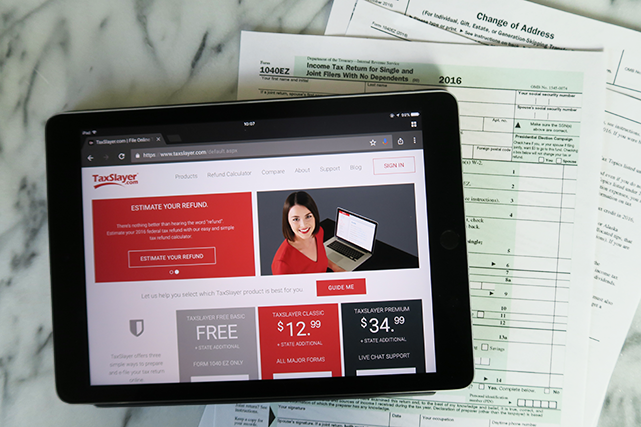

Thank you TaxSlayer for sponsoring this post. Get simple pricing with no surprises when you e-file with TaxSlayer this tax season!

Tax season is often a stressful time of the year for many, especially as our finances get more complicated as we get older. I always feel like I’m scrambling to find the right form and the correct information to get my taxes filed on time!

I have been filing my taxes on my own since I turned 18. When I got married, I felt like I had to relearn the entire process as my husband and I combined our lives. There were so many decisions to make and new things to learn about the filing process.

The first thing I had to do was update my name. I went through the process and first updated my name with the Social Security Administration. After that, I made sure to update my passport, credit and debit cards, and loan lenders as well. Keeping a list of all the accounts I had open made this part a breeze. I made sure to update my name change with the Social Security Administration before I filed my taxes to avoid any issues with the IRS.

My husband and I had to decide if we would be filing separately jointly, and then who would become the head of household. There are different deductions based on how you file, so we had to figure out which option would work best for us, both now and in the long term. With the help of TaxSlayer, I was able to determine that filing jointly was the way to go for us.

After getting married, many couples move, either into one another’s living space or into a home together. My husband and I moved cross-country and had to learn the requirements for filing taxes in our new state. It was also more complicated because part of the year we worked and earned an income in one state, and then we also worked and earned an income in another. Without guidance, this would have be a struggle to figure out who we had to pay and on what income numbers.

Along with moving, we had to update our address with all of our employers to make sure we received our correct tax forms on time and in the right place. Not having these forms would have delayed our filing process as you are unable to file until you have all of the paperwork in order.

We’re also currently renting for our own personal reasons. There are no tax deductions for renting (we found out that there is an exception to this in a few states, but we do not live in one of them). As I do work from home, we would be able to claim the square footage of our apartment as a deduction if we chose to.

While taxes do become more complicated after you get married, if you stay on top of them and keep your documents and information together, it won’t be as bad as you think!

Having the additional guidance of TaxSlayer to help us figure out which deductions we qualified for and how to file as a married couple made the process so simple. You can choose your level of service (compare them if you are not sure which one fits your needs) and have access to live phone and email support to help with any questions. It is an easy to use platform that makes doing your taxes feel like common sense.

Happy filing!

I was selected for this opportunity as a member of CLEVER and the content and opinions expressed here are all my own.