Here’s a phrase you’ve probably heard before: “save early, save often.”

It’s no mystery why you should save often: saving in several small increments throughout your life is infinitely more manageable than finding a huge chunk to save all at once. Got it.

But why should we bother saving early? Money earned in 2027 is just as good as money earned in 2017, so why not wait to save ‘til 2027? A decade from now, you’ll have a higher income, more discipline over your expensive daily coffee habit, and the maturity to stick to your financial goals. Might as well leave the saving to your future self, right?

You have an advantage over your 2027 self right now, though: time.

Particularly for longer-term savings goals (retirement, mostly), time is like a magic ingredient. The reason? Compound interest.

One reason compound interest is awesome is it doesn’t take a personal finance degree to understand it or benefit from it. To understand it, you just need to think back to algebra class and remember exponents and exponential curves.

Simply put, the more your money grows, the faster and faster that growth will occur.

You start by earning small amounts of interest (the beginning of the curve), and then that interest becomes part of the curve (it’s added to the principal).

Because the principal now is larger, you’re earning more interest on that principle.

That larger interest earning is now part of your new principle, which leads to an even larger interest payout next time.

And on and on it goes. One day, you’ll realize you’re on the steep part of the curve.

If you want to let compound interest work its exponential magic without looking into the fine print of your interest-accruing accounts, that’s fine. You’ll still earn money. However, the details make a major difference in the outcome. In my opinion, it’s worth putting in the work to maximize your returns.

An important variable, obviously, is the interest rate.

Various types of accounts and investments have different rates. The rate is typically higher on riskier investments, like the stock market, and very low on conservative accounts like a savings account at a bank.

The type of account you should use depends on how risk averse you are and how soon you’ll need the money.

We’re getting into more complicated territory, here; if you need specific advice on where to put your savings, ask to talk to someone at your bank or use an automated system like Betterment. They’ll ask the right questions to find the account that makes sense for your situation.

Another variable that impacts your balance, of course, is how often and how much you save.

The money you put directly from your paycheck into savings is added to the principal.

This is related to compound interest because, the larger your principal balance is, the more interest you will earn and the more compound interest you’ll see in the future.

We already kinda covered this, but I wanted to revisit it to make the following point:

Every dollar you spend now is a lost opportunity in compound interest.

I am not here to put the kibosh on your fun. Tom Haverford and Donna Meagle’s Treat Yo Self philosophy is basically my religion, so I’m not saying you should erase fun from your life.

But technically every dollar you spend today would be worth a lot more in the future if you saved it instead.

I feel guilty each time I spend three dollars on an iced coffee and remember that, if I saved it, those 3 dollars could be worth more like 20 dollars in retirement.

Then again, life is short and iced coffees are essentially portable happiness. Choices are hard.

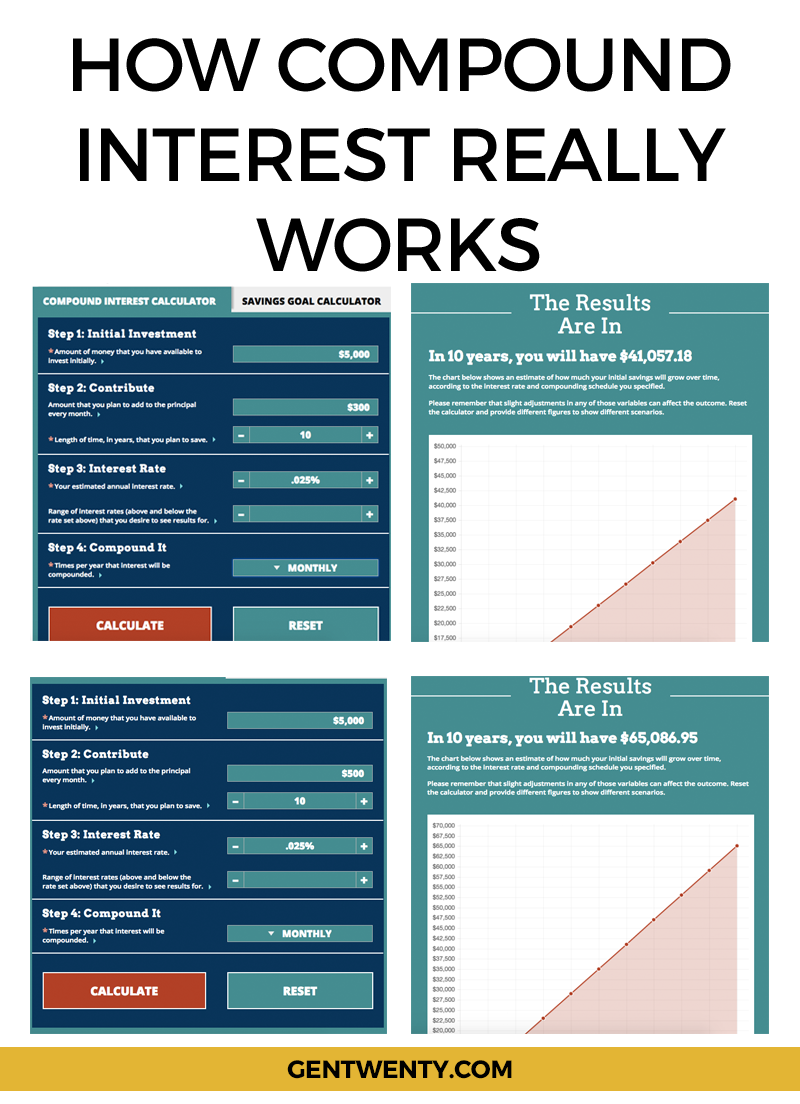

If you’re more of a visual person and you learn with examples, check out a compound interest calculator.

If you adjust each variable by a tiny amount, you will see just how much each alteration changes the ending balance. It’s wild.

One variable that can make a massive difference in how much your account grows is the frequency of compounding.

Accounts might be compounded annually, monthly, or even daily. As a rule, the more compounding periods, the more compound interest will be earned.

You want as many compounding periods on your savings accounts as possible, but few compounding periods on your loans. This brings me to my next point.

Compound interest can work against you as a borrower.

It’s built into your student loans, your car loan, and your home loan. The longer it takes you to pay it back, the loan will exponentially cost more.

For this reason, minimum payments are the real devil’s tools (idle hands are a close runner-up). Try to make larger payments if you can.

If you’re choosing between making larger payments on loans and saving for retirement, though, my unofficial advice would be to prioritize saving.

In an emergency situation, you can borrow from your a savings account that you started five years ago, but you cannot borrow from an auto loan that you paid off five years ago. Those are my two cents, but you should consult a professional if you’re struggling with creating a financial plan.

Now that we understand the basics, let’s get out of the world of hypotheticals and talk about some real money that actually grew with compound interest for two centuries.

Ben Franklin put compound interest to work in a big way. He gave the cities of Boston and Pittsburgh about $5,000 dollars each back in 1790, under the conditions that it had to spend most of the next two hundred years untouched.

By 1991, those accounts together totaled 6.5 million. It’s enough to make me want to put together a savings account for my great-great-great-great-great grandchildren.

You may not be able to grow our wealth to twenty million in your lifetime, but a little understanding of compound interest could make a huge difference later in your life.

Treat yo self now, but don’t forget to treat yo (future) self, too.