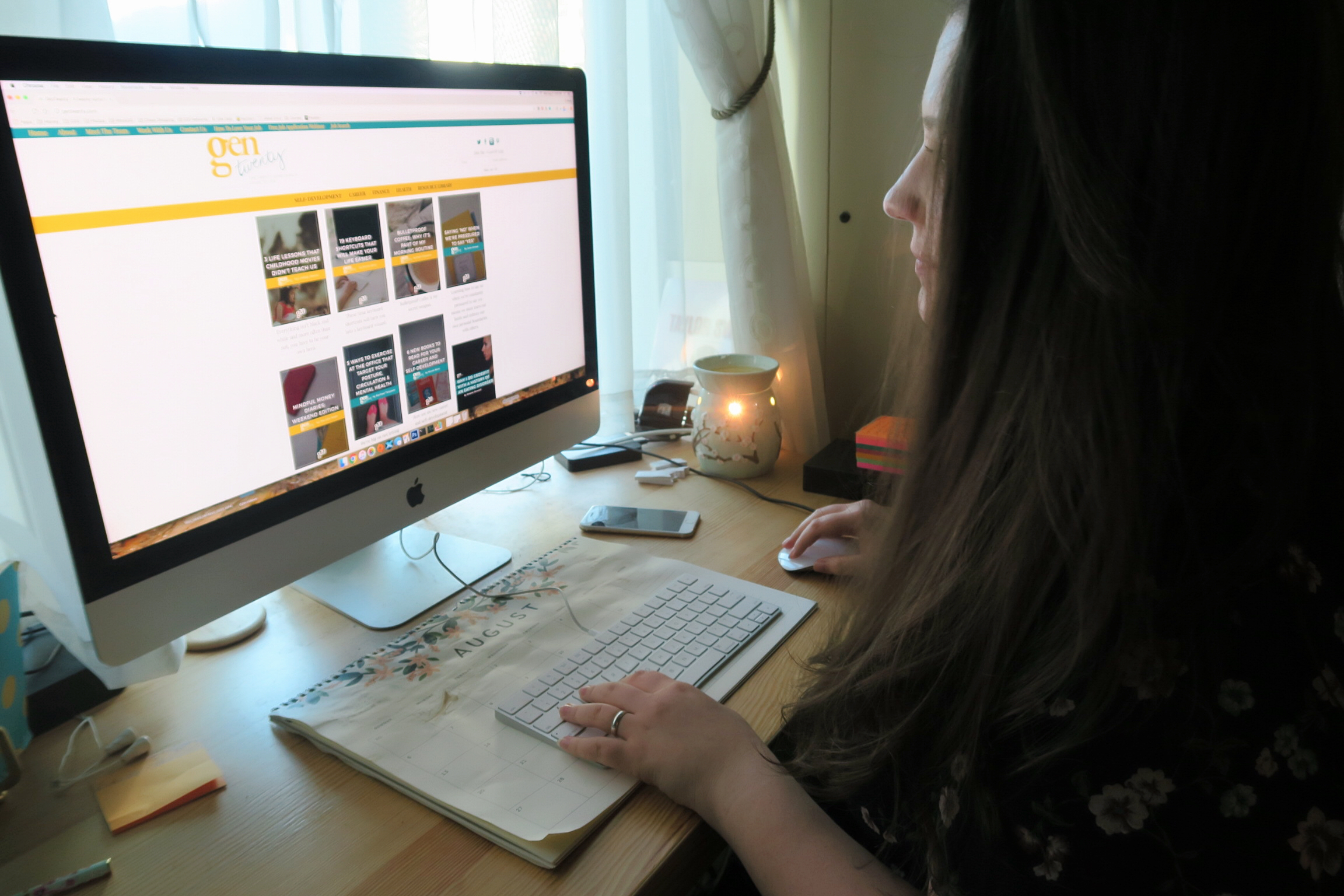

After graduating, I made a cross-country move with my husband for his job. This worked in my favor because it gave me time to evaluate what I wanted to do next. After a few months of considering my options, I decided to go all-in on what had been on my mind for at least a year: GenTwenty.

It seemed like a platform like ours was needed more than ever. My friends were going through some really confusing times post-grad and I wanted to create an educational and inspirational space that was comforting, motivating, and most of all, understanding.

Turning GenTwenty into a business became my goal. Those early years were tough. There were a lot of sacrifices, including living with roommates and not traveling. Ultimately, these sacrifices were necessary to meet my and my husband’s goal of living debt-free.

GenTwenty, along with a few freelance services like editing and writing, is now my full-time job. I am able to support myself, pay a team of writers, and move into my own office space next month.

My college education led me to where I am today. Majoring in psychology taught me that I love people, behavior, and experience. My job now allows me to connect with and help people in innovative ways. It also ties in other creative aspects I enjoy — writing, community building, and photography.

To make my dreams possible, I implemented a few strategies to pay off my student loans:

1. I put more towards the higher interest loans each month.

These loans accrue interest faster, meaning you’re going to be paying more for them over time. This was a strategy that allowed me to accrue less interest and therefore pay less.

With my loan servicer, I was able to allocate how much I wanted to pay on each loan. Of course I always paid the minimum, but I was also able to put more of my payment towards certain loans.

2. I doubled my payments.

A few weeks ago, I explained how I doubled my student loan payments without making more money. We kept a strict budget (with weekly check-ins) to make sure we weren’t overspending.

Not only did this give us great saving and spending habits that we still use today, but it also showed us where in our budget we could cut back even more.

Paying back our loans meant these cut backs were short-term sacrifices with amazing long-term gains.

For us, it means living with roommates for a year (that saved us $900/month alone), meal planning weekly, and finding free hobbies to take up our time. You tend to spend money when you’re bored!

3. I made debt-repayment and saving my top priorities.

Those early years out of college are a weird time. For many, college has sort of a financial cushion. You’re either doing fine because of your loans or because of your parents footing the bill. (Every time I went home my mom would give me some cash, so somehow there was always money to eat out). There’s the trope of “broke college kids” but in reality, it’s more like “broke college graduate.”

Even though I worked two jobs for two years (and one for three), I didn’t save very much money when I was in school at all. It was hard to change that mentality when I graduated. In some ways, it leads to lifestyle inflation when you’re fresh out of school. You might be making little (if any) money right away, and it’s hard to adjust.

As a family, we decided that we didn’t want to be making loan payments in our late twenties and thirties because our priorities would be shifting.

Every month when we made a loan payment, I thought about how good it would feel to put that money into savings instead. This was so motivating for me — and debt repayment and saving became my number one priorities.

4. I made a plan and stuck to it.

I had to look at my spending and savings rate realistically. There were some things I knew I wouldn’t be able to do without. We liked to go out to new places to eat a few times a month. Instead of doing that all the time, we settled for twice a month and turned Fridays into homemade pizza night. There are loads of creative ways to save money that fit your lifestyle!

After a cross-country move, I knew I would be traveling back home a few times a year so I had to budget that in too. To cut back on these expenses, we cut back on our trips back east.

We decided to pay our loans off in 18 months (24 with the grace period). This meant we had to figure out how to make that happen. And we did.

Without my loans to help fund my education, I wouldn’t have been able to graduate on time, if at all. While I couldn’t see how everything fit together at the time, in hindsight, it all makes perfect sense. My passion for connecting others through shared experiences led me to major in psychology; my passion for writing and creativity led me to an online business; what I learned in school became the basis of my platform.

All of it worked together to make my dream come together: I have a job I am deeply passionate about and I live debt-free.

Thank you again to Navient for sponsoring this post. All content and opinions expressed here are all my own.