This post is sponsored by Lexington Law.

Money is one of those parts of adulting that many of us tend to avoid thinking about. It can be stressful and overwhelming, and honestly? It can be downright intimidating at times. Over the next four weeks, we will be discussing how to manage your finances during big life transitions. We’re beginning our series, Adulting and Money, with one huge step most of us go through: starting a new job.

Starting a new job comes not only with jumping a few career hurdles, but financial ones as well. If this is your first salary, or even a higher one than your previous role, it can be a challenge to figure out what exactly to do with that increase in income. Today we’re going to discuss how to manage your first salary (and how to manage debt and savings), as well as making the most of your benefits. They are a part of your compensation and it’s up to you to understand and maximize them!

How To Manage Your First Salary

When you begin making a full-time income it can suddenly seem like you’re Scrooge Mcduck rolling in a pile of money. Truthfully, once taxes have been taken out and your bills have been paid, what’s left might be disappointing. But fear not, I have some tips for you to set yourself up for success.

1. Make a budget.

By this point, you should have a budget. Here, Maggie shared five tips based on her experience budgeting her first real, consistent salary. This post also includes a free budget printable so don’t miss it!

A basic budget is your income (what you bring in every month) minus expenses (fixed and variable) equals net income (the leftover money from your paycheck).

Once you’re making more money, it’s likely that you will up level your lifestyle as well. I caution against this, especially at first. It might seem like your new salary can easily cover a new car payment and rent in a nicer neighborhood but making too many moves too quickly can put a strain on your budget and overall wellbeing.

Start by looking at your previous three months of expenses to get a handle on where your money is going. Add in any new expense you will be incurring. Any debt you have should be included in your fixed expenses because you have to make those payments. Your variable expenses category covers everything from entertainment, dining out, groceries, gifts, etc.

And what’s leftover should go to…

2. Debt or savings?

My answer is both. I think debt repayment should be a priority, but so should savings. You need to examine your budget and see what is realistic on both fronts.

I’ve discussed this before, but I did not see any real progress on my debt until I doubled and tripled my payments. This took a lot of discipline but I made it through, and it was worth it. At the same time, I was also growing my savings accounts. My original goal was three months of emergency savings and I have since grown that to six months. And even now that they are fully funded, I still put $50 in each of my emergency accounts each month.

I think savings are important because you want to avoid going into debt to cover an emergency expense. I have had to dip into my emergency savings multiple times and have always been relieved that money is there when I needed it.

If you aren’t sure how to trim the fat from your budget, here are a couple of strong ideas from Lexington Law.

3. Live “comfortably” but not above your means.

You’re working hard for your money and life should be enjoyed. Stretching yourself so thin just to pinch pennies is exhausting. Take into account your physical health and wellbeing. If having a gym membership keeps you active and social, then by all means don’t cut it from your budget if you are only going to be miserable and unmotivated at home. If you value fitness, this is a good place to put your income. It supports you in multiple ways and is not a waste of money if it is serving its purpose.

As another example, you might get local channels for free but with Netflix, you have so many more shows available. If you enjoy relaxing at the end of the night with a cup of tea and a miniseries, this isn’t what you would want to cut from your budget. When you’re utilizing something to its full potential, look for other areas where you can cut back. If you have a gym membership and you’re only going once or twice per week, maybe that should be the thing to go instead.

One caveat, though. If anything is putting you at the very top of your budget and preventing you from pursuing financial freedom, or worse — putting you in debt, my advice is to reevaluate in the short term until you can find a solution that works for your lifestyle, values, and budget.

4. Practice living with expenses you’re considering.

Basically, before you take on an expense, start pretending that you’re already paying it a month or two ahead of time. For example, if your rent is currently $900/month and you’re looking at a $1,500/month apartment, stat putting that extra $600 into savings a few months in advance. See how it affects the rest of your budget before you’re locked into the expense for the foreseeable future.

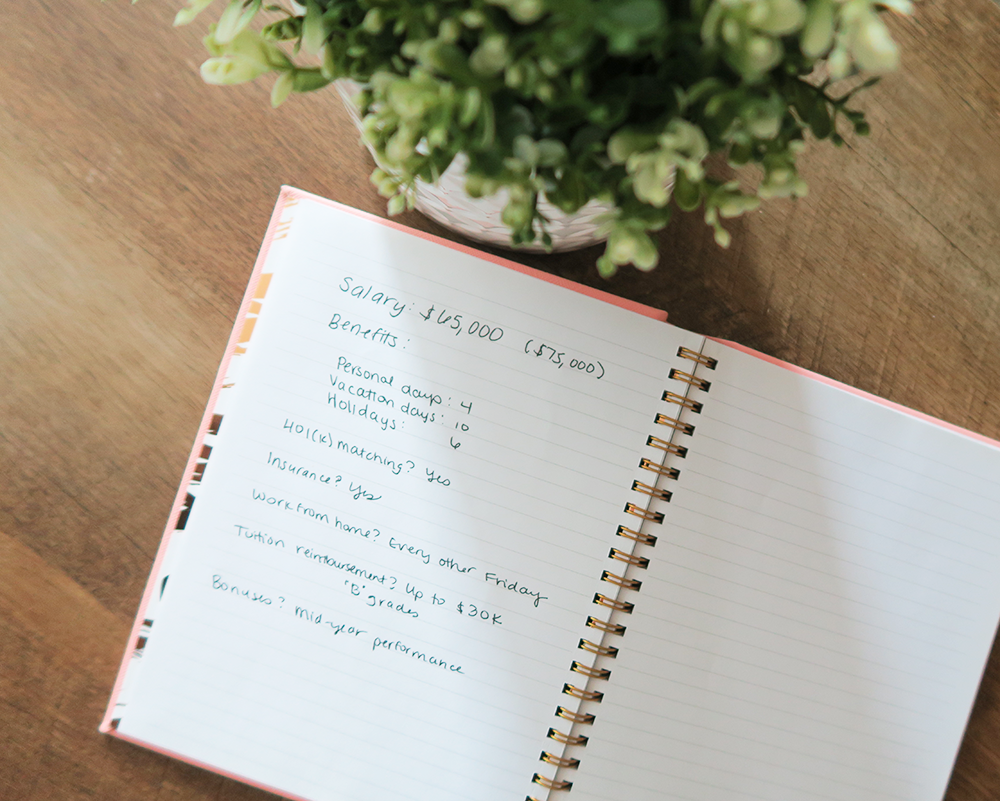

Making The Most of Your Benefits

While it’s a huge perk of a regular job to have regular, steady income, the benefits that come along with it shouldn’t be overlooked. When your future company offers you a job, and along with it, a compensation package — remember that everything is negotiable.

Firstly, look into the market compensation standards for the field you are in, or maybe even the job position, or similar job positions to yours. Although sometimes you might face some obstacles, as salary transparency is not a widespread thing, try to find as much information as possible.

First things first, you should always be negotiating your salary. Not doing so leaves money on the table and means potentially hundreds of thousands, or even over a million dollars, lost.

Before negotiating, always do your research on salary expectations for positions given your expertise and experience.

And even then, always ask for more. Start with these tips. Negotiating is something you should be doing whenever you start a new job. It might be uncomfortable at first, but it’s necessary and most employers are expecting you to do it. The sooner you start, the more comfortable you will be negotiating over time.

Beyond your salary, there are a huge plethora of benefits you can negotiate in your compensation package as well. If your employer isn’t as flexible on salary, these are great options to discuss. Plus, they not only improve your overall quality of life, but your financial situation as well.

1. Paid leave, vacation days, and flexible holidays.

Having paid leave means you can take time off of work for things like injuries, mental health days, illness, bereavement, and more without lost income. That lost income can be financially devastating and crippling. It can put your behind on your debt repayment and expenses causing missed payments and late fees. If your potential employer isn’t offering these benefits, or enough of them, ask for them.

2. 401(k) matching.

Many companies offer this perk and it’s one you should take advantage of! In your early and mid-twenties, the best thing you have on your side is time. It takes time for investments to grow so the sooner you are investing money for retirement, the better off you will be. Really, though, it’s important at any age to begin saving for your future so don’t let being older stop you from saving.

When it comes to 401(k) matching, many companies will match up to a percentage of what you’re putting into your 401(k). This is essentially “free money” and it would be a waste to leave it on the table!

3. Insurance.

When you’re a full-time employee, you generally have insurance through your employer. There are generally options for various levels of coverage. Many young people tend to go for the cheaper insurance to save money. Look very carefully at these package options and think long-term. Check with your employer to see if they cover any healthcare costs outside of these this coverage (like flexible spending — an employer-sponsored add-on for qualified expenses).

All of these things do cost your employer money, so in my opinion, it’s important to remember that they are part of your compensation as well. Think about how much it would cost you to have to subsidize these costs out of your own pockets and it shows the bigger picture.

4. Tuition reimbursement.

This is an awesome benefit to see if your employer covers. Out of pocket higher education expenses can reach into the tens of thousands in just a few semesters. If your current employer offers this as an option, not only will you save money, but you’ll be making yourself more valuable (meaning a raise at your next annual review or negotiating for more during your next career move).

This usually has grade or GPA requirements to qualify. You typically pay to upfront costs out of pocket and then your employer will reimburse you at the end of the semester when you submit the required paperwork. My best friend was getting her MBA through her employer when her contract ended and she had to change companies. She negotiated tuition reimbursement at her new job even though it wasn’t something they typically covered. It is possible to get these extra benefits!

5. Work from home opportunities.

Working from home is a very desirable option for many! Whether you have a family at home or not, working from home saves on commuting costs. If you have kids, you could potentially be saving on child care costs as well. Plus, you can work in your pajamas! If you want to, of course.

Your employer might want you to “earn” these work from home days when you first start, but they could start anywhere from 6-12 months after your first day on the job.

6. Stock options and bonuses.

This varies company to company, but many, especially tech companies, offer this in addition to base pay. You might have to wait two to five years to vest the stocks. Or you’ll be limited to a certain window to do so, but overall it is a great investment. Your company should continue to grow which means you’ll get more money over time. Then, you can plan to use this money to seed large expenses like a home or a car purchase or to pay down debt. Alternatively, you can also invest it somewhere else to diversify your portfolio.

Your company might also offer annual or performance-based bonuses. Make sure you know what the qualifications for these are so you are meeting them. Once you start earning these, use that money in a financially-savvy way. The experts at Lexington Law suggest using it to pay down debt and reduce your credit debt utilization ratio to improve your credit score.

This is also important for future jobs because in certain industries and careers, your employer may pull your credit reports. A study in 2010 by the Society for Human Resources Management reported that 47 percent of employers considered background checks in the hiring process. That’s an astounding amount of employers that are taking your financial history into account! If there’s anything in your background that needs to be cleared up, now is the time.

Taking The Next Step

Starting your first job is the time to start tackling your personal financial situation because you’re bringing in steady income. Knowing this consistent factor can help stabilize the rest of your finances.

If you’re actively working to take charge of your financial situation, consider working with the professionals at Lexington Law.

They can help you repair your credit and will advocate on your behalf to challenge any unfair, inaccurate or unsubstantiated item listed on your credit report. This can help increase your credit score which gives you a leg up in the future.

Your credit plays a major in many life transitions you’ll encounter in your twenties, like buying a house, for instance. Lexington Law works for you, not a credit bureau or a creditor and they have your best interest at heart.

If you’re feeling confident about your credit, look into a credit and identity monitoring service. While you’re busy growing your career and striving for financial freedom, it takes a load off of your shoulders to know that someone has your back. Learn more about Lexington Law’s OnTrack Tool here to see if this is the right option for you.

Once you’ve adjusted your budget, debt, and savings goals, it’s a great time to start looking ahead for what other financial goals you want to achieve in your twenties (here are five that we suggest).

Congrats on starting a new job! You should be very proud of yourself for landing the position.

If this is your first experience with steady income, it’s very important that you learn how to manage your first salary early on in your career.

It may seem like a lot of money now compared to what you made at your college internship, but money is very easily spent. As we get older, it’s easy to inflate our lifestyles without even realizing it, too.

If you have any questions on managing your first salary or benefits, leave them in the comments below!

Read the full Adulting and Money series here:

- How To Manage Your First Salary and Benefits

- Building Your Emergency Fund & Preparing Your Financial Future

- How To Talk To Your Partner About Money

- How To Prepare Your Finances For a Family