This post is sponsored by Lexington Law.

Welcome back to Adulting and Money! Today we’re going to go in depth on how to talk about money with your partner. Relationships often involve major life transitions. Whether you are engaged, married, living together, or committed to a relationship, having the money conversation is important.

Why, you ask? Well, for several reasons. Money is emotional and can have a massive impact on our everyday lives. The way we perceive money can also impact our individual feelings of self-worth as well as bring up negative feelings towards others. Opening up the conversation can help you confront these feelings in an open and healthy way. Plus, you’ll identify potential issues sooner rather than later.

Another reason is because where we spend our money often indicates our values. These values often inform our long-term life plans and goals. Talking about money will help ensure you’re on the same page. Beyond that, you can help identity each other’s strengths and weaknesses when it comes to finances in the household. And truthfully, whether you share a bank account or not, your money decisions affect your partner and vice versa. Not discussing money shuts down a vital line of communication –aka the foundation of a healthy relationship.

How To Bring Up The “M” Word

If you’re comfortable simply asking your partner to get financially naked with each other, go for it! If not, there are a few approaches you can try instead.

1. Ask them what they would do if they won the lottery.

This is an easy way to start talking about money objectively. If debt repayment is a priority for them, this can help open up the conversation on what debts they have and how they plan to handle them.

It was also get you both talking about what you value and where your priorities lie. Move the conversation along by working backwards and asking them what retirement looks like in their mind. What about ten years from now? Or five? Use this as a starting point to get on each other’s financial page.

If you do ask this question, try to avoid reacting negatively or in a judgmental way. This is only going to shut down the conversation and take you two steps back.

2. Ask them a question about your personal finances.

By asking them a question about your finances, you’re immediately showing that you value their opinion. And that shows a form of trust in the relationship. In this way, talking about money can actually bring you closer together!

With this proposition, you’ll get an idea of your partner’s financial knowledge. The advice they share will give you insight into how they manage their finances. Take it from there and ask another question until you propose opening up your budgets and accounts.

3. Start listening to money podcasts or reading a finance book and get your partner involved.

Start with a simple, “Hey I was reading this book and it said something interesting about compound interest. What do you think?” Again, you’re asking for your partner’s thoughts and opinion so avoid reactive negatively.

This is a great way to get your partner talking about various financial topics. Eventually, you can segue the conversation to your personal finances. A healthy relationship is one where you encourage each other’s growth, and working together financially is one way to do that.

Keep In Mind…

Of course, not every relationship is the same and not every person is the same. We all have unique backgrounds that influences the way we think about money. Maybe in your household your parents openly talked about money and in your partner’s it was never mentioned.

If your partner is extremely reluctant to talk about money, it might be a major red flag. Our friends at Lexington Law have outlined five ways your partner or spouse might be a financial cheater. If you’re noticing any of these signs, you’ll need to consider how you would protect yourself if you do become legally bound to each other.

And if you are the partner who doesn’t want to talk about money, perhaps it’s time you confront why that is. It’s likely that those hang-ups are holding you back.

What To Talk About

Whether you get married or not, your finances will impact each other if you live together or are in a long-term relationship. I believe in financial transparency with your partner. Not only does it help you work towards common goals and your life together, but it also encourages you to make smarter decisions going forward.

I suggest pulling together your budgets, spreadsheets, and bank statements and sitting down with each other to establish your income, spending, and savings.

Take a Saturday afternoon and sit down and cover these major points:

1. Your debts.

I think this is one of the first major points that should be covered. From consumer credit debt, to student loans, to personal loans, to a mortgage, car loan, and gambling or other personal debt — everything should be laid out on the table.

Whether you are going to tackle these debts together or not is a personal decision the two of you need to make. For example, there’s one blogging couple I know of where one party had a large savings account and no debt and the other had six figures of student loans. They worked out a plan together and ended up putting a large amount of her savings towards his debt to become a debt-free couple in pursuit of their other financial goals.

Even with that example, there’s not necessarily a “right” way to go about. You need to trust your gut. If taking on your partner’s debt is not something you want to do, don’t. Work together to make a plan and wait until the debt is gone to take the next step in your relationship.

Also note that if you do get or already are married, depending on your state laws and their loans, your partner’s debt may become yours if something happens to them.

2. Your credit score and reports.

Your credit score is just one measure of where you are standing financially. But it’s a powerful one. (If you need a brush up, check out our guide here.)

You should care about your partner’s credit score because whatever you go in on together — say, a home or a car — their score will affect the outcome just like yours will.

If either of you is not in good standing (below 750), I suggest working to improve your credit score before making any major moves. Here are instructions on how to pull your credit reports.

Tip: Set an annual day to pull your credit reports and check for discrepancies.

If your score is below 750, you can begin improving your credit by:

-

- Getting your utilization ratio down below 30%. From my post on credit: “Utilization is how much of your available credit that you’re currently using. The ratio is determined by dividing available credit by used credit to get a percentage. For example, if your credit card has a $3,000 dollar limit and you have charged $1,000 to the card, your utilization ratio is 1,000/3,000 or about 33%. When it comes to utilization, both Line Item Utilization and Aggregate Utilization affect your credit score and could have a huge impact on your overall strategy if used incorrectly. Your total utilization should generally not be higher than 30%. Read more here on how to keep your credit utilization low (tip number four is a total game-changer).”

- Make all of your payments on time. If you’re not making your payments on time, ask yourself why not? You’re only costing yourself more in terms of interest charges, late payment charges, and points of your credit score. If you due dates don’t match with your paydays, call your lenders and ask to change the date. Most are flexible on this sort of thing. Once you stop making late payments, you score likely rise will rise.

Now is also a good time to pull your credit reports if you haven’t already. Check to make sure everything you’ve opened is on there and nothing you haven’t isn’t. If you notice anything suspicious, it could be unfairly negatively affecting your credit score.

You might be able to mediate some of these issues yourself by calling your creditors but if it’s too much to handle, consider bringing in a professional.

3. Your income.

Sharing your income gives you both an idea of where you stand together. If you’re afraid a difference income might cause tension, I think it’s better to get it out on the table right away.

Use this as a growth moment and encourage each other to stand up for what you deserve. Encourage each other to grow professionally. Maybe that means a job change or negotiating a better compensation package. Either way, to budget together effectively, you’ll need to know your total household income. And remind each other that you are not how much money you make.

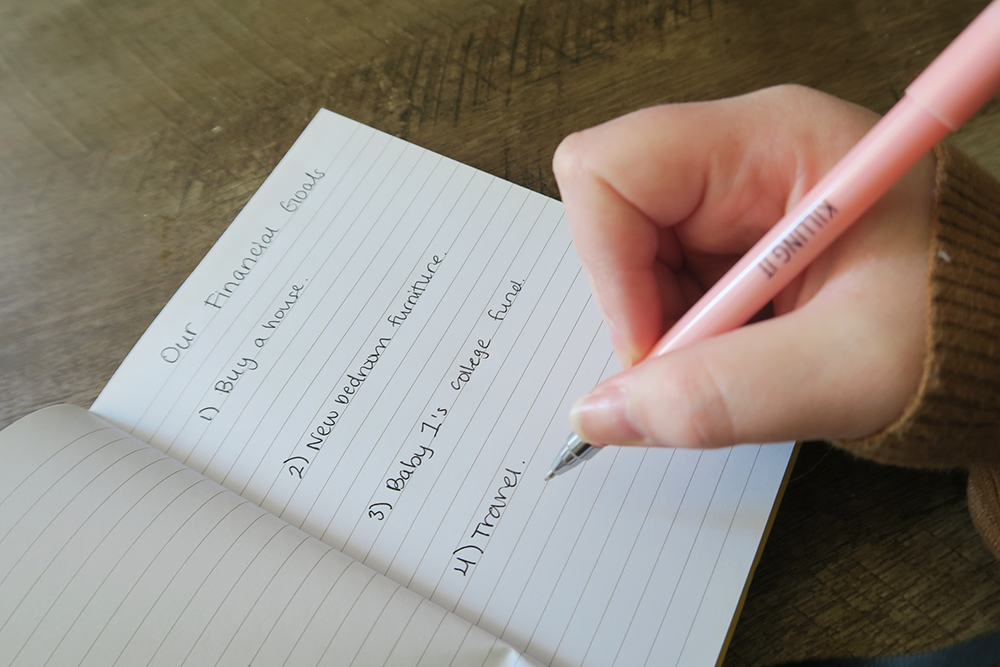

4. Your savings goals.

Discuss your savings goals and how they fit into your plans and lifestyles. Are you saving for retirement? Travel? A home? A car? Discuss with each other why these goals are important to you and why you value them.

There may be some overlap in your goals or none at all — now is a great time to talk about it!

5. Your personal budget and your combined budget.

After you’ve discussed your income and savings goals, it’s time to lay out your overall budget. If you don’t have one, I highly recommend that you take the last three months of your expenses and make one. Is your spending in line with the goals you outlined above?

Here, you can discuss which aspects of your money you want to manage together and which, if any, you’d like to keep seperate. I know couples who combine all of their finances and couples who combine none. Will you each be contributing percentage-wise to your joint expenses or will everything be split down the middle? Again, there is no right or wrong answer, but you both will need to do what feels right for your relationship.

If having to pay half the rent on a $2,500 apartment is straining your personal budget, talk to your partner about that. Even when you’re in a relationship, no matter how much money you make, your voice matters. Don’t decimate your finances, even for the love of your life.

If you do choose to combine your money fully, make a combined budget that covers both of your total expenses.

6. Your accounts.

If you choose to do so, you’ll need to talk about which accounts you want to open together. Do you want solely a joint bank account? Do you want joint investment accounts? Will you have any individual accounts? Who will manage these accounts? Talk about these questions and figure out what will work for you and your budgeting choices.

If you do choose to open a joint account, figure out which bank or credit union is the right choice. Do your research on types of accounts that best fit your long-term goals and plans, plus a checking and savings account that fits your daily life. Weigh the pros and cons before making a decision.

Tip: Make a joint spreadsheet of all of your accounts.

7. Life insurance.

It may feel a little morbid, but this is absolutely something you need to discuss together. Particularly if you have debt, joint assets, and children. Life insurance can be imperative in not only taking care of funeral and end-of-life expenses, but replacing a loss of income. For a joint-income household, that loss can be devastating. You don’t want to leave your partner and potentially your children with a heavy financial burden that will send them into turmoil for years.

I strongly believe that all members of your family should have life insurance. Openly discuss what the plan should be in the event of either partner’s demise death. This article can help you ballpark how much life insurance you’ll need.

Additionally, you both will need a will. Tomorrow is an app that guides you seamlessly through the process and helps you create a will and/or living trust. Make it a goal to work on this together in the next six months.

8. Your future plans.

Before you make any moves, it’s a good idea to get clear on your future plans. Work together to make a budget where you both can live within your means and still save for your goals. Whether you’re combining your accounts or not, it’s imperative that you work together and stay honest about your finances. Also consider things like having children or adopting. Does one of you plan to stay home and/or take extended leave from work? How will you finance this? Knowing your goals can help you pinpoint the topics you need to discuss.

I’d also recommend you both sign up for identity and credit monitoring. A service like Lex OnTrack from Lexington Law is truly invaluable in managing your credit and financial goals. Use it to monitor your credit, analyze your score to figure out what you need to do differently, optimize your financial planning, and work with professionals as needed for credit repair. Plus, you get $1,000,000 in identity insurance. And all for under $25/month — how great is that? Click here to learn more and sign up.

Checking In

So, how often should you talk about money? My husband and I check in on our finances once per week and have a more in-depth discussion once a month. We see how we are doing on our goals, how we need to adjust our spending, and what changes we plan to make in the next month. We also evaluate which expenses we have coming up and what we need to adjust our savings/spending for. This method has worked extremely well for us over the past six years of marriage.

We also do an annual review of all of our financial accounts and credit reports to make sure there are no errors. I highly suggest making a spreadsheet of all of your accounts so it’s easy to do this every year. Make sure nothing is out of place, compare your progress to your end goals, and adjust accordingly. And if necessary, consult with an expert to help you get on the right financial path.

Talking about money with your partner might feel uncomfortable at first, but it is a necessary part of a healthy relationship. You should both be aware of your finances at any given time and understand how they impact you both. Get the conversation started — the more you talk about it, the easier it will be. Good luck!

Have questions? Leave them in the comments! Or reach out to the experts at Lexington Law to discuss your unique situation with an expert.

Read the full Adulting and Money series here:

- How To Manage Your First Salary and Benefits

- Building Your Emergency Fund & Preparing Your Financial Future

- How To Talk To Your Partner About Money

- How To Prepare Your Finances For a Family